Answered step by step

Verified Expert Solution

Question

1 Approved Answer

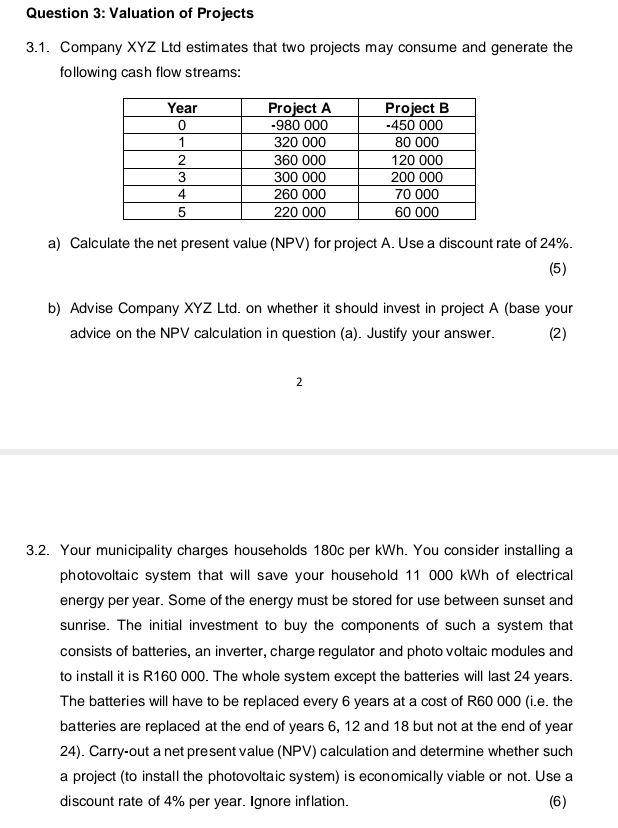

Question 3: Valuation of Projects 3.1. Company XYZ Ltd estimates that two projects may consume and generate the following cash flow streams: Year 0 1

Question 3: Valuation of Projects 3.1. Company XYZ Ltd estimates that two projects may consume and generate the following cash flow streams: Year 0 1 2 3 4 5 Project A -980 000 320 000 360 000 300 000 260 000 220 000 Project B -450 000 80 000 120 000 200 000 70 000 60 000 a) Calculate the net present value (NPV) for project A. Use a discount rate of 24%. (5) b) Advise Company XYZ Ltd. on whether it should invest in project A (base your advice on the NPV calculation in question (a). Justify your answer. (2) 2 3.2. Your municipality charges households 180c per kWh. You consider installing a photovoltaic system that will save your household 11 000 kWh of electrical energy per year. Some of the energy must be stored for use between sunset and sunrise. The initial investment to buy the components of such a system that consists of batteries, an inverter, charge regulator and photo voltaic modules and to install it is R160 000. The whole system except the batteries will last 24 years. The batteries will have to be replaced every 6 years at a cost of R60 000 (i.e. the batteries are replaced at the end of years 6, 12 and 18 but not at the end of year 24). Carry-out a net present value (NPV) calculation and determine whether such a project (to install the photovoltaic system) is economically viable or not. Use a discount rate of 4% per year. Ignore inflation. (6)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started