Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 Unique Corp Ltd is a manufacturer of smart phone. John, the CEO of Unique Corp, has been aware of an acquisition opportunity in

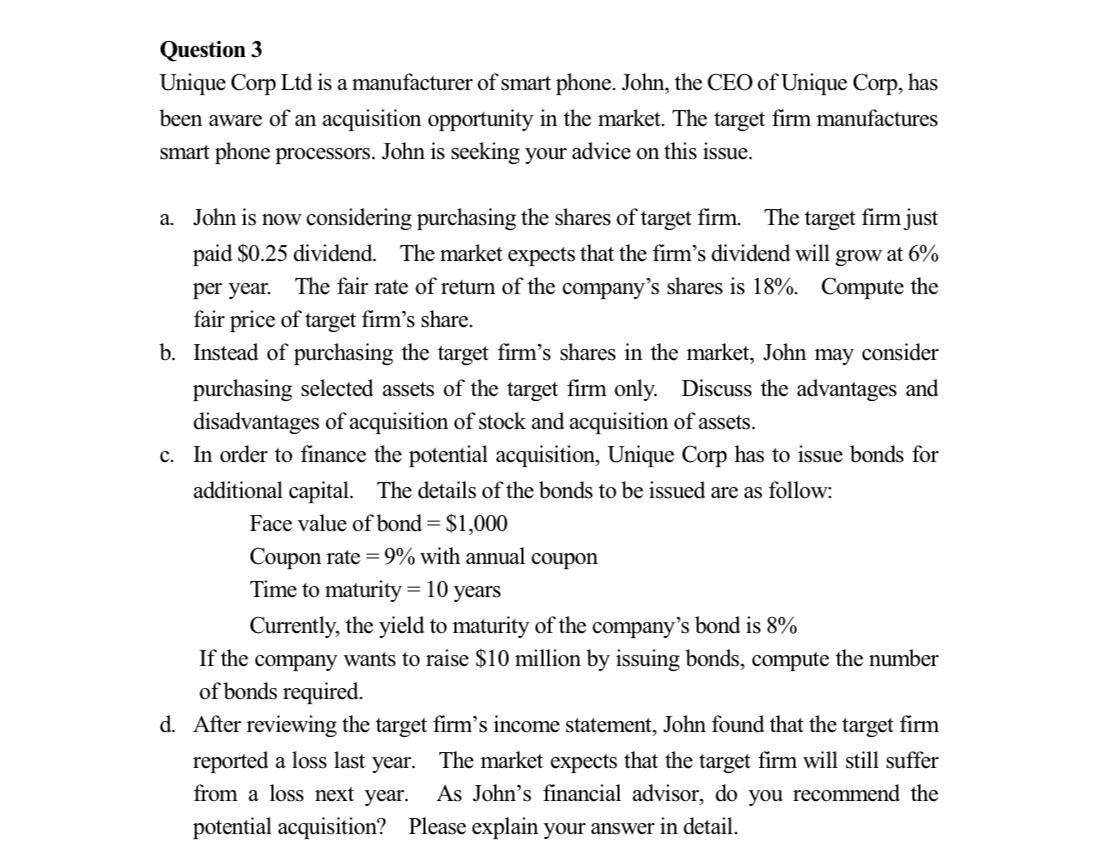

Question 3 Unique Corp Ltd is a manufacturer of smart phone. John, the CEO of Unique Corp, has been aware of an acquisition opportunity in the market. The target firm manufactures smart phone processors. John is seeking your advice on this issue. a. John is now considering purchasing the shares of target firm. The target firm just paid $0.25 dividend. The market expects that the firm's dividend will grow at 6% per year. The fair rate of return of the company's shares is 18%. Compute the fair price of target firm's share. b. Instead of purchasing the target firm's shares in the market, John may consider purchasing selected assets of the target firm only. Discuss the advantages and disadvantages of acquisition of stock and acquisition of assets. c. In order to finance the potential acquisition, Unique Corp has to issue bonds for additional capital. The details of the bonds to be issued are as follow: Face value of bond =$1,000 Coupon rate =9% with annual coupon Time to maturity =10 years Currently, the yield to maturity of the company's bond is 8% If the company wants to raise $10 million by issuing bonds, compute the number of bonds required. d. After reviewing the target firm's income statement, John found that the target firm reported a loss last year. The market expects that the target firm will still suffer from a loss next year. As John's financial advisor, do you recommend the potential acquisition? Please explain your answer in detail

Question 3 Unique Corp Ltd is a manufacturer of smart phone. John, the CEO of Unique Corp, has been aware of an acquisition opportunity in the market. The target firm manufactures smart phone processors. John is seeking your advice on this issue. a. John is now considering purchasing the shares of target firm. The target firm just paid $0.25 dividend. The market expects that the firm's dividend will grow at 6% per year. The fair rate of return of the company's shares is 18%. Compute the fair price of target firm's share. b. Instead of purchasing the target firm's shares in the market, John may consider purchasing selected assets of the target firm only. Discuss the advantages and disadvantages of acquisition of stock and acquisition of assets. c. In order to finance the potential acquisition, Unique Corp has to issue bonds for additional capital. The details of the bonds to be issued are as follow: Face value of bond =$1,000 Coupon rate =9% with annual coupon Time to maturity =10 years Currently, the yield to maturity of the company's bond is 8% If the company wants to raise $10 million by issuing bonds, compute the number of bonds required. d. After reviewing the target firm's income statement, John found that the target firm reported a loss last year. The market expects that the target firm will still suffer from a loss next year. As John's financial advisor, do you recommend the potential acquisition? Please explain your answer in detail Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started