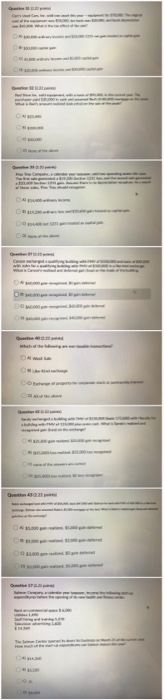

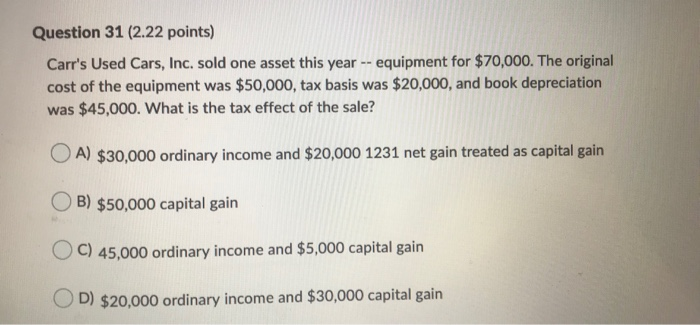

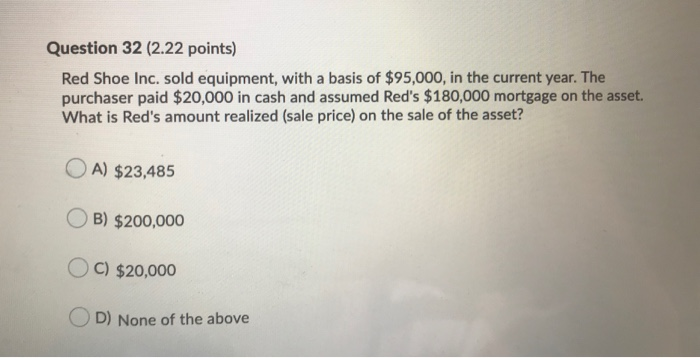

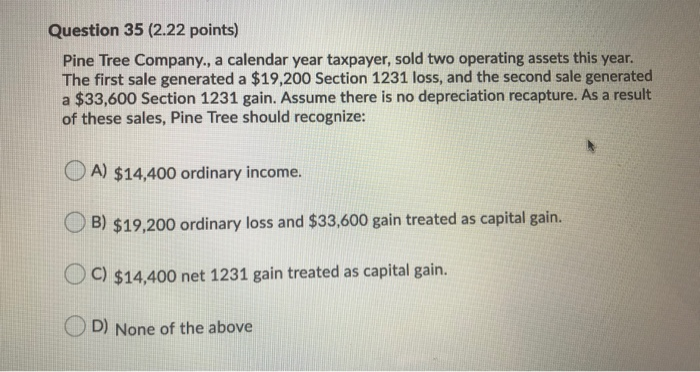

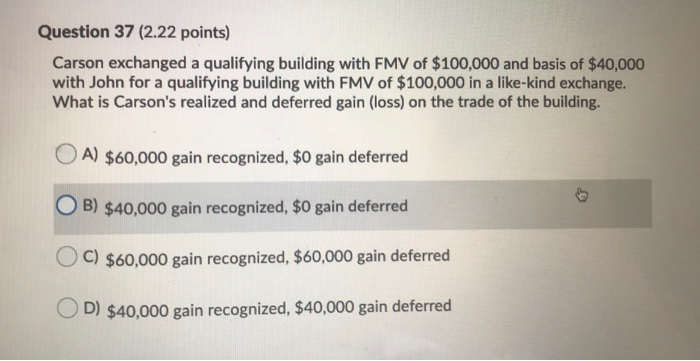

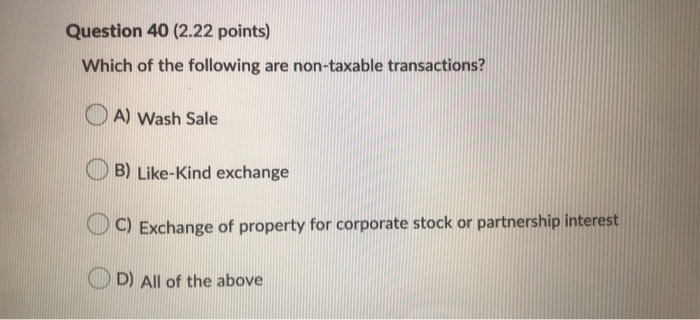

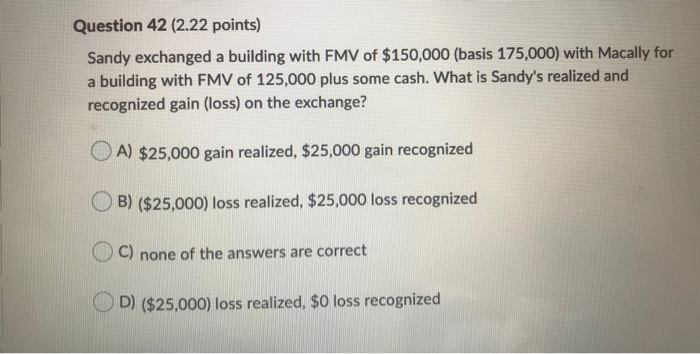

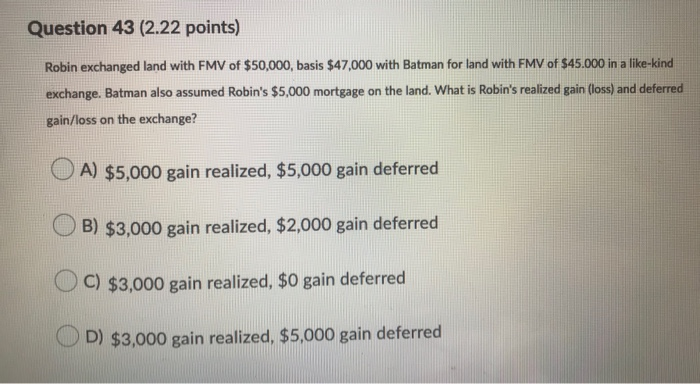

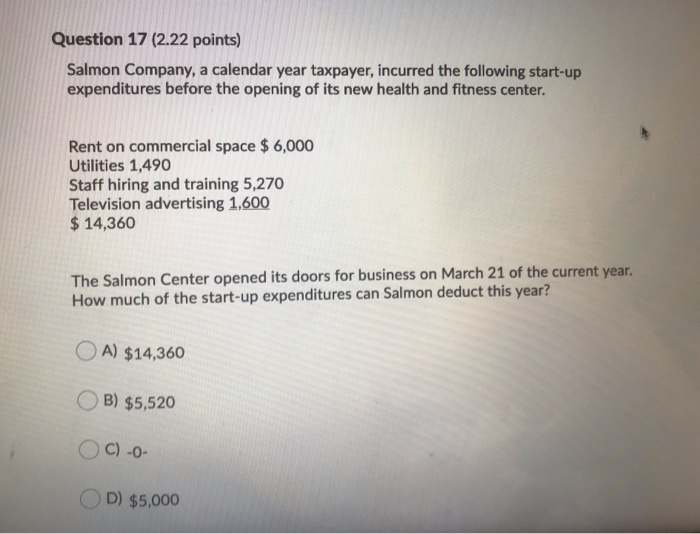

Question 31 (2.22 points) Carr's Used Cars, Inc. sold one asset this year -- equipment for $70,000. The original cost of the equipment was $50,000, tax basis was $20,000, and book depreciation was $45,000. What is the tax effect of the sale? OA) $30,000 ordinary income and $20,000 1231 net gain treated as capital gain OB) $50,000 capital gain C) 45,000 ordinary income and $5,000 capital gain D) $20,000 ordinary income and $30,000 capital gain Question 32 (2.22 points) Red Shoe Inc. sold equipment, with a basis of $95,000, in the current year. The purchaser paid $20,000 in cash and assumed Red's $180,000 mortgage on the asset. What is Red's amount realized (sale price) on the sale of the asset? OA) $23,485 OB) $200,000 C) $20,000 D) None of the above Question 35 (2.22 points) Pine Tree Company., a calendar year taxpayer, sold two operating assets this year. The first sale generated a $19,200 Section 1231 loss, and the second sale generated a $33,600 Section 1231 gain. Assume there is no depreciation recapture. As a result of these sales, Pine Tree should recognize: OA) $14,400 ordinary income. B) $19,200 ordinary loss and $33,600 gain treated as capital gain. OC) $14,400 net 1231 gain treated