Answered step by step

Verified Expert Solution

Question

1 Approved Answer

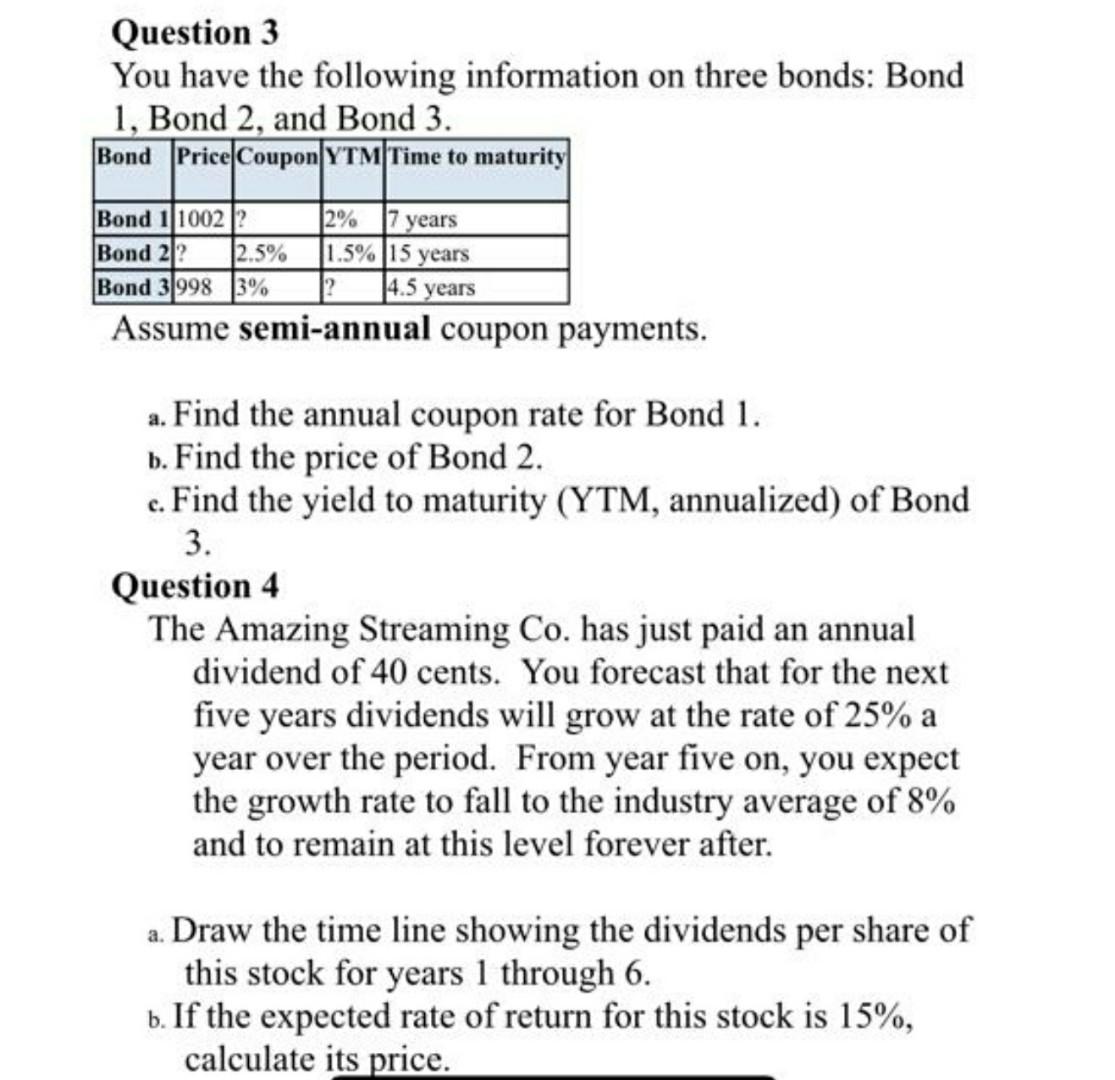

Question 3 You have the following information on three bonds: Bond 1, Bond 2, and Bond 3. Bond Price Coupon YTM Time to maturity Bond

Question 3 You have the following information on three bonds: Bond 1, Bond 2, and Bond 3. Bond Price Coupon YTM Time to maturity Bond 1 10022 12% 17 years Bond 2 22.5% 1.5% 15 years Bond 3 998 3% 14.5 years Assume semi-annual coupon payments. a. Find the annual coupon rate for Bond 1. b. Find the price of Bond 2. c. Find the yield to maturity (YTM, annualized) of Bond 3. Question 4 The Amazing Streaming Co. has just paid an annual dividend of 40 cents. You forecast that for the next five years dividends will grow at the rate of 25% a year over the period. From year five on, you expect the growth rate to fall to the industry average of 8% and to remain at this level forever after. a. Draw the time line showing the dividends per share of this stock for years 1 through 6. b. If the expected rate of return for this stock is 15%, calculate its price. a. Providing formulas in symbols. Formulas are those used in the lecture notes and the text book. Excel or Financial Calculator formulas are NOT appropriate substitutes. b. Illustrating how you plug numbers, given in each question, into these formulas. c. Writing a short verbal summary at the end of the problem Please use posted HW solutions as a guide on how detailed your solutions should be. 8. Draw timelines and graphs to illustrate your answers. Voor Requirements for solutions: As always, you need to write your detailed solutions, in which you need to: 1. Provide the appropriate formula for each step in each problem. Formulas should be written in symbols (please, do not write Excel formulas -- they do not count). 2. Show how you plug numbers from the problem into each formula 3. Present time lines and graphs, etc., where appropriate. 4. Write a short verbal comment at the end of each step in each problem, explaining what you achieved with your calculations 5. Write a short verbal conclusion at the end of each problem with the summary of your results. 6. A numerical answer by itself (even if it is correct) without a detailed solution and explanations does not deserve ANY credit. 7. Use my posted solutions as examples of how to write a detailed solution to a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started