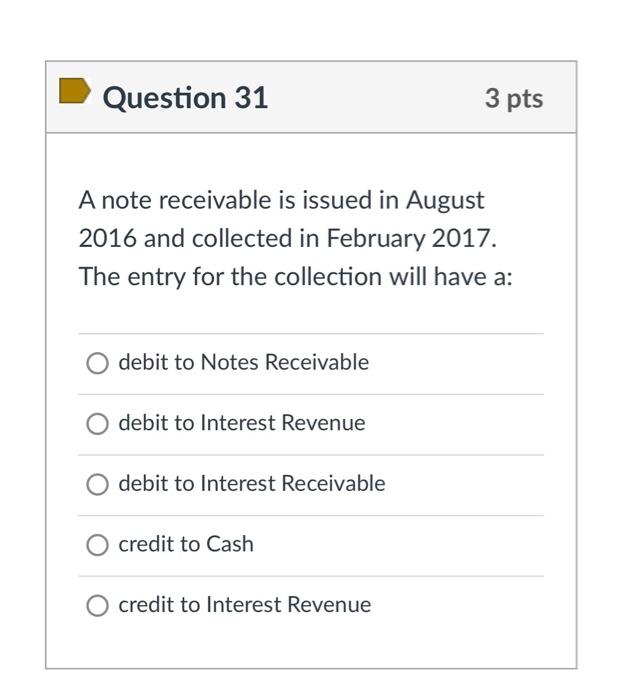

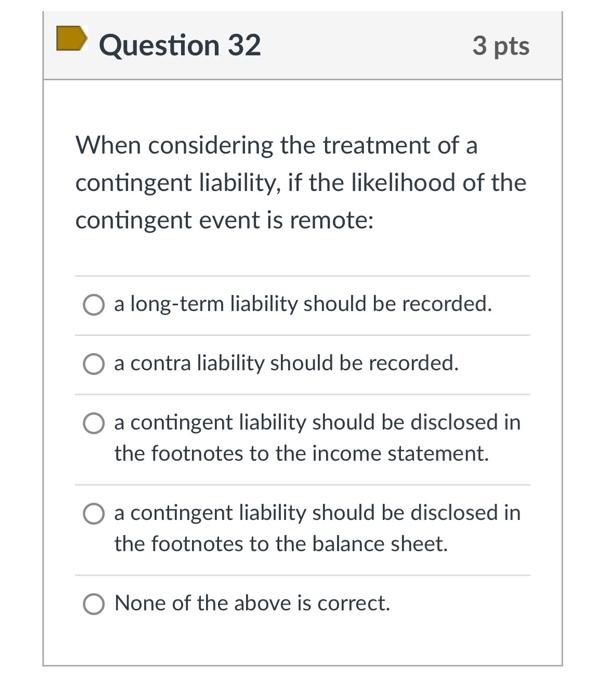

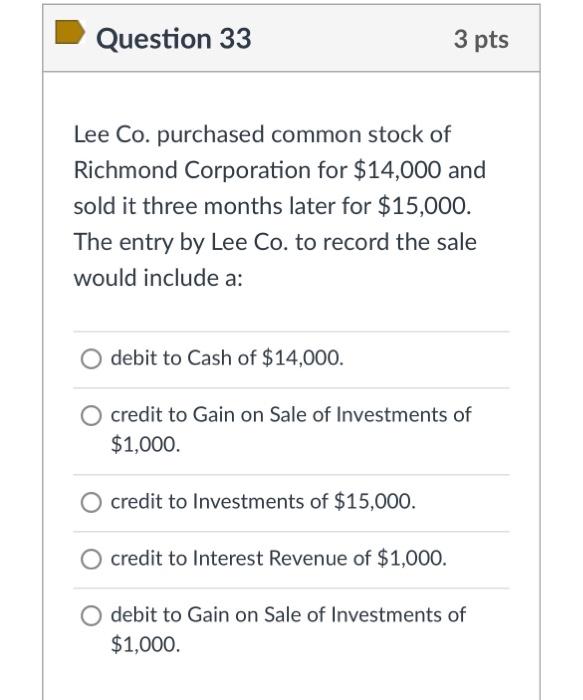

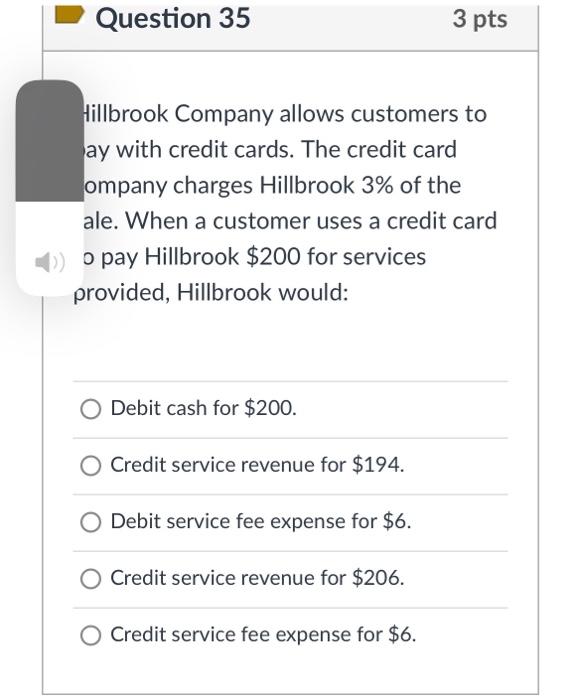

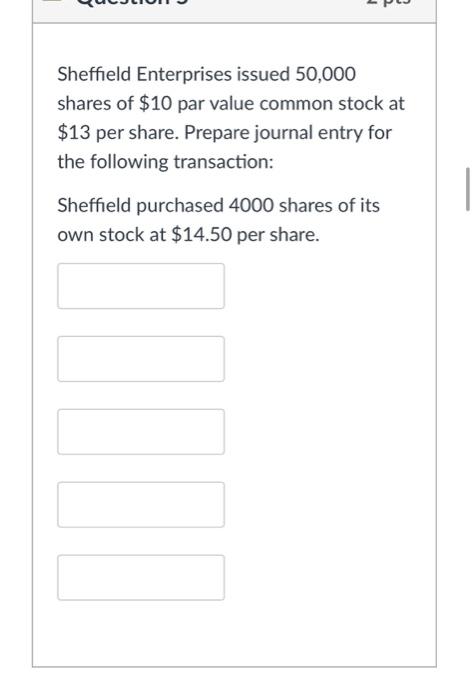

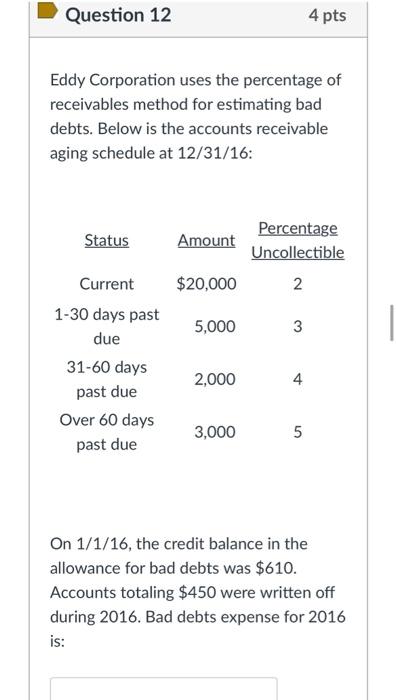

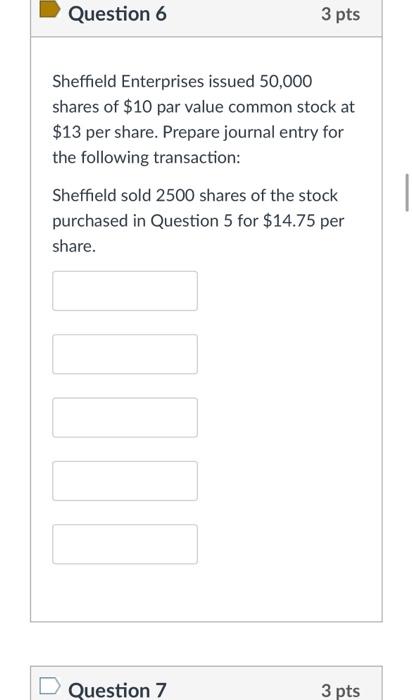

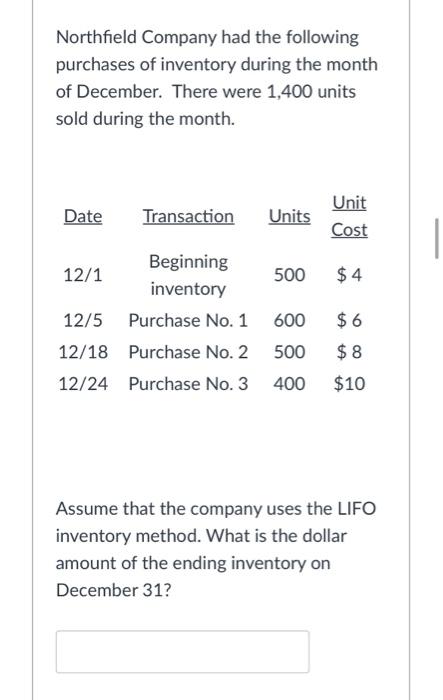

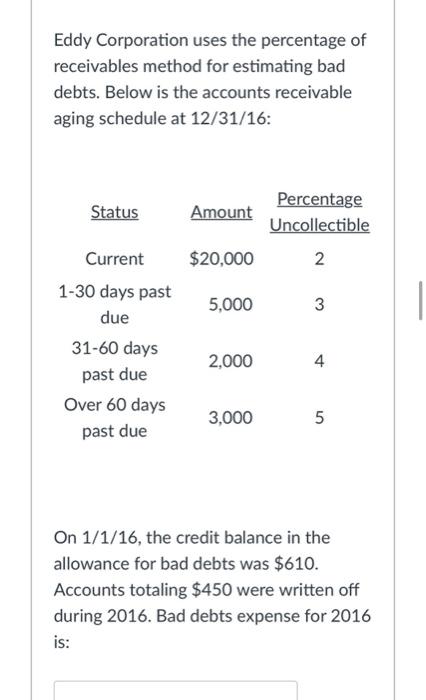

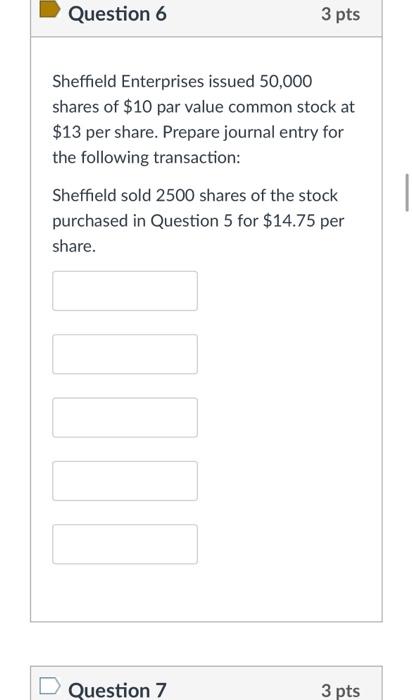

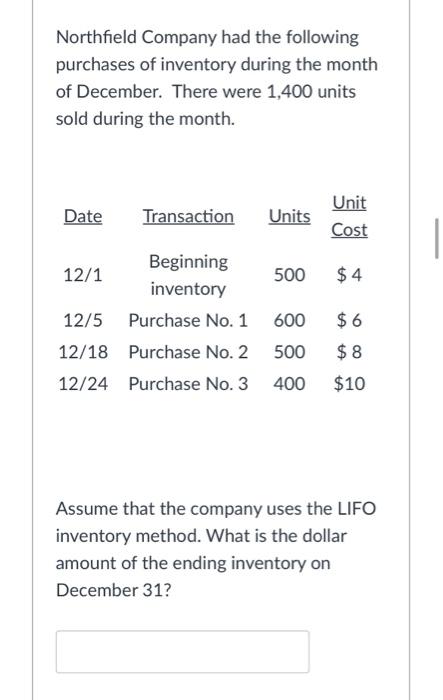

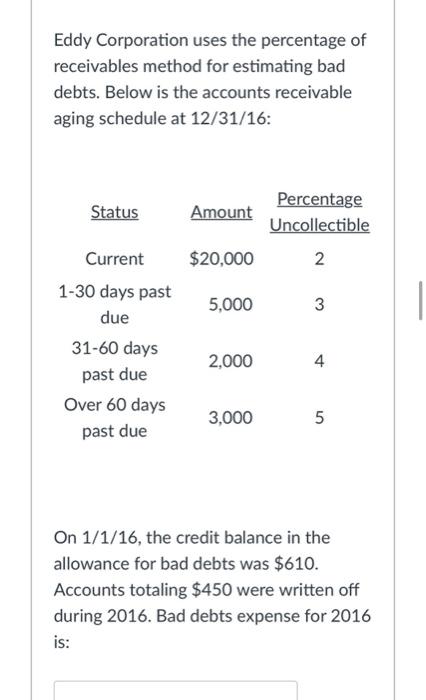

Question 31 3 pts A note receivable is issued in August 2016 and collected in February 2017. The entry for the collection will have a: debit to Notes Receivable debit to Interest Revenue debit to Interest Receivable credit to Cash credit to Interest Revenue Question 32 3 pts When considering the treatment of a contingent liability, if the likelihood of the contingent event is remote: a long-term liability should be recorded. a