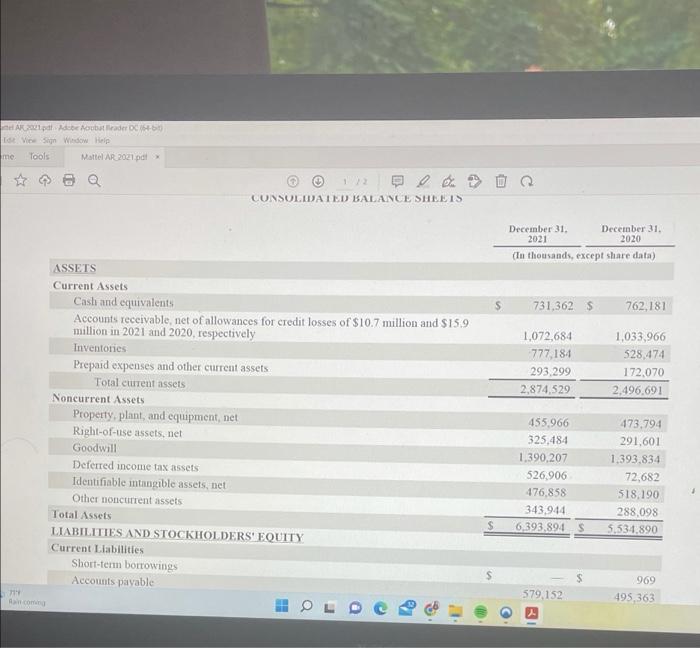

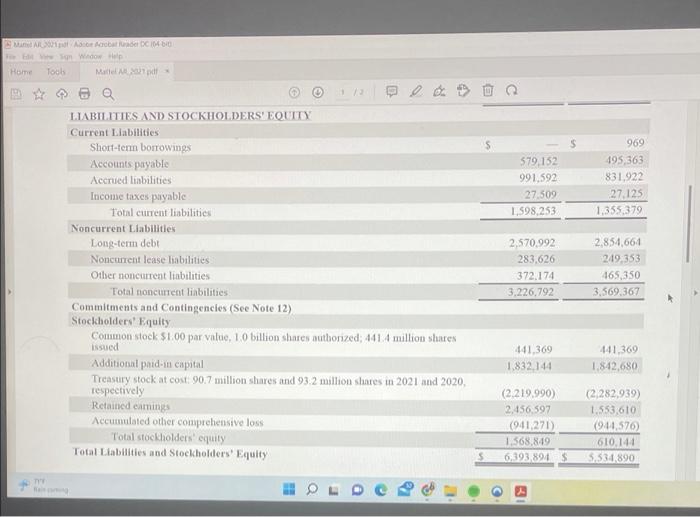

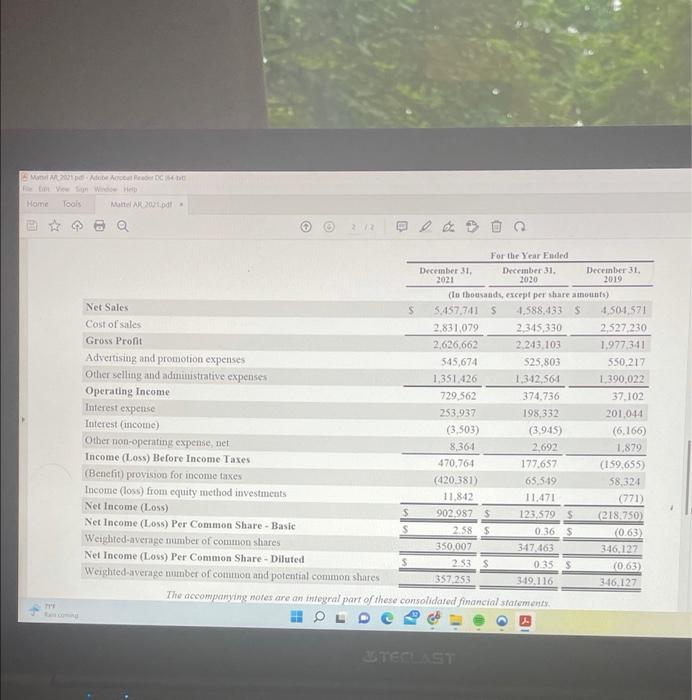

Question 3 Using Mattel's Balance Sheet and Income Statement for 2021 (see instructions above), it appears that they are managing their working capital well with a current ratio of [Select] however one analyst points out that it is worrisome that their quick ratio is lower at [Select] turnover [Select] [ Select] 8 pts " with relatively low inventory and a low TIE ratio of which means that they may be in trouble paying their interest costs and current liabilities if the economy turns. el AR 2021.pdf Adobe Acrobat Reader DC (64-bit) Edt View Sign Window Help me. Tools Mattel AR 2021.pdf x 719 Rais coming ASSETS Current Assets Cash and equivalents Accounts receivable, net of allowances for credit losses of $10.7 million and $15.9 million in 2021 and 2020, respectively Inventories Prepaid expenses and other current assets Total current assets Noncurrent Assets Property, plant, and equipment, net Right-of-use assets, net Goodwill Deferred income tax assets. Identifiable intangible assets, net Other noncurrent assets & D CONSOLIDATED BALANCE SHEE IS Total Assets LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities Short-term borrowings Accounts payable $ December 31. 2021 December 31, 2020 (In thousands, except share data) 731,362 $ 1,072,684 777,184 293,299 2,874,529 455,966 325,484 1,390,207 526,906 476,858 343,944 6,393,894 S 579,152 762,181 1,033,966 528,474 172,070 2,496.691 473,794 291,601 1,393,834 72,682 518,190 288,098 5,534,890 969 495,363 Manel AR-3021 Adobe Acrobat rader DC (64-bi Elit View Sign Window Help Tools Home TYV Mattel Al 2001 pdf LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities Short-term borrowings Accounts payable Accrued liabilities Income taxes payable Total current liabilities Noncurrent Liabilities Long-term debt Noncurrent lease liabilities Other noncurrent liabilities Total noncurrent