Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 You are interested in buying shares of Tesla, but the stock was very volatile lately and you are afraid that it might

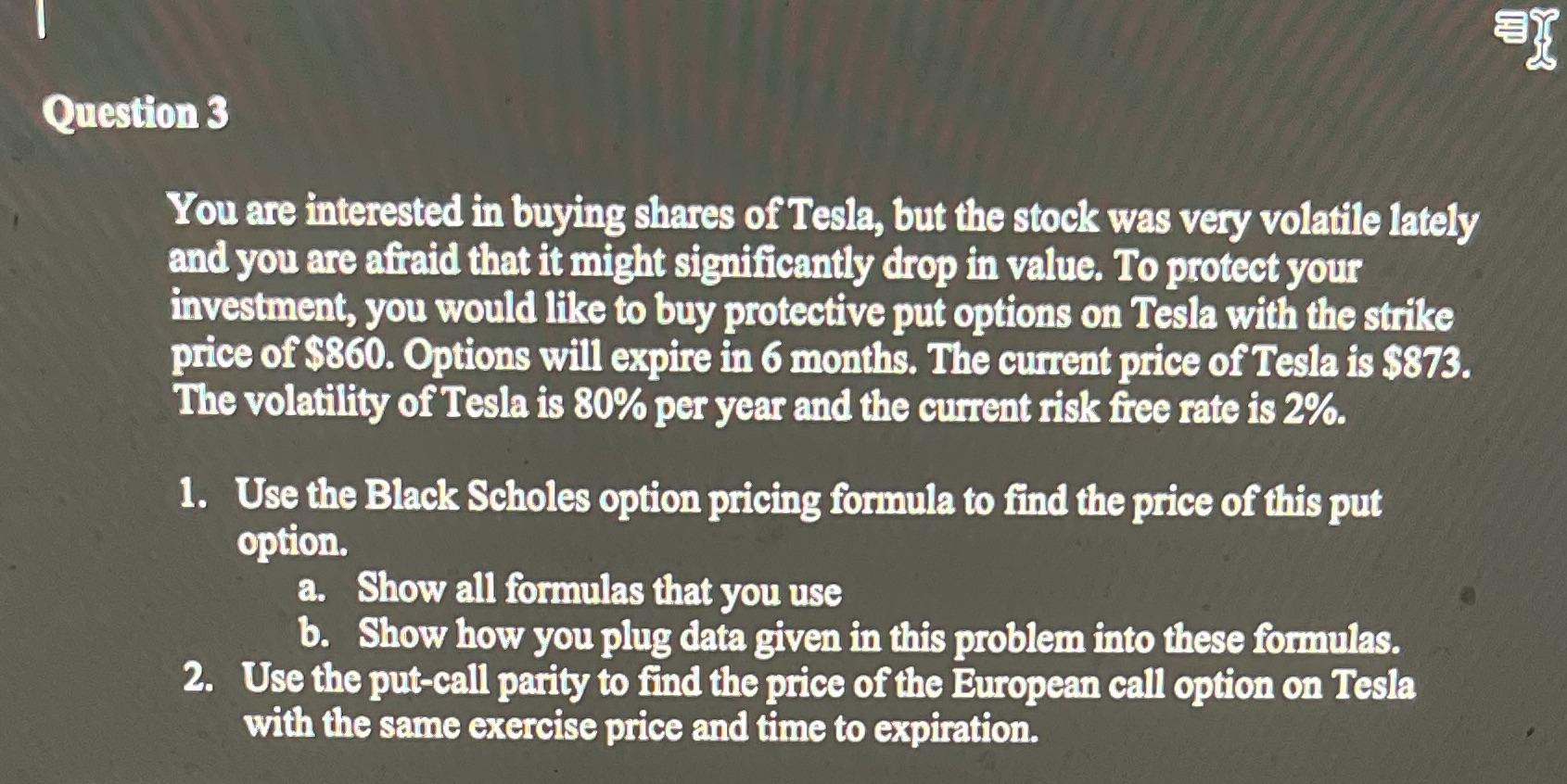

Question 3 You are interested in buying shares of Tesla, but the stock was very volatile lately and you are afraid that it might significantly drop in value. To protect your investment, you would like to buy protective put options on Tesla with the strike price of $860. Options will expire in 6 months. The current price of Tesla is $873. The volatility of Tesla is 80% per year and the current risk free rate is 2%. 1. Use the Black Scholes option pricing formula to find the price of this put option. a. Show all formulas that you use b. Show how you plug data given in this problem into these formulas. 2. Use the put-call parity to find the price of the European call option on Tesla with the same exercise price and time to expiration. ay

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Price of the Put Option Using BlackScholes a Formulas BlackScholes formula for puts C S Nd1 K erT ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started