as capital gain. D) None of the above Question 37 (2.22 points) Carson exchanged a qualifying building with FMV of $100,000 and basis of $40,000 with John for a qualifying building with FMV of $100,000 in a like-kind exchange. What is Carson's realized and deferred gain (loss) on the trade of the building. A) $60,000 gain recognized, $0 gain deferred O B) $40,000 gain recognized, $0 gain deferred OC) $60,000 gain recognized, $60,000 gain deferred OD) $40,000 gain recognized, $40,000 gain deferred Question 40 (2.22 points) Which of the following are non-taxable transactions? A) Wash Sale B) Like-Kind exchange C) Exchange of property for corporate stock or partnership interest D) All of the above Question 42 (2.22 points) Sandy exchanged a building with FMV of $150,000 (basis 175,000) with Macally for a building with FMV of 125,000 plus some cash. What is Sandy's realized and recognized gain (loss) on the exchange? OA) $25,000 gain realized, $25,000 gain recognized B) ($25,000) loss realized, $25,000 loss recognized C) none of the answers are correct D) ($25,000) loss realized, $0 loss recognized Question 17 (2.22 points) Salmon Company, a calendar year taxpayer, incurred the following start-up expenditures before the opening of its new health and fitness center. Rent on commercial space $ 6,000 Utilities 1,490 Staff hiring and training 5,270 Television advertising 1,600 $ 14,360 The Salmon Center opened its doors for business on March 21 of the current year. How much of the start-up expenditures can Salmon deduct this year? A) $14,360 B) $5,520 C) -0- D) $5,000