Answered step by step

Verified Expert Solution

Question

1 Approved Answer

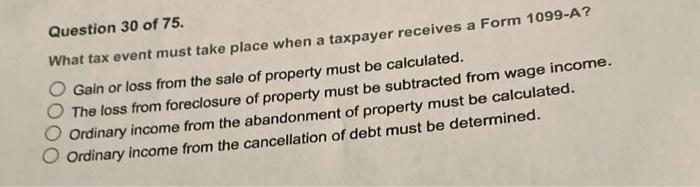

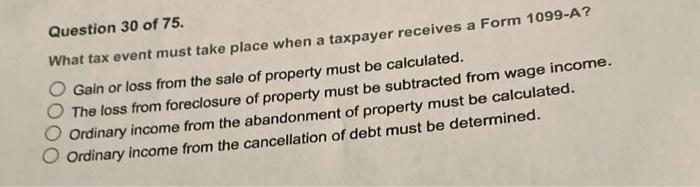

Question 30 of 75. What tax event must take place when a taxpayer receives a Form 1099-A? Gain or loss from the sale of property

Question 30 of 75. What tax event must take place when a taxpayer receives a Form 1099-A? Gain or loss from the sale of property must be calculated. The loss from foreclosure of property must be subtracted from wage income. Ordinary income from the abandonment of property must be calculated. Ordinary income from the cancellation of debt must be determined

Question 30 of 75. What tax event must take place when a taxpayer receives a Form 1099-A? Gain or loss from the sale of property must be calculated. The loss from foreclosure of property must be subtracted from wage income. Ordinary income from the abandonment of property must be calculated. Ordinary income from the cancellation of debt must be determined

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started