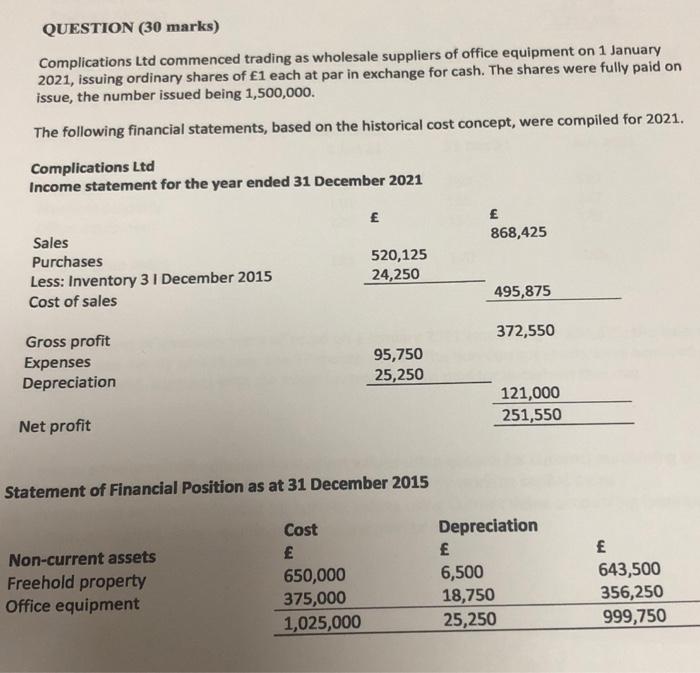

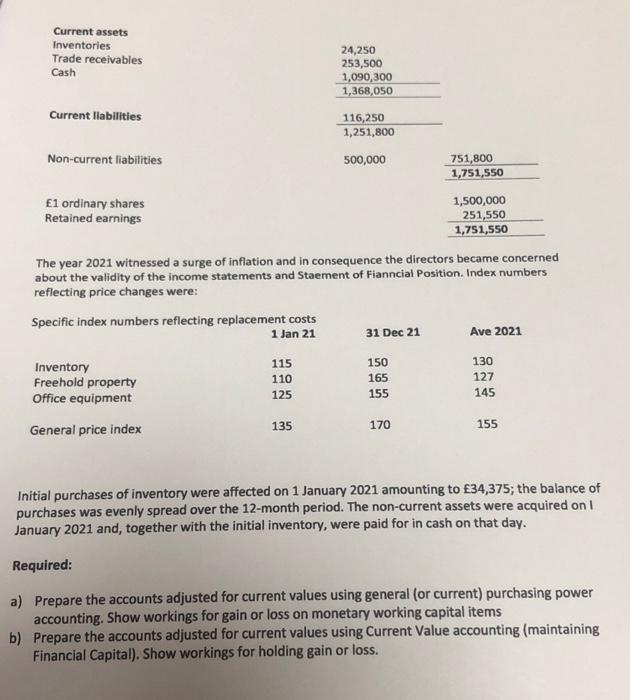

QUESTION (30 marks) Complications Ltd commenced trading as wholesale suppliers of office equipment on 1 January 2021, issuing ordinary shares of 1 each at par in exchange for cash. The shares were fully paid on issue, the number issued being 1,500,000. The following financial statements, based on the historical cost concept, were compiled for 2021. Complications Ltd Income statement for the year ended 31 December 2021 868,425 Sales Purchases Less: Inventory 3 1 December 2015 Cost of sales 520,125 24,250 495,875 372,550 Gross profit Expenses Depreciation 95,750 25,250 121,000 251,550 Net profit Statement of Financial Position as at 31 December 2015 Non-current assets Freehold property Office equipment Cost E 650,000 375,000 1,025,000 Depreciation 6,500 18,750 25,250 643,500 356,250 999,750 Current assets Inventories Trade receivables Cash 24,250 253,500 1,090,300 1,368,050 Current liabilities 116,250 1,251,800 Non-current liabilities 500,000 751,800 1,751,550 1 ordinary shares 1,500,000 Retained earnings 251,550 1,751,550 The year 2021 witnessed a surge of inflation and in consequence the directors became concerned about the validity of the income statements and Staement of Fianncial Position. Index numbers reflecting price changes were: Specific index numbers reflecting replacement costs 1 Jan 21 31 Dec 21 Ave 2021 115 Inventory Freehold property Office equipment 110 125 150 165 155 130 127 145 135 170 General price index 155 Initial purchases of inventory were affected on 1 January 2021 amounting to 34,375; the balance of purchases was evenly spread over the 12-month period. The non-current assets were acquired on 1 January 2021 and, together with the initial inventory, were paid for in cash on that day. Required: a) Prepare the accounts adjusted for current values using general (or current) purchasing power accounting. Show workings for gain or loss on monetary working capital items b) Prepare the accounts adjusted for current values using Current Value accounting (maintaining Financial Capital). Show workings for holding gain or loss. QUESTION (30 marks) Complications Ltd commenced trading as wholesale suppliers of office equipment on 1 January 2021, issuing ordinary shares of 1 each at par in exchange for cash. The shares were fully paid on issue, the number issued being 1,500,000. The following financial statements, based on the historical cost concept, were compiled for 2021. Complications Ltd Income statement for the year ended 31 December 2021 868,425 Sales Purchases Less: Inventory 3 1 December 2015 Cost of sales 520,125 24,250 495,875 372,550 Gross profit Expenses Depreciation 95,750 25,250 121,000 251,550 Net profit Statement of Financial Position as at 31 December 2015 Non-current assets Freehold property Office equipment Cost E 650,000 375,000 1,025,000 Depreciation 6,500 18,750 25,250 643,500 356,250 999,750 Current assets Inventories Trade receivables Cash 24,250 253,500 1,090,300 1,368,050 Current liabilities 116,250 1,251,800 Non-current liabilities 500,000 751,800 1,751,550 1 ordinary shares 1,500,000 Retained earnings 251,550 1,751,550 The year 2021 witnessed a surge of inflation and in consequence the directors became concerned about the validity of the income statements and Staement of Fianncial Position. Index numbers reflecting price changes were: Specific index numbers reflecting replacement costs 1 Jan 21 31 Dec 21 Ave 2021 115 Inventory Freehold property Office equipment 110 125 150 165 155 130 127 145 135 170 General price index 155 Initial purchases of inventory were affected on 1 January 2021 amounting to 34,375; the balance of purchases was evenly spread over the 12-month period. The non-current assets were acquired on 1 January 2021 and, together with the initial inventory, were paid for in cash on that day. Required: a) Prepare the accounts adjusted for current values using general (or current) purchasing power accounting. Show workings for gain or loss on monetary working capital items b) Prepare the accounts adjusted for current values using Current Value accounting (maintaining Financial Capital). Show workings for holding gain or loss