Answered step by step

Verified Expert Solution

Question

1 Approved Answer

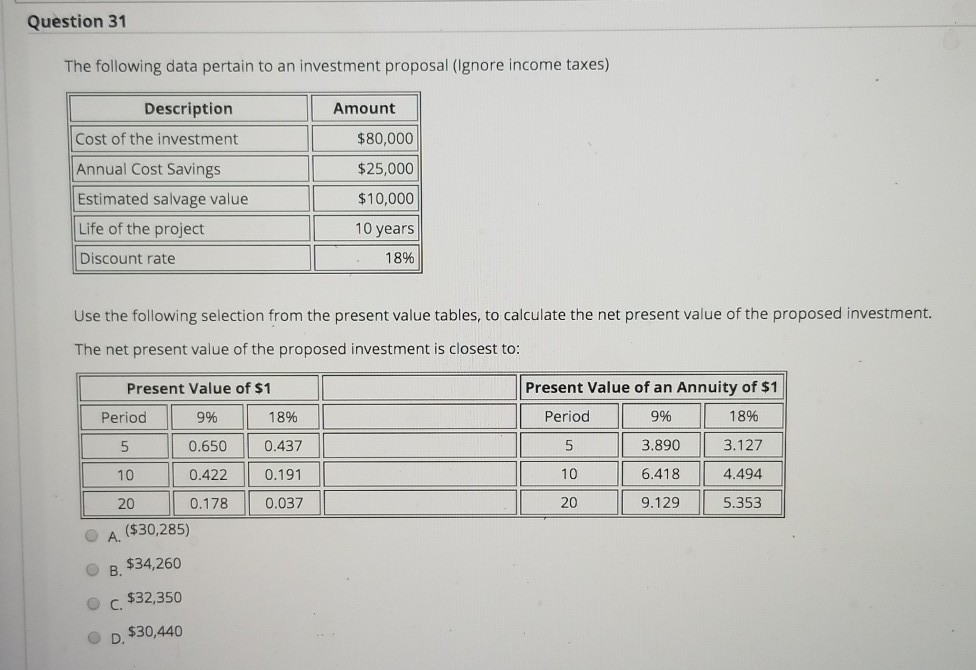

Question 31 The following data pertain to an investment proposal (Ignore income taxes) Amount $80,000 Description Cost of the investment Annual Cost Savings Estimated salvage

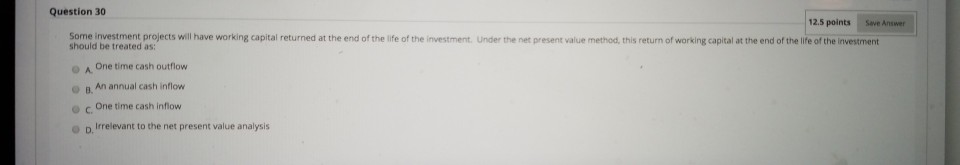

Question 31 The following data pertain to an investment proposal (Ignore income taxes) Amount $80,000 Description Cost of the investment Annual Cost Savings Estimated salvage value Life of the project Discount rate $25,000 $10,000 10 years 18% Use the following selection from the present value tables, to calculate the net present value of the proposed investment. The net present value of the proposed investment is closest to: Present Value of $1 Period 9% 18% 5 | 0.650 | 0.437 10 0.422 0.191 20 0.178 0.037 Present Value of an Annuity of $1 Period | 9% 18% 3.890 3.127 6.418 4.494 9.129 | 5.353 OA ($30,285) B. $34,260 oc $32,350 D. $30,440 Question 30 12.5 points Save Answer Some investment projects will have working capital returned at the end of the life of the investment. Under the net present value method, this return of working capital at the end of the life of the investment should be treated as: One time cash outflow An annual cash inflow One time cash inflow p. Irrelevant to the net present value analysis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started