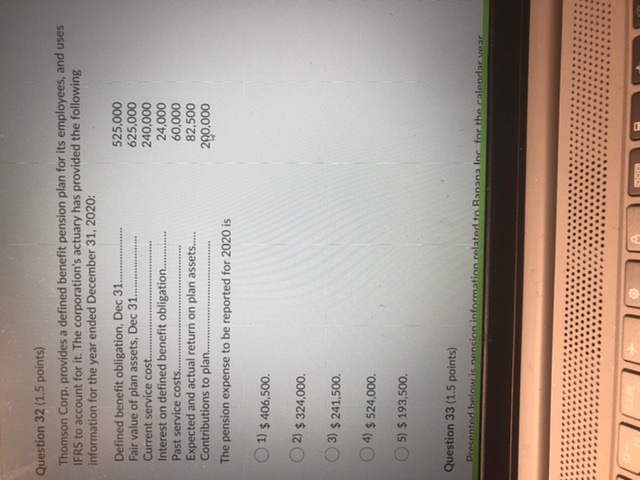

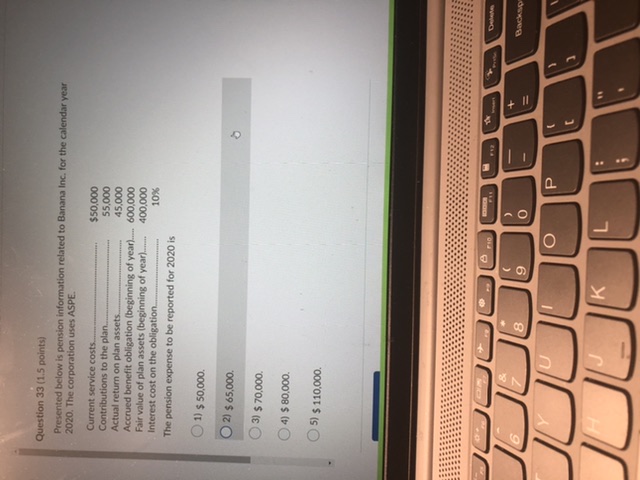

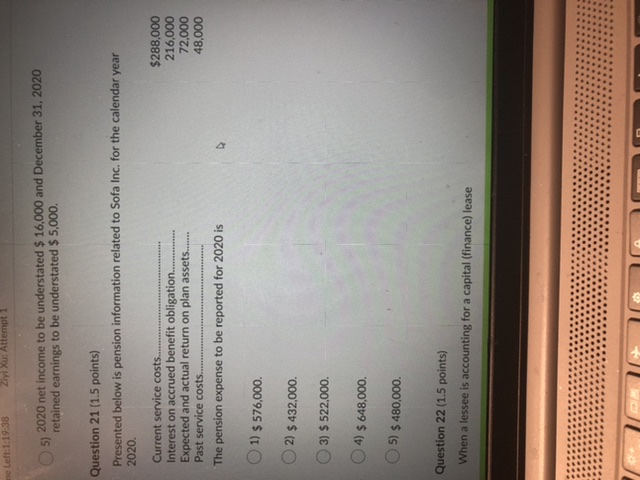

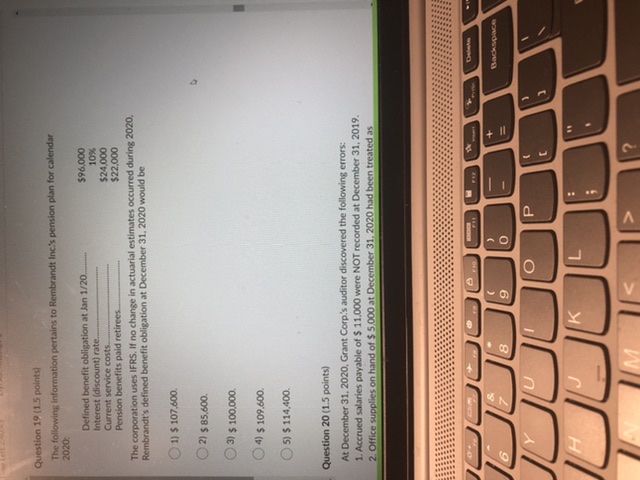

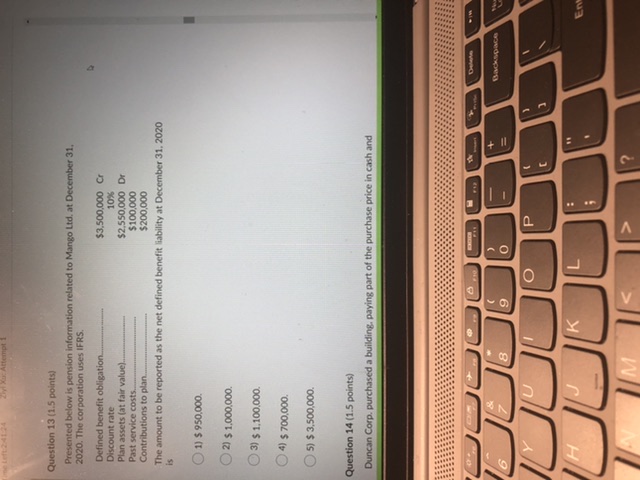

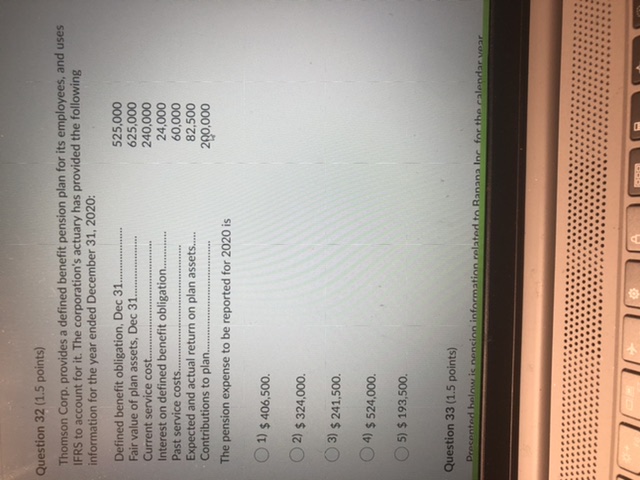

