Question

Question 3 Which of the following statements is true? An employee travels out of town as required by his job, and he is not

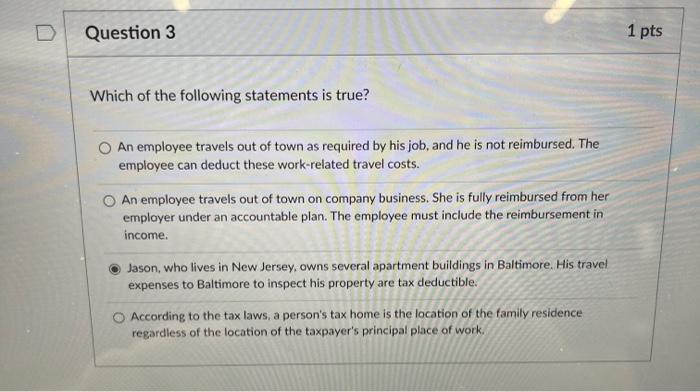

Question 3 Which of the following statements is true? An employee travels out of town as required by his job, and he is not reimbursed. The employee can deduct these work-related travel costs. An employee travels out of town on company business. She is fully reimbursed from her employer under an accountable plan. The employee must include the reimbursement in income. Jason, who lives in New Jersey, owns several apartment buildings in Baltimore. His travel expenses to Baltimore to inspect his property are tax deductible. According to the tax laws, a person's tax home is the location of the family residence regardless of the location of the taxpayer's principal place of work. 1 pts

Step by Step Solution

3.56 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2015

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven Gill

33rd Edition

9781305177772, 128543952X, 1305177770, 978-1285439525

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App