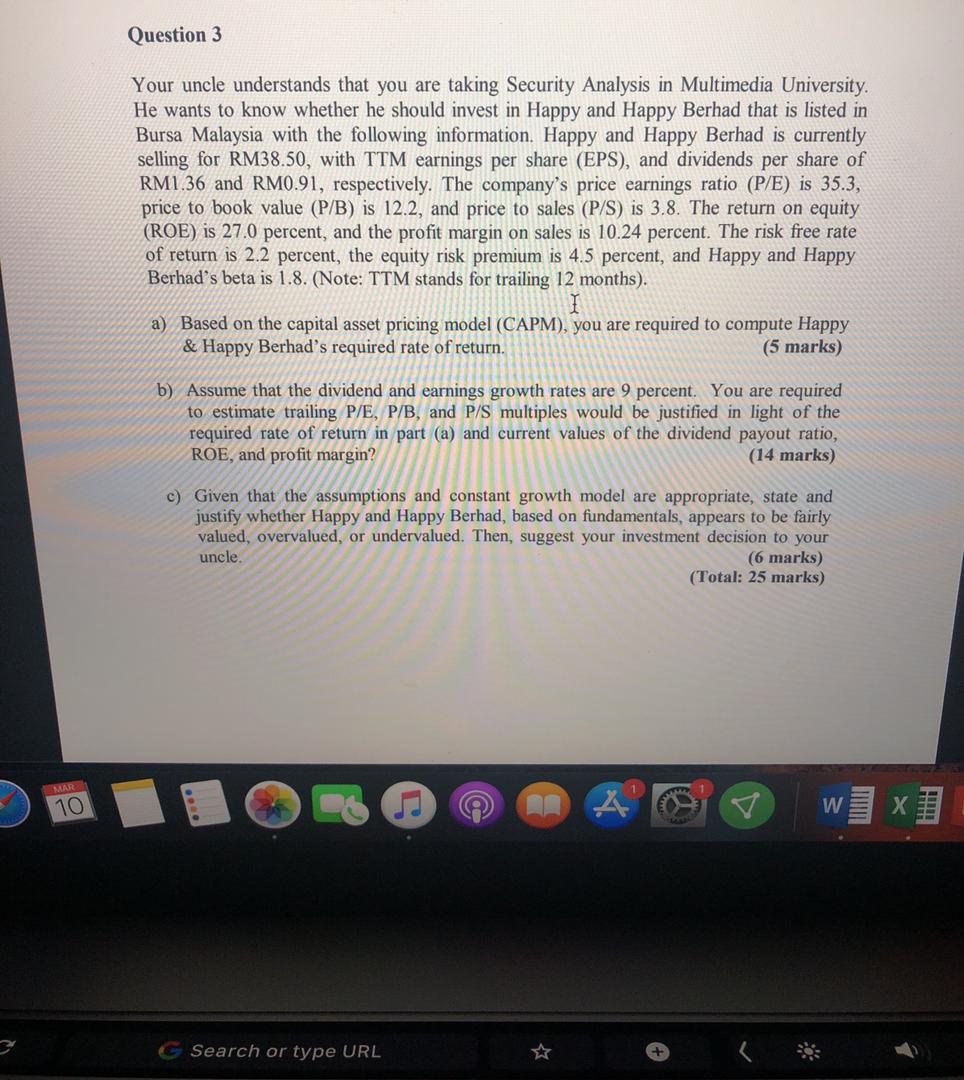

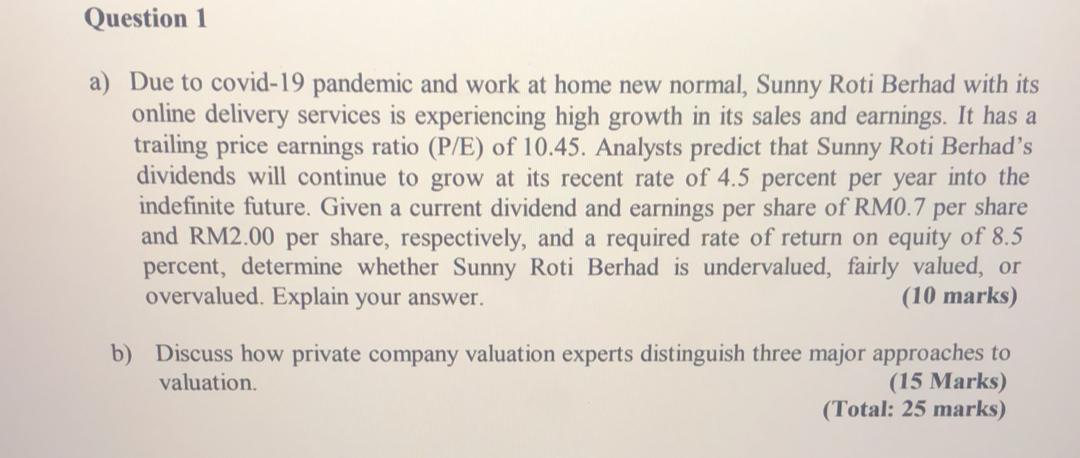

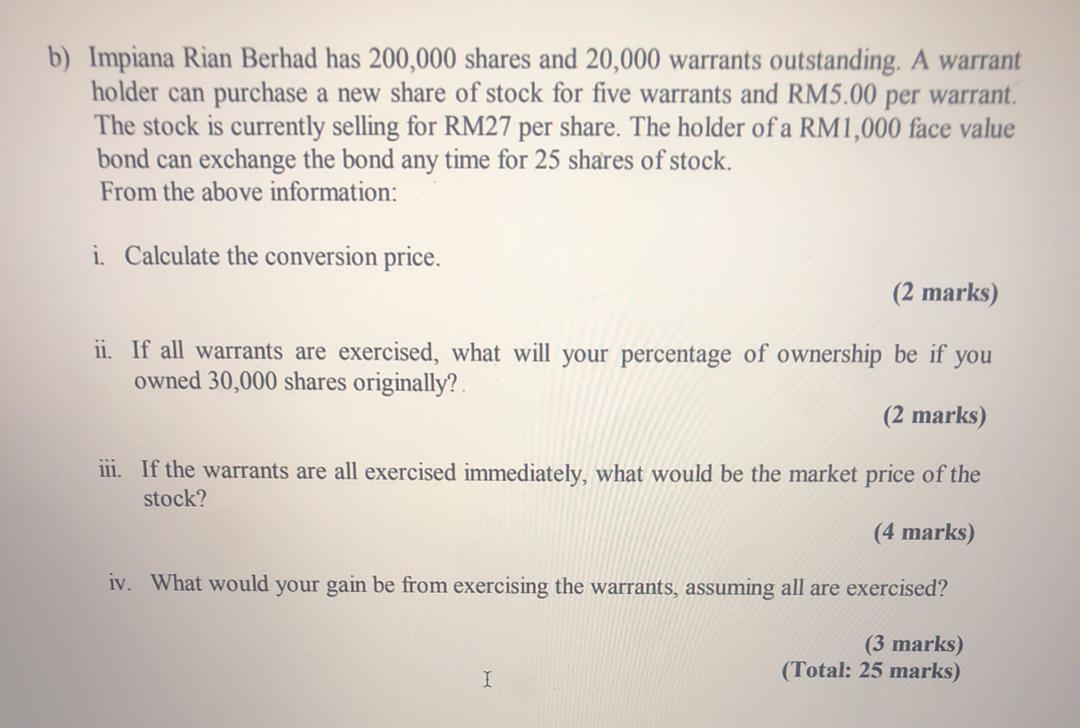

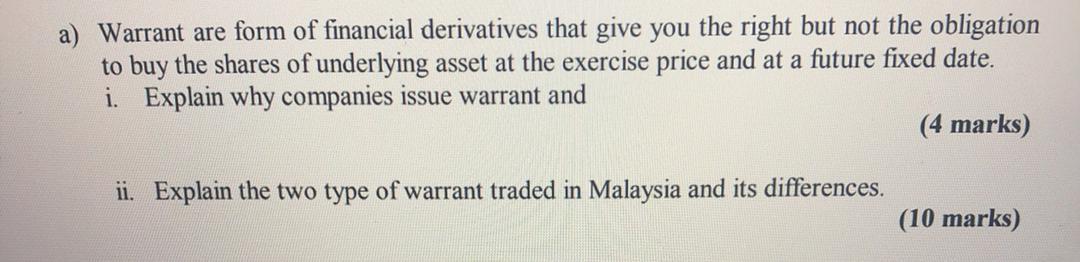

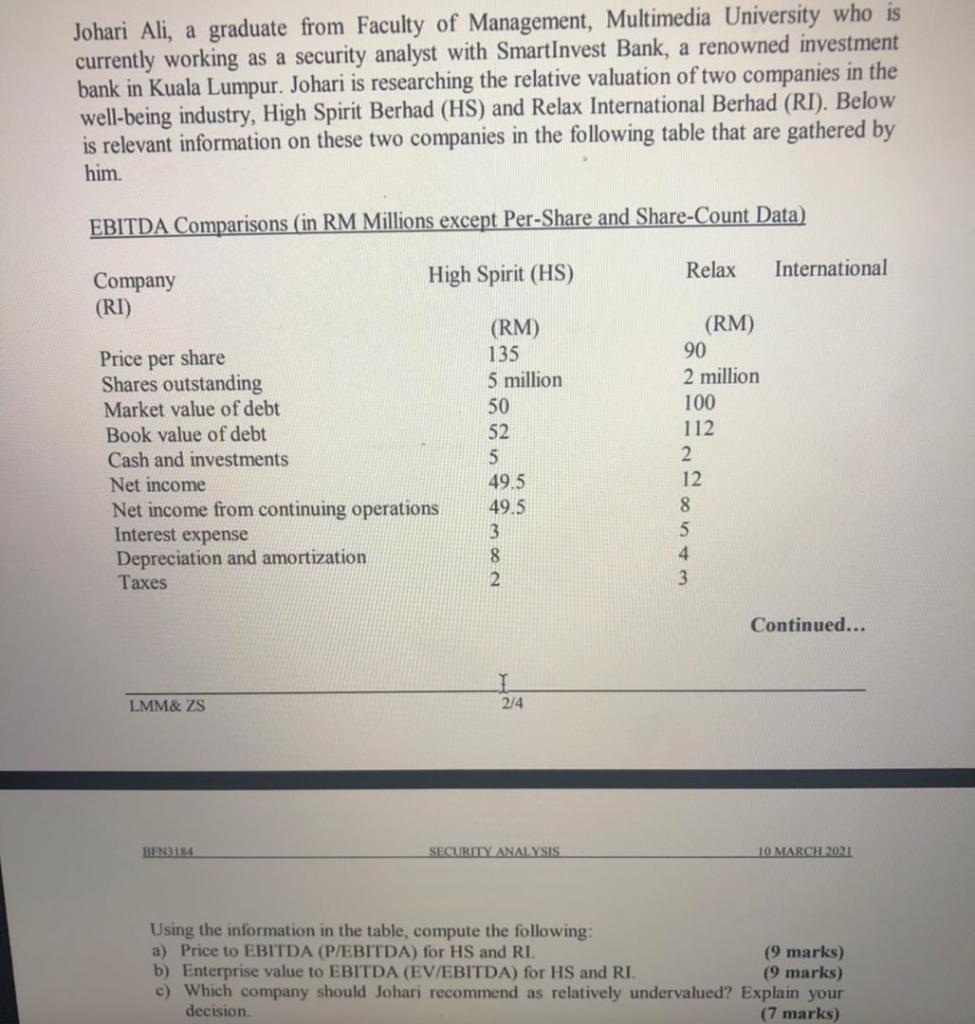

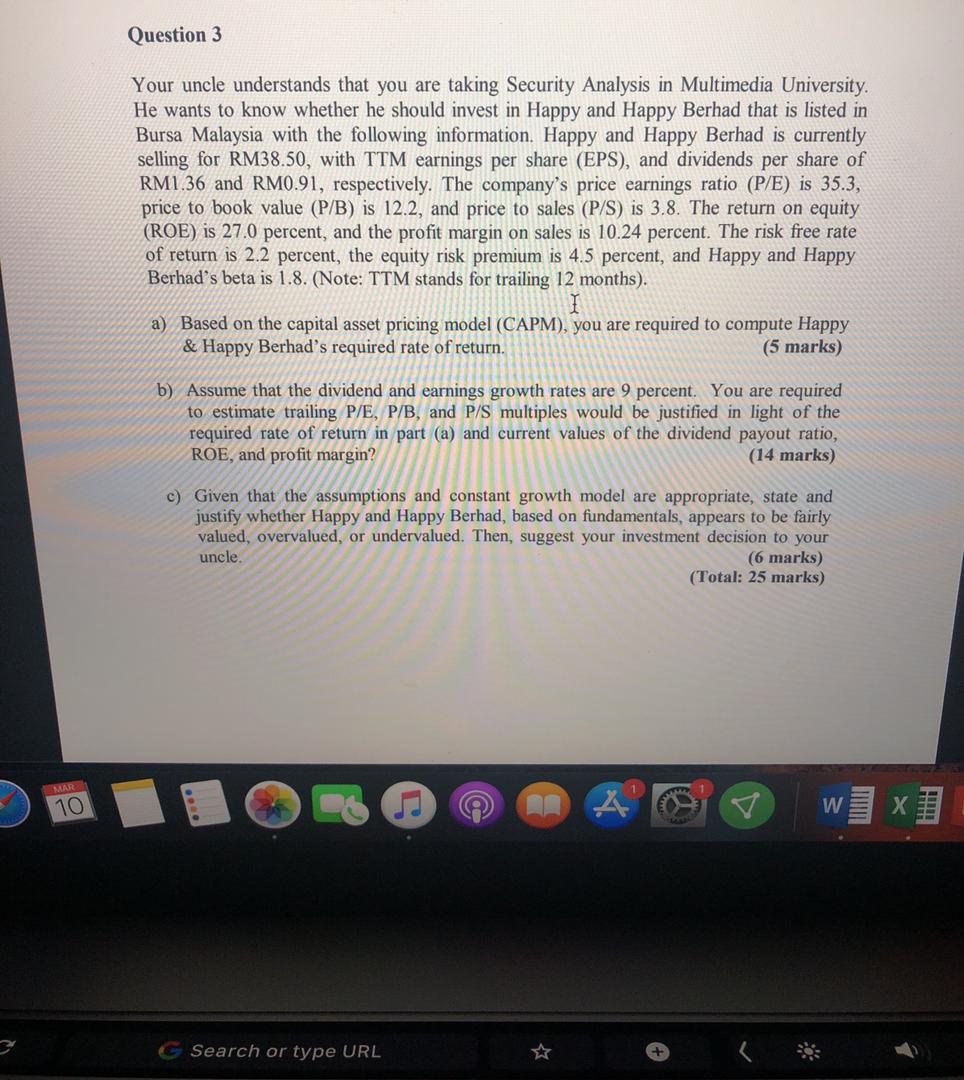

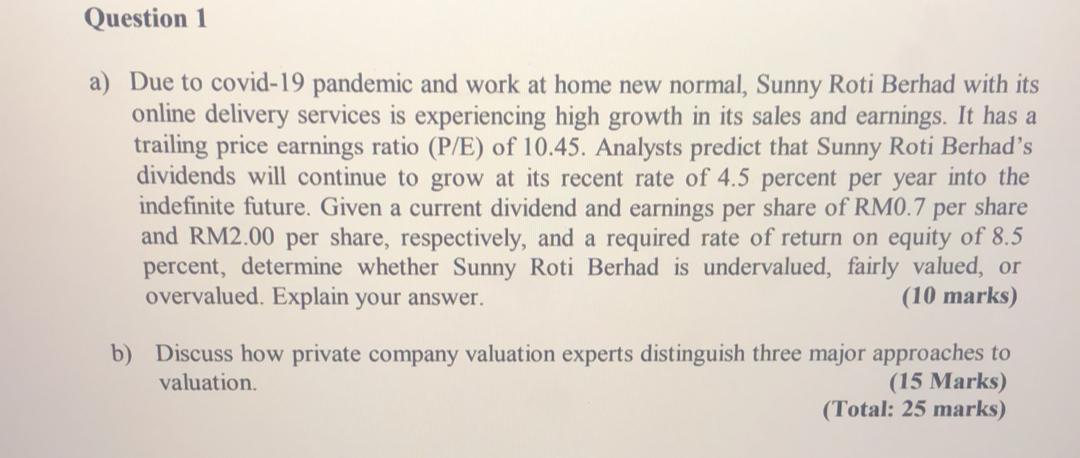

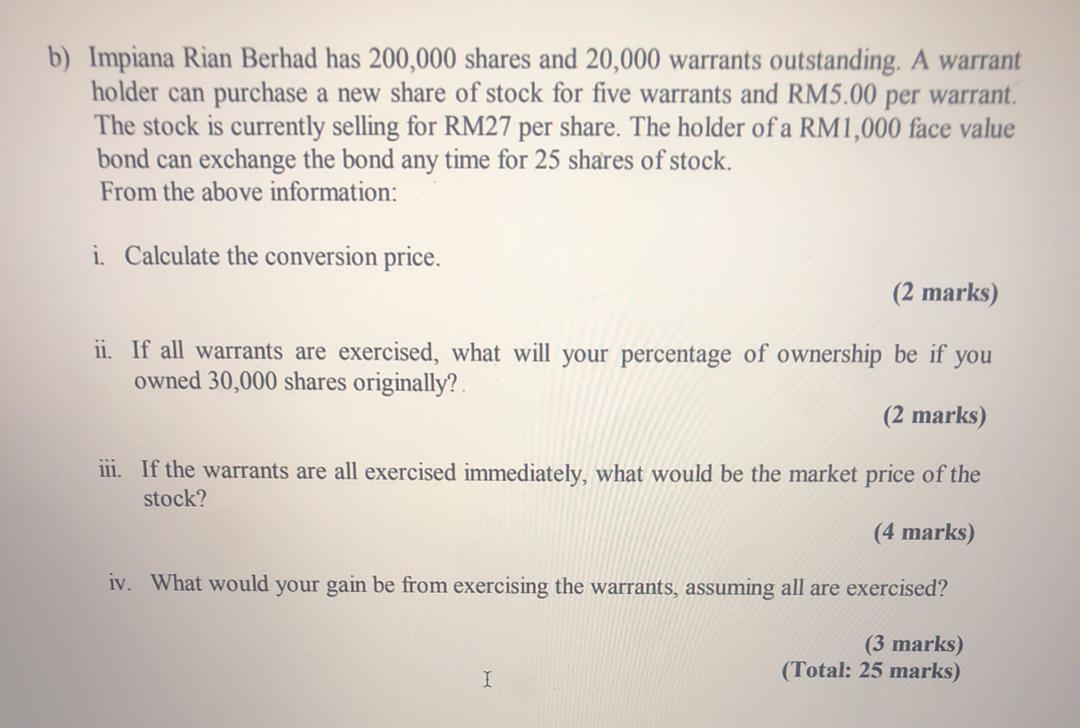

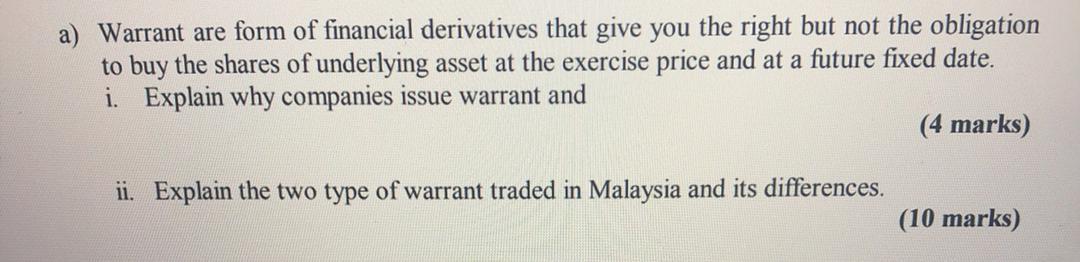

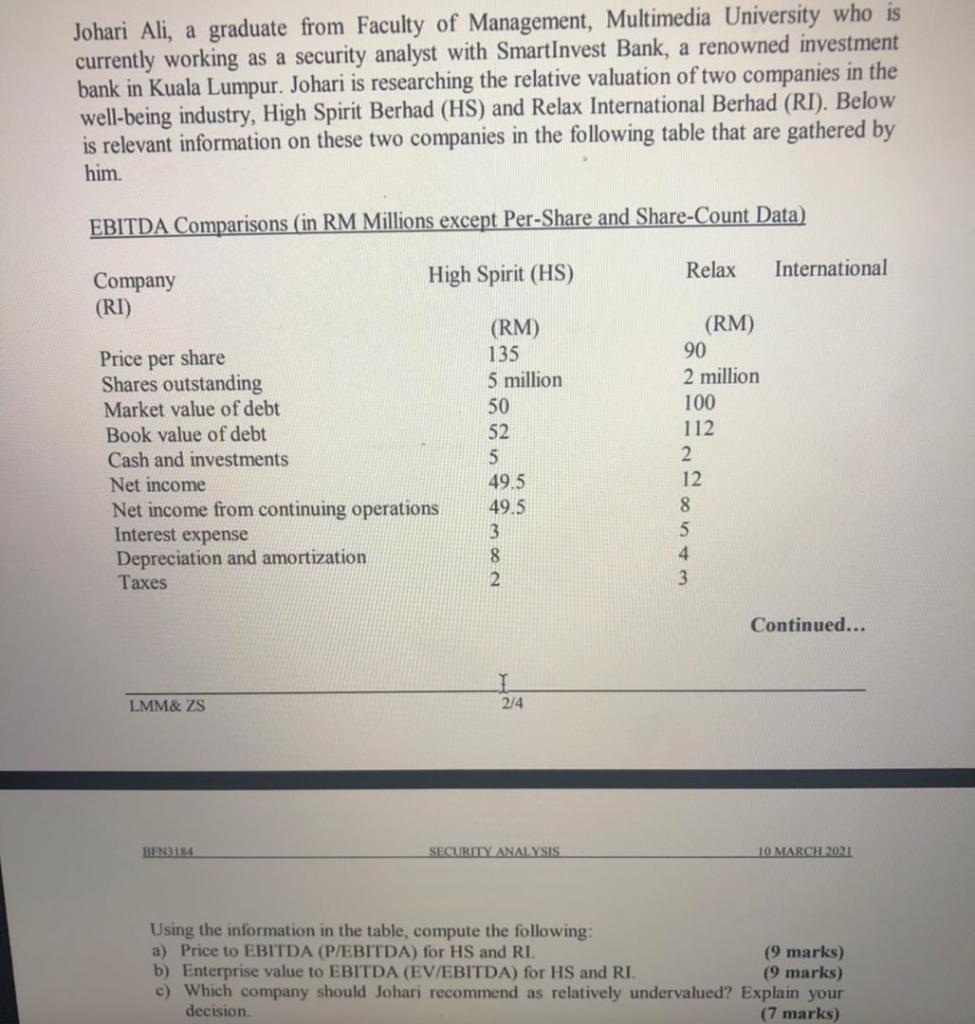

Question 3 Your uncle understands that you are taking Security Analysis in Multimedia University. He wants to know whether he should invest in Happy and Happy Berhad that is listed in Bursa Malaysia with the following information. Happy and Happy Berhad is currently selling for RM38.50, with TTM earnings per share (EPS), and dividends per share of RM1.36 and RM0.91, respectively. The company's price earnings ratio (P/E) is 35.3, price to book value (P/B) is 12.2, and price to sales (P/S) is 3.8. The return on equity (ROE) is 27.0 percent, and the profit margin on sales is 10.24 percent. The risk free rate of return is 2.2 percent, the equity risk premium is 4.5 percent, and Happy and Happy Berhad's beta is 1.8. (Note: TTM stands for trailing 12 months). a) Based