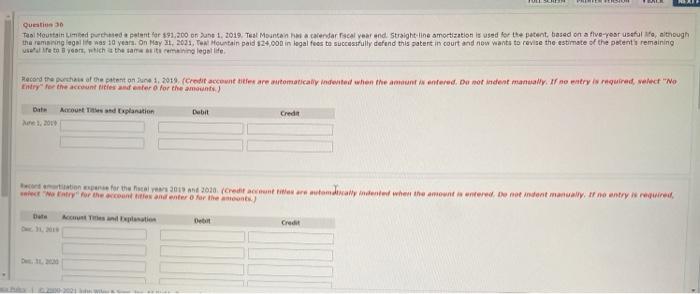

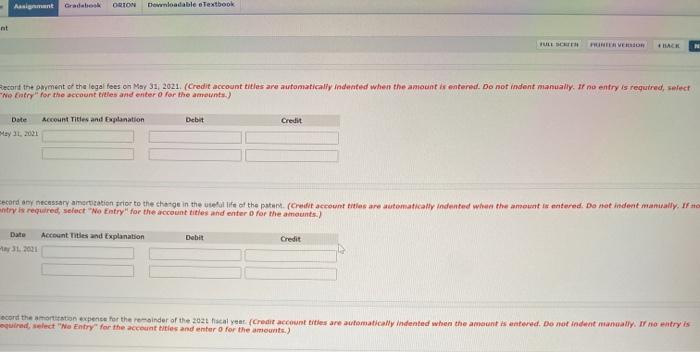

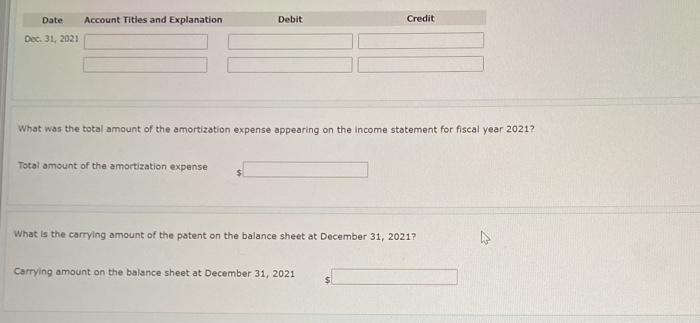

Question 30 Tal Mountain Limited purchased aptent for $91,200 onune 1, 2019. Test Mountains a calendariscal year and straight line amortization is used for the patent based on a five-year useful, strough the remaining onlife was 10 years on May 20, Mountain paid 124.000 in legal fees to successfully defend this patent in court and now wants to revise the estimate of the potents remaining ale to yoon which the same timining legal life Record the path of restent en un 1, 2014 (credit account sites are automatically indertel when the amount / entered. Do norindent manually. If no ustry is required velvet "No Entry for the accounties and enter for the amounts Date Account and Explanation 2009 Debit Creda tertion and for the 2019 2020. (Credit a bune are today dented when the amount ante. Done Antent manual, Ir ne ustry i mire we try for the countries and enter for the tete Credit Assignment Grada ORION Downloadable eTextbook at FULL SCREEN INTERVENTO HACK Record the onment of the legal fees on May 31, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is requtred, select Ne tatry for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit May 31, 2021 econd any necessary amortization prior to the change in the useful life of the patum. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Account Tities and Explanation 2001 Debit Credit cord the mortation expense for the remainder of the 20th cal year (Credit account tities are automatically indented when the amount Wanted. Do not indent manually. If no entry is quired, select "No Entry for the account bites and enter for the amounts) Date Account Titles and Explanation Debit Credit Dec 31, 2021 What was the total amount of the amortization expense appearing on the income statement for fiscal year 2021? Total amount of the amortization expense What is the carrying amount of the patent on the balance sheet at December 31, 2021? A Carrying amount on the balance sheet at December 31, 2021 $ Question 30 Tal Mountain Limited purchased aptent for $91,200 onune 1, 2019. Test Mountains a calendariscal year and straight line amortization is used for the patent based on a five-year useful, strough the remaining onlife was 10 years on May 20, Mountain paid 124.000 in legal fees to successfully defend this patent in court and now wants to revise the estimate of the potents remaining ale to yoon which the same timining legal life Record the path of restent en un 1, 2014 (credit account sites are automatically indertel when the amount / entered. Do norindent manually. If no ustry is required velvet "No Entry for the accounties and enter for the amounts Date Account and Explanation 2009 Debit Creda tertion and for the 2019 2020. (Credit a bune are today dented when the amount ante. Done Antent manual, Ir ne ustry i mire we try for the countries and enter for the tete Credit Assignment Grada ORION Downloadable eTextbook at FULL SCREEN INTERVENTO HACK Record the onment of the legal fees on May 31, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is requtred, select Ne tatry for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit May 31, 2021 econd any necessary amortization prior to the change in the useful life of the patum. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Account Tities and Explanation 2001 Debit Credit cord the mortation expense for the remainder of the 20th cal year (Credit account tities are automatically indented when the amount Wanted. Do not indent manually. If no entry is quired, select "No Entry for the account bites and enter for the amounts) Date Account Titles and Explanation Debit Credit Dec 31, 2021 What was the total amount of the amortization expense appearing on the income statement for fiscal year 2021? Total amount of the amortization expense What is the carrying amount of the patent on the balance sheet at December 31, 2021? A Carrying amount on the balance sheet at December 31, 2021 $