contra liability should be recorded. a contingent liability should be disclosed in the footnotes to the income statement. O a contingent liability should be disclosed in the footnotes to the balance sheet. None of the above is correct. Question 33 3 pts Lee Co. purchased common stock of Richmond Corporation for $14,000 and sold it three months later for $15,000. The entry by Lee Co. to record the sale would include a: O debit to Cash of $14,000. credit to Gain on Sale of Investments of $1,000. O credit to Investments of $15,000. O credit to Interest Revenue of $1,000. debit to Gain on Sale of Investments of $1,000. Question 35 3 pts Hillbrook Company allows customers to ay with credit cards. The credit card ompany charges Hillbrook 3% of the ale. When a customer uses a credit card ) o pay Hillbrook $200 for services provided, Hillbrook would: O Debit cash for $200. Credit service revenue for $194. Debit service fee expense for $6. Credit service revenue for $206. Credit service fee expense for $6. Sheffield Enterprises issued 50,000 shares of $10 par value common stock at $13 per share. Prepare journal entry for the following transaction: Sheffield purchased 4000 shares of its own stock at $14.50 per share. Question 12 4 pts Eddy Corporation uses the percentage of receivables method for estimating bad debts. Below is the accounts receivable aging schedule at 12/31/16: Status Amount Percentage Uncollectible $20,000 2 5,000 3 Current 1-30 days past due 31-60 days past due Over 60 days past due 2,000 4 3,000 5 5 On 1/1/16, the credit balance in the allowance for bad debts was $610. Accounts totaling $450 were written off during 2016. Bad debts expense for 2016 is: Question 6 3 pts Sheffield Enterprises issued 50,000 shares of $10 par value common stock at $13 per share. Prepare journal entry for the following transaction: Sheffield sold 2500 shares of the stock purchased in Question 5 for $14.75 per share. Question 7 3 pts Northfield Company had the following purchases of inventory during the month of December. There were 1,400 units sold during the month. Date Transaction Units Unit Cost 500 $4 Beginning 12/1 inventory 12/5 Purchase No. 1 12/18 Purchase No. 2 12/24 Purchase No. 3 600 6 500 $6 $ 8 $10 400 Assume that the company uses the LIFO inventory method. What is the dollar amount of the ending inventory on December 31 Eddy Corporation uses the percentage of receivables method for estimating bad debts. Below is the accounts receivable aging schedule at 12/31/16: Status Amount Percentage Uncollectible 2 $20,000 5,000 3 Current 1-30 days past due 31-60 days past due Over 60 days past due 2,000 4 3,000 5 On 1/1/16, the credit balance in the allowance for bad debts was $610. Accounts totaling $450 were written off during 2016. Bad debts expense for 2016 is