on the capital asset pricing model (CAPM), you are required to compute Happy & Happy Berhad's required rate of return. (5 marks) b) Assume that the dividend and earnings growth rates are 9 percent. You are required to estimate trailing P/E, P/B, and P/S multiples would be justified in light of the required rate of return in part (a) and current values of the dividend payout ratio, ROE, and profit margin? (14 marks) c) Given that the assumptions and constant growth model are appropriate, state and justify whether Happy and Happy Berhad, based on fundamentals, appears to be fairly valued, overvalued, or undervalued. Then, suggest your investment decision to your uncle. (6 marks) (Total: 25 marks) MAR 10 W III HH Search or type URL Question 1 a) Due to covid-19 pandemic and work at home new normal, Sunny Roti Berhad with its online delivery services is experiencing high growth in its sales and earnings. It has a trailing price earnings ratio (P/E) of 10.45. Analysts predict that Sunny Roti Berhad's dividends will continue to grow at its recent rate of 4.5 percent per year into the indefinite future. Given a current dividend and earnings per share of RM0.7 per share and RM2.00 per share, respectively, and a required rate of return on equity of 8.5 percent, determine whether Sunny Roti Berhad is undervalued, fairly valued, or overvalued. Explain your answer. (10 marks) b) Discuss how private company valuation experts distinguish three major approaches to valuation (15 Marks) (Total: 25 marks) b) Impiana Rian Berhad has 200,000 shares and 20,000 warrants outstanding. A warrant holder can purchase a new share of stock for five warrants and RM5.00 per warrant. The stock is currently selling for RM27 per share. The holder of a RM1,000 face value bond can exchange the bond any time for 25 shares of stock. From the above information: i. Calculate the conversion price. (2 marks) ii. If all warrants are exercised, what will your percentage of ownership be if you owned 30,000 shares originally? (2 marks) iii. If the warrants are all exercised immediately, what would be the market price of the stock? (4 marks) iv. What would your gain be from exercising the warrants, assuming all are exercised? (3 marks) (Total: 25 marks) I a) Warrant are form of financial derivatives that give you the right but not the obligation to buy the shares of