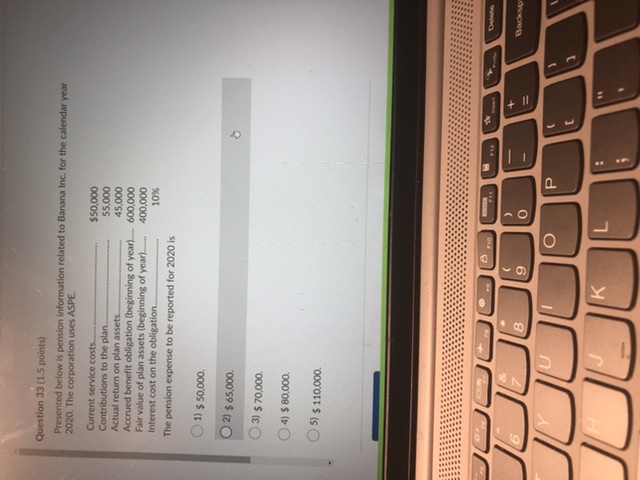

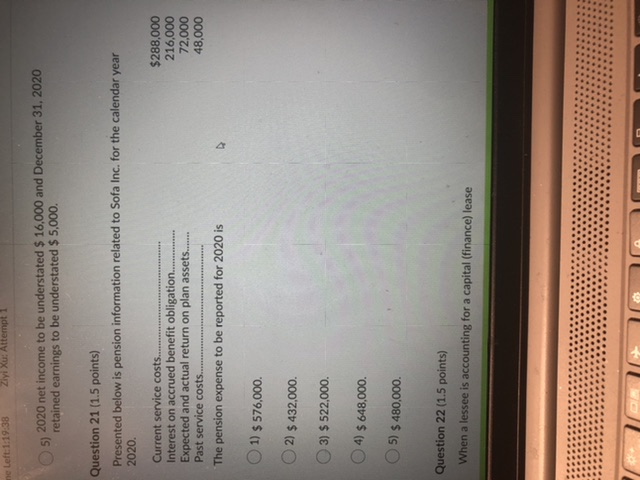

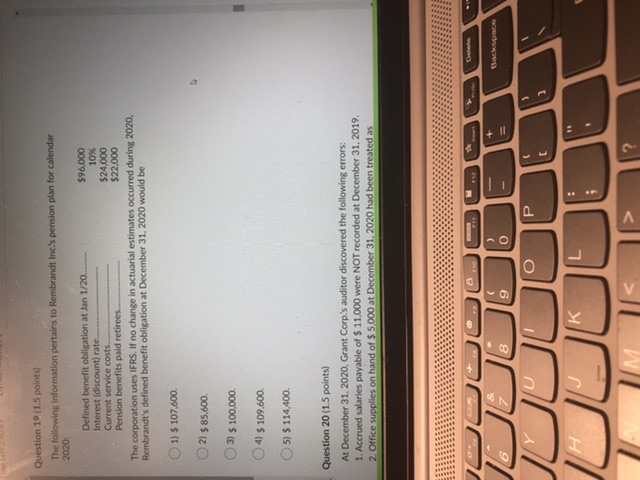

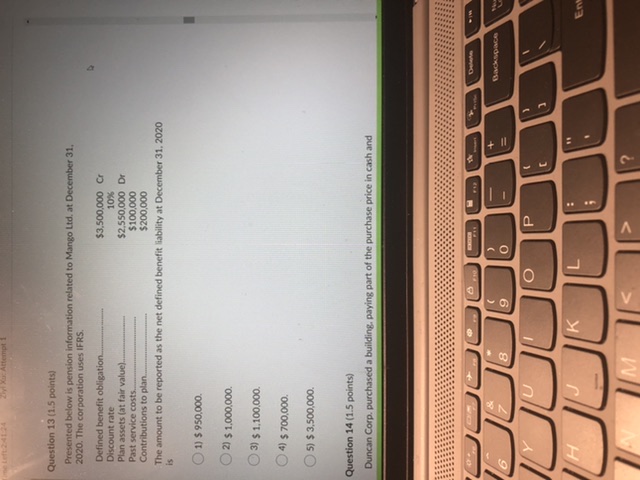

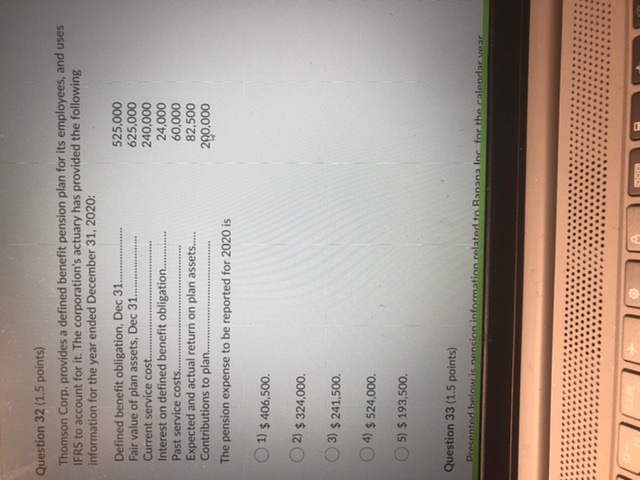

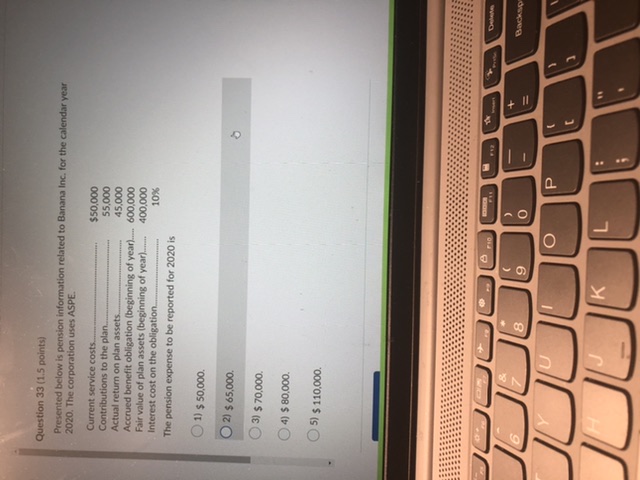

