Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3. You have been hired to value the stock of a privately-held chain of grocery stores, FreshCo. FreshCo has 25,000 common shares outstanding In

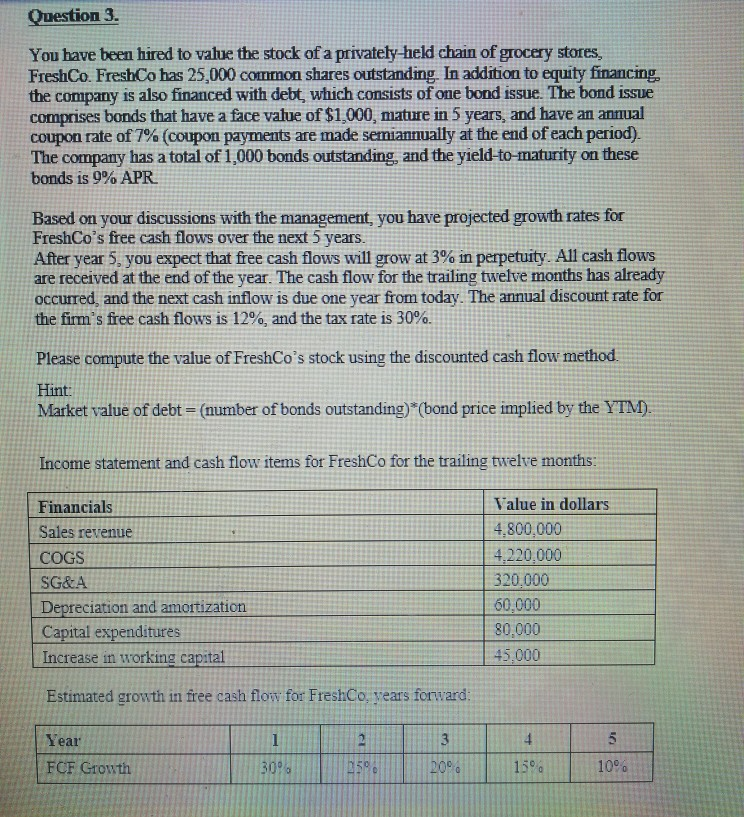

Question 3. You have been hired to value the stock of a privately-held chain of grocery stores, FreshCo. FreshCo has 25,000 common shares outstanding In addition to equity financing, the company is also financed with debt, which consists of one bond issue. The bond issue comprises bonds that have a face value of $1,000, mature in 5 years, and have an annual coupon rate of 7% coupon payments are made semiannually at the end of each period The company has a total of 1,000 bonds outstanding, and the yield-to-maturity on these bonds is 9% APR. Based on your discussions with the management, you have projected growth rates for FreshCo's free cash flows over the next 5 years. After year 5, you expect that free cash flows will grow at 3% in perpetuity. All cash flows are received at the end of the year. The cash flow for the trailing twelve months has already occurred, and the next cash inflow is due one year from today. The annual discount rate for the firm's fee cash flows is 12%, and the tax rate is 30%. Please compute the value of FreshCo's stock using the discounted cash flow method Hint Market value of debt- (number of bonds outstanding) (bond price implied by the YTM) Income statement and cash flow items for FreshCo for the trailing twelve months Financials Sales revenue COGS SG&A Depreciation and amortization Capital expenditures Value in dollars 4.800.000 4,220,000 320.000 60,000 45.000 Estimated growth in free cash flow for FreshCo, years forward Year FCF Growth 30% 125% 20% 15% 10%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started