underlying asset at the exercise price and at a future fixed date. i. Explain why companies issue warrant and (4 marks) ii. Explain the two type of warrant traded in Malaysia and its differences. (10 marks) Johari Ali, a graduate from Faculty of Management, Multimedia University who is currently working as a security analyst with Smart Invest Bank, a renowned investment bank in Kuala Lumpur. Johari is researching the relative valuation of two companies in the well-being industry, High Spirit Berhad (HS) and Relax International Berhad (RI). Below is relevant information on these two companies in the following table that are gathered by him. EBITDA Comparisons (in RM Millions except Per-Share and Share-Count Data) High Spirit (HS) Relax International Company (RI) Price per share Shares outstanding Market value of debt Book value of debt Cash and investments Net income Net income from continuing operations Interest expense Depreciation and amortization Taxes (RM) 135 5 million 50 52 5 49.5 49.5 3 8 2 (RM) 90 2 million 100 112 2. 12. 8 5 4 3 Continued... T 2/4 LMM& ZS BEN3184 SECURITY ANALYSIS 10 MARCHRO Using the information in the table, compute the following: a) Price to EBITDA (P/EBITDA) for HS and RI (9 marks) b) Enterprise value to EBITDA (EV/EBITDA) for HS and RI. (9 marks) c) Which company should Johari recommend as relatively undervalued? Explain your decision (7 marks) Question 3 Your uncle understands that you are taking Security Analysis in Multimedia University. He wants to know whether he should invest in Happy and Happy Berhad that is listed in Bursa Malaysia with the following information. Happy and Happy Berhad is currently selling for RM38.50, with TTM earnings per share (EPS), and dividends per share of RM1.36 and RM0.91, respectively. The company's price earnings ratio (P/E) is 35.3, price to book value (P/B) is 12.2, and price to sales (P/S) is 3.8. The return on equity (ROE) is 27.0 percent, and the profit margin on sales is 10.24 percent. The risk free rate of return is 2.2 percent, the equity risk premium is 4.5 percent, and Happy and Happy Berhad's beta is 1.8. (Note: TTM stands for trailing 12 months). a) Based on the capital asset pricing model (CAPM), you are required to compute Happy & Happy Berhad's required rate of return. (5 marks) b) Assume that the dividend and earnings growth rates are 9 percent. You