liabilities Commitments and Contingencies (See Note 12) Stockholders' Equity Common stock $1.00 par value, 1.0 billion shares authorized; 441.4 million shares issued Additional paid-in capital Treasury stock at cost: 90.7 million shares and 93.2 million shares in 2021 and 2020, respectively Retained earnings Accumulated other comprehensive loss Total stockholders' equity Total Liabilities and Stockholders' Equity 579,152 991,592 27,509 1,598,253. 2,570,992 283,626 372.174 3,226,792 441,369 1,832,144 (2.219,990) 2,456,597 969 495,363 831,922 27,125 1,355,379 2,854,664 249,353 465,350 3,569,367 441,369 1,842,680 (2,282,939) 1,553,610 (941,271) (944,576) 1,568,849 610,144 6.393,894 $ 5,534,890 Manel A2025 pd Adobe Acrobat Reader DC View Sign Window Help Tools Home 719 Rais coming Mattel AR 2021.pdf Q Net Sales Cost of sales Gross Profit Advertising and promotion expenses Other selling and administrative expenses Operating Income 2:12 Interest expense Interest (income) Other non-operating expense, net Income (Loss) Before Income Taxes (Benefit) provision for income taxes Income (loss) from equity method investments Net Income (Loss) Net Income (Loss) Per Common Share - Basic Weighted-average number of common shares Net Income (Loss) Per Common Share - Diluted Weighted-average number of common and potential common shares S $ $ December 31, 2021 (In thousands, 5,457,741 S 2,831,079 2,626,662 545,674 1,351,4261 729,562 253,937 (3,503) 8,364 470,764 (420 381) 11,842 902,987 $ 2.58 S 350.007 For the Year Ended December 31, 2020 2.53 S 357,253 TECLAST except per share amounts) 4,588,433 $ 2,345,330 2,243,103 525,803 1,342,564 374,736 198,332 (3,945) 2,692 177,657 65,549 11.471 123,579 S 0.36 $ 347,463 0.35 $ 349,116 The accompanying notes are an integral part of these consolidated financial statements. December 31, 2019 4,504,571 2,527,230 1,977,3411 550,217 1,390,022 37,102 201,044 (6,166) 1,879 (159,655) 58,324 (771) (218,750) (0.63) 346,127 (0.63) 346,127