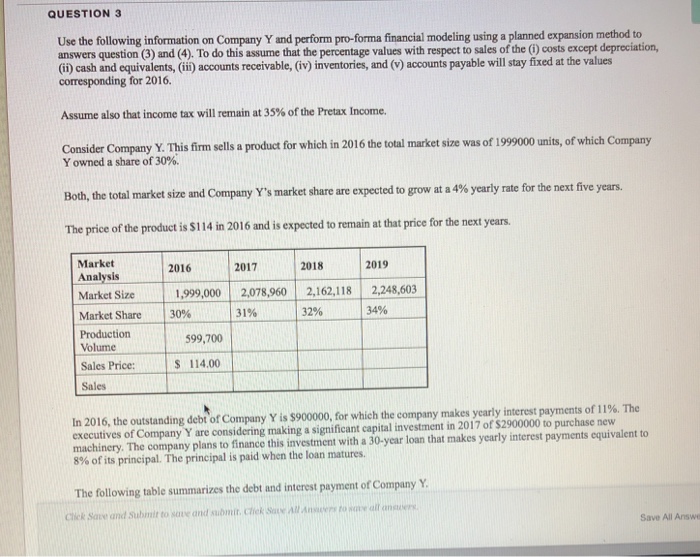

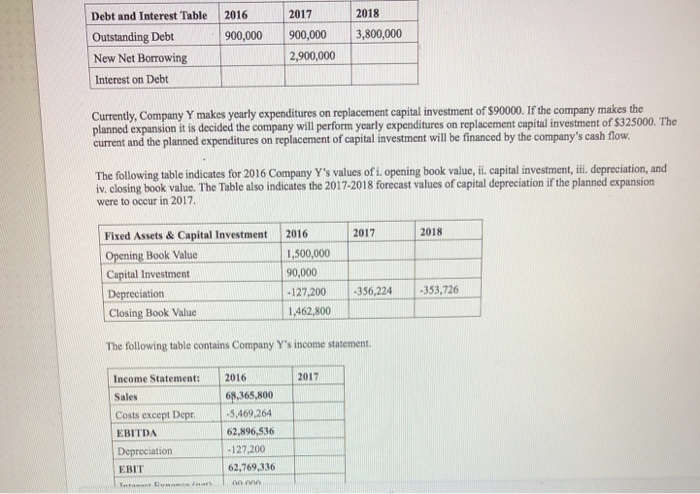

QUESTION 3 Use the following information on Company Y and perform pro-forma financial modeling using a planned expansion method to answers question (3) and (4). To do this assume that the percentage values with respect to sales of the (1) costs except depreciation, (ii) cash and equivalents, (i) accounts receivable, (iv) inventories, and (v) accounts payable will stay fixed at the values corresponding for 2016. Assume also that income tax will remain at 35% of the Pretax Income. Consider Company Y. This firm sells a product for which in 2016 the total market size was of 199000 units, of which Company Y owned a share of 30%. Both, the total market size and Company Y's market share are expected to grow at a 4% yearly rate for the next five years. The price of the product is $114 in 2016 and is expected to remain at that price for the next years Market 2016 2017 2018 2019 Analysis Market Size999000 2078,960 2,162,118 2,248,603 130% 31% 34% Market Share Production Volume Sales Price: Sales 32% 599,700 S 114.00 In 2016, the outstanding debt or Company Y is s900000, for which the company makes yearly interest payments of 11%. The executives of Company Y are considering making a significant capital investment in 2017 of $2900000 to purchase new machinery. The company plans to finance this investment with a 30-year loan that makes yearly interest payments equivalent to 8% of its principal. The principal is paid when the loan matures. The following table summarizes the debt and interest payment of Company Y Chek Save and Suhmir to sove and submit, ciek Swll Avr to ww all ans Save All Answe QUESTION 3 Use the following information on Company Y and perform pro-forma financial modeling using a planned expansion method to answers question (3) and (4). To do this assume that the percentage values with respect to sales of the (1) costs except depreciation, (ii) cash and equivalents, (i) accounts receivable, (iv) inventories, and (v) accounts payable will stay fixed at the values corresponding for 2016. Assume also that income tax will remain at 35% of the Pretax Income. Consider Company Y. This firm sells a product for which in 2016 the total market size was of 199000 units, of which Company Y owned a share of 30%. Both, the total market size and Company Y's market share are expected to grow at a 4% yearly rate for the next five years. The price of the product is $114 in 2016 and is expected to remain at that price for the next years Market 2016 2017 2018 2019 Analysis Market Size999000 2078,960 2,162,118 2,248,603 130% 31% 34% Market Share Production Volume Sales Price: Sales 32% 599,700 S 114.00 In 2016, the outstanding debt or Company Y is s900000, for which the company makes yearly interest payments of 11%. The executives of Company Y are considering making a significant capital investment in 2017 of $2900000 to purchase new machinery. The company plans to finance this investment with a 30-year loan that makes yearly interest payments equivalent to 8% of its principal. The principal is paid when the loan matures. The following table summarizes the debt and interest payment of Company Y Chek Save and Suhmir to sove and submit, ciek Swll Avr to ww all ans Save All Answe