are required to estimate trailing P/E, P/B, and P/S multiples would be justified in light of the required rate of return in part (a) and current values of the dividend payout ratio, ROE, and profit margin? (14 marks) c) Given that the assumptions and constant growth model are appropriate, state and justify whether Happy and Happy Berhad, based on fundamentals, appears to be fairly valued, overvalued, or undervalued. Then, suggest your investment decision to your uncle. (6 marks) (Total: 25 marks) MAR 10 W III HH Search or type URL Question 1 a) Due to covid-19 pandemic and work at home new normal, Sunny Roti Berhad with its online delivery services is experiencing high growth in its sales and earnings. It has a trailing price earnings ratio (P/E) of 10.45. Analysts predict that Sunny Roti Berhad's dividends will continue to grow at its recent rate of 4.5 percent per year into the indefinite future. Given a current dividend and earnings per share of RM0.7 per share and RM2.00 per share, respectively, and a required rate of return on equity of 8.5 percent, determine whether Sunny Roti Berhad is undervalued, fairly valued, or overvalued. Explain your answer. (10 marks) b) Discuss how private company valuation experts distinguish three major approaches to valuation (15 Marks) (Total: 25 marks) b) Impiana Rian Berhad has 200,000 shares and 20,000 warrants outstanding. A warrant holder can purchase a new share of stock for five warrants and RM5.00 per warrant. The stock is currently selling for RM27 per share. The holder of a RM1,000 face value bond can exchange the bond any time for 25 shares of stock. From the above information: i. Calculate the conversion price. (2 marks) ii. If all warrants are exercised, what will your percentage of ownership be if you owned 30,000 shares originally? (2 marks) iii. If the warrants are all exercised immediately, what would be the market price of the stock? (4 marks) iv. What would your gain be from exercising the warrants, assuming all are exercised? (3 marks) (Total: 25 marks) I a) Warrant are form of financial derivatives that give you the right but not the obligation to buy the shares of underlying asset at the exercise price and at a future fixed date. i. Explain why companies issue warrant and (4 marks) ii. Explain the two type of warrant traded in Malaysia and its differences. (10 marks) Johari Ali, a graduate from Faculty of Management, Multimedia University who is currently working as a security analyst with Smart Invest Bank, a renowned investment bank in Kuala Lumpur. Johari is researching the relative valuation of two companies in the well-being industry, High Spirit Berhad (HS) and Relax International Berhad (RI). Below is relevant information on these two companies in the following table that are gathered by him. EBITDA Comparisons (in RM Millions except Per-Share and Share-Count Data) High Spirit (HS) Relax International Company (RI) Price per share Shares outstanding Market value of debt Book value of debt Cash and investments Net income Net income from continuing operations Interest expense Depreciation and amortization Taxes (RM) 135 5 million 50 52 5 49.5 49.5 3 8 2 (RM) 90 2 million 100 112 2. 12. 8 5 4 3 Continued... T 2/4 LMM& ZS BEN3184 SECURITY ANALYSIS 10 MARCHRO Using the information in the table, compute the following: a) Price to EBITDA (P/EBITDA) for HS and RI (9 marks) b) Enterprise value to EBITDA (EV/EBITDA) for HS and RI. (9 marks) c) Which company should Johari recommend as relatively undervalued? Explain your decision (7 marks)