Question 3 You friend went back to his engineering books and realized that he forgot to account for the growth rate of the well's

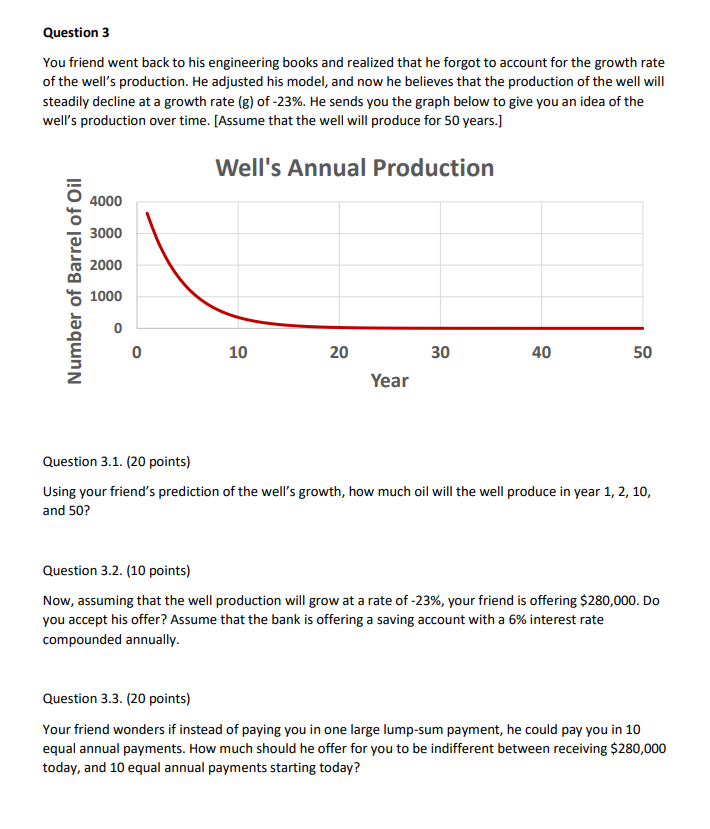

Question 3 You friend went back to his engineering books and realized that he forgot to account for the growth rate of the well's production. He adjusted his model, and now he believes that the production of the well will steadily decline at a growth rate (g) of -23%. He sends you the graph below to give you an idea of the well's production over time. [Assume that the well will produce for 50 years.] Well's Annual Production Number of Barrel of Oil 4000 3000 2000 1000 0 0 10 20 Year 30 40 50 Question 3.1. (20 points) Using your friend's prediction of the well's growth, how much oil will the well produce in year 1, 2, 10, and 50? Question 3.2. (10 points) Now, assuming that the well production will grow at a rate of -23%, your friend is offering $280,000. Do you accept his offer? Assume that the bank is offering a saving account with a 6% interest rate compounded annually. Question 3.3. (20 points) Your friend wonders if instead of paying you in one large lump-sum payment, he could pay you in 10 equal annual payments. How much should he offer for you to be indifferent between receiving $280,000 today, and 10 equal annual payments starting today?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Question 31 To calculate the oil production in each year well use the formula for exponential decay Pt P0ert Where Pt is the production at time t P0 is the initial production r is the growth rate in d...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started