Answered step by step

Verified Expert Solution

Question

1 Approved Answer

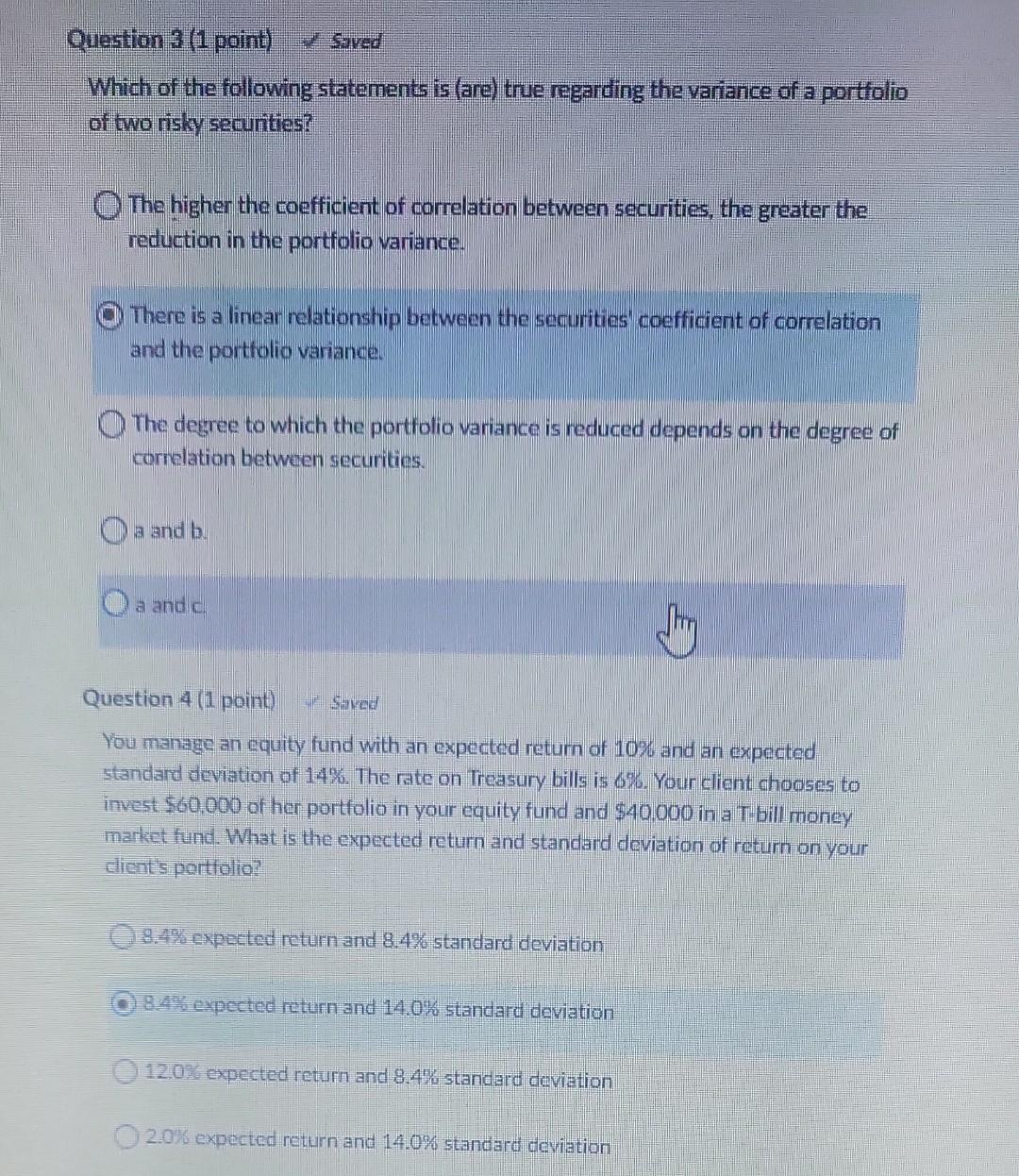

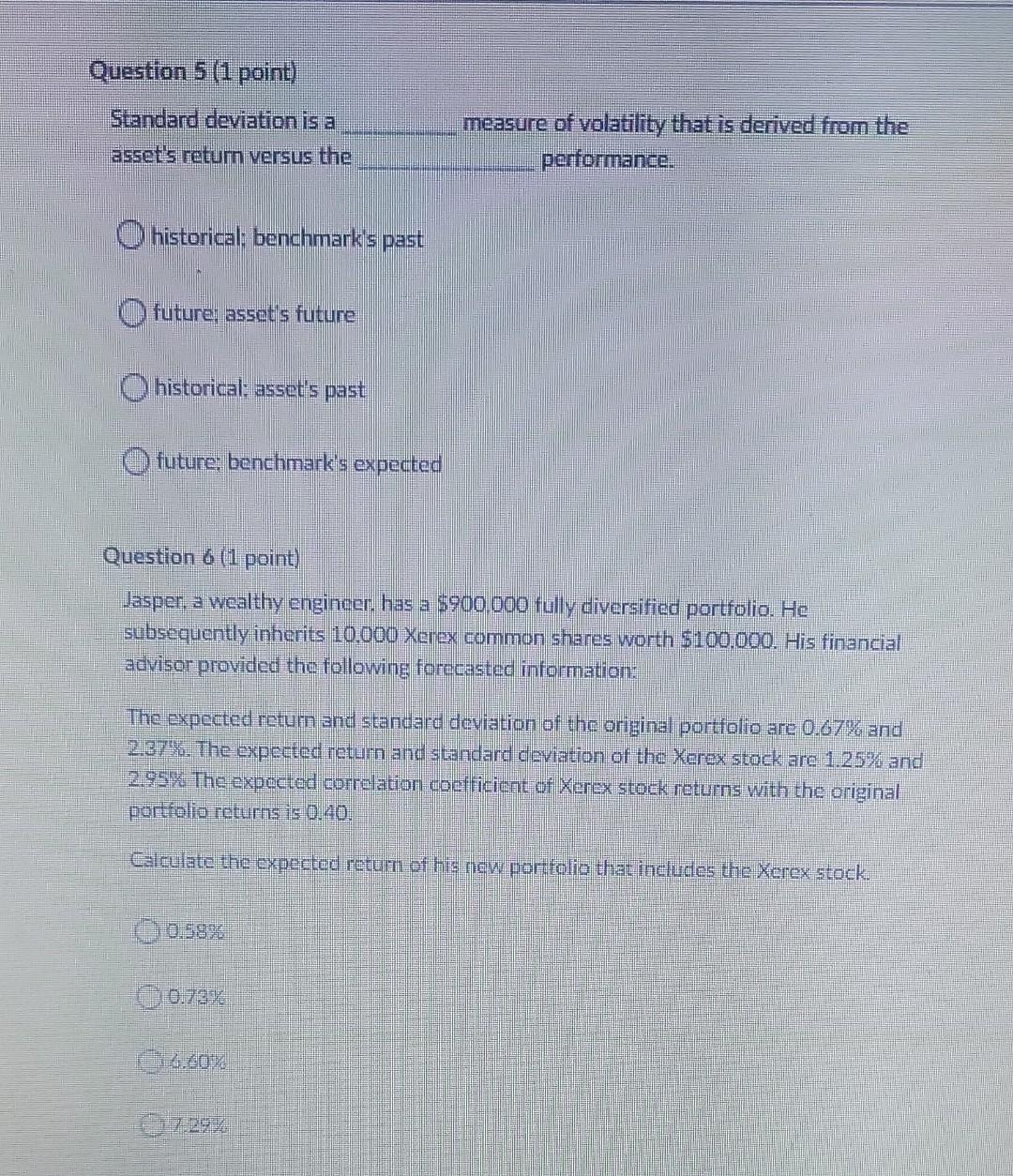

Question 3(1 point), Saved Which of the following statements is (are) true regarding the variance of a portfolio of two risky securities? The higher the

Question 3(1 point), Saved Which of the following statements is (are) true regarding the variance of a portfolio of two risky securities? The higher the coefficient of correlation between securities, the greater the reduction in the portfolio variance. There is a linear relationship between the securities coefficient of correlation and the portfolio variance. The degree to which the portfolio variance is reduced depends on the degree of correlation between securities. a and b. a and c stirs Question 4 (1 point) saved Yeu manage an equity fund with an expected return of 10% and an expected standard deviation of 14%. The rate on Treasury bills is 6%. Your client chooses to invest $60,000 of her portfolio in your equity fund and $40.000 in a T bill money market fund. What is the expected return and standard deviation of return on your cleat sportiolio? 8.49 expected return and 8.4% standard deviation 8.4\% expected return and 14.0% standard deviation 12.0\% expected return and 8.4y standard deviation 2.0\% expected retarn and 14.0% standard deviation Question 5 (1 point) Standard deviation is a measure of volatility that is derived from the asset's return versus the performance. historical; benchmark's past future; asset's future historical; asset's past future: benchmark's expected Question 6 (1point) Jasper, a wealthy engineer. has a 5900.000 fully diversified portfolio. He subsequently inherits 10.000 Xerex common shares worth $100.000. His financial advisor provided the following forecasted information: The expected return and standard deviation of the original portiolio are 0.67% and 2.37 . The expected return and standard ceviation of the Xerex stock are 1.25% and 2.95% The expected correlation coef icient of Xerex stock returns with the original porifolio returns is 0.40. Calculate the cxpected retum of his new por folio that includes the Xerex stock. (2) 0.58 0,73 3.60%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started