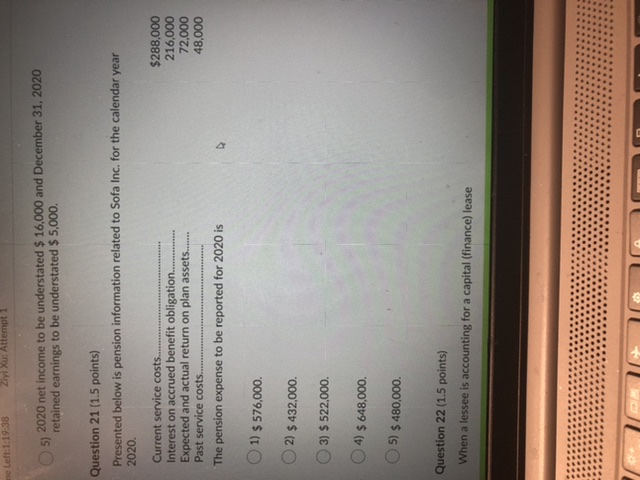

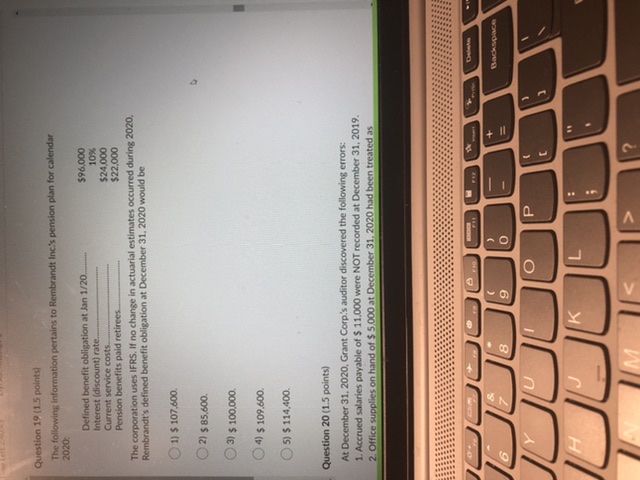

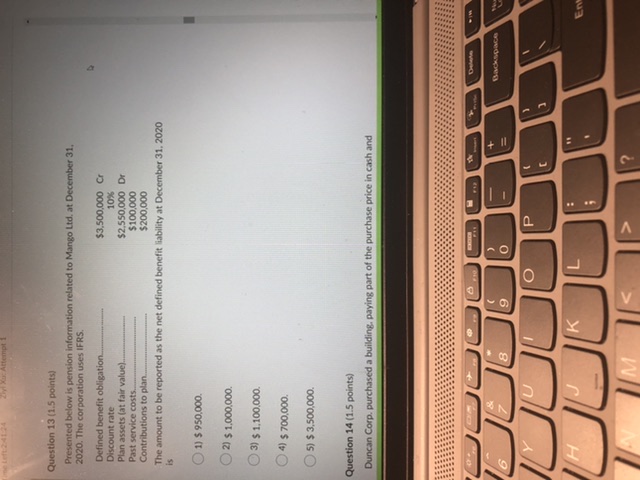

Question 32 (1.5 points) Thomson Corp. provides a defined benefit pension plan for its employees, and uses IFRS to account for it. The corporation's actuary has provided the following information for the year ended December 31, 2020: Defined benefit obligation, Dec 31....... 525,000 Fair value of plan assets, Dec 31...... .1 15 625,000 Current service COSt.....asset:1asserttassotti4: 240,000