Answered step by step

Verified Expert Solution

Question

1 Approved Answer

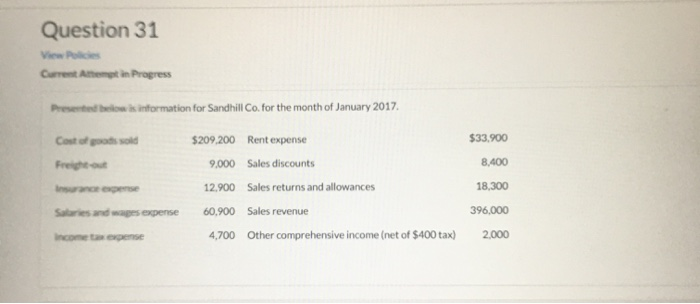

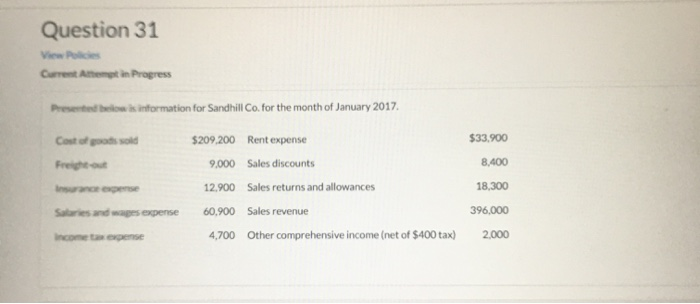

Question 31 View Policies Current Attempt in Progress Presented below is information for Sandhill Co. for the month of January 2017 $209,200 Rent expense $33.900

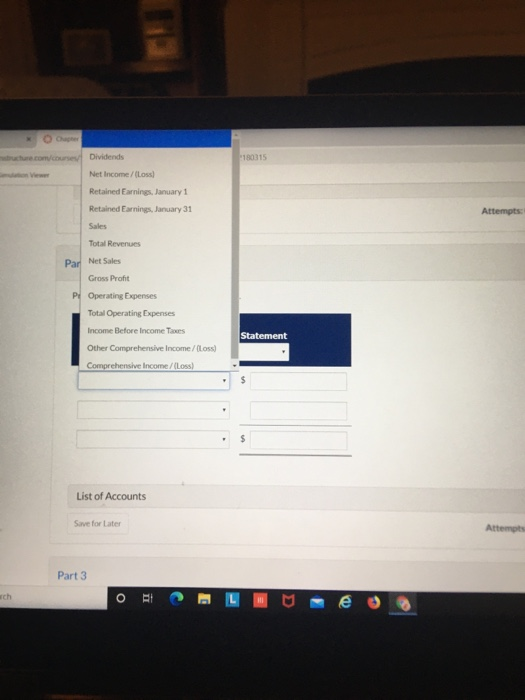

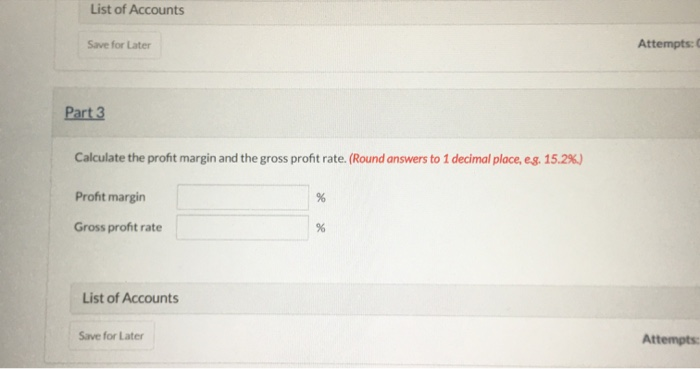

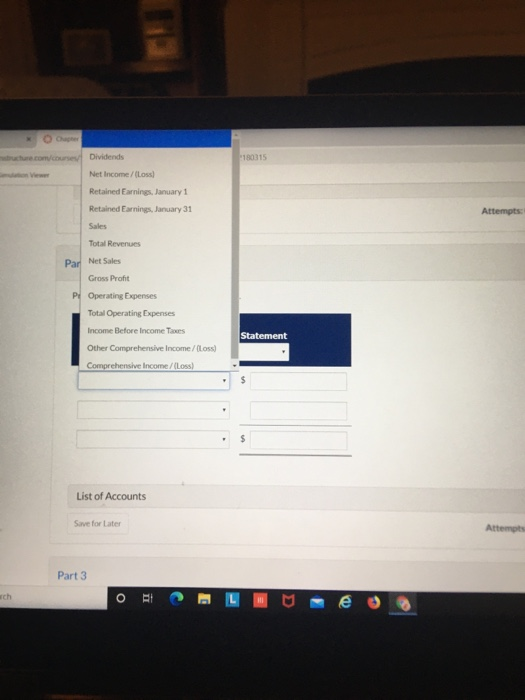

Question 31 View Policies Current Attempt in Progress Presented below is information for Sandhill Co. for the month of January 2017 $209,200 Rent expense $33.900 9,000 Sales discounts 8.400 Cost of goods sold Freight-out Insurance expense Salaries and wages expense 12.900 Sales returns and allowances 60,900 Sales revenue 4,700 Other comprehensive income (net of $400 tax) 18,300 396,000 2,000 Income expense Dividends Attempts: Net Income/(Loss) Retained Earnings, January 1 Retained Earnings, January 31 Sales Total Revenues Net Sales Gross Profit P: Operating Expenses Total Operating Expenses Income Before Income Tars Statement Other Comprehensive Income /(Loss) Comprehensive Income /(Loss) List of Accounts Save for Later Attempts Part 3 arch List of Accounts Save for Later Attempts: Part 3 Calculate the profit margin and the gross profit rate. (Round answers to 1 decimal place, eg. 15.2%) Profit margin a Gross profit rate de List of Accounts Save for Later Attempts

Question 31 View Policies Current Attempt in Progress Presented below is information for Sandhill Co. for the month of January 2017 $209,200 Rent expense $33.900 9,000 Sales discounts 8.400 Cost of goods sold Freight-out Insurance expense Salaries and wages expense 12.900 Sales returns and allowances 60,900 Sales revenue 4,700 Other comprehensive income (net of $400 tax) 18,300 396,000 2,000 Income expense Dividends Attempts: Net Income/(Loss) Retained Earnings, January 1 Retained Earnings, January 31 Sales Total Revenues Net Sales Gross Profit P: Operating Expenses Total Operating Expenses Income Before Income Tars Statement Other Comprehensive Income /(Loss) Comprehensive Income /(Loss) List of Accounts Save for Later Attempts Part 3 arch List of Accounts Save for Later Attempts: Part 3 Calculate the profit margin and the gross profit rate. (Round answers to 1 decimal place, eg. 15.2%) Profit margin a Gross profit rate de List of Accounts Save for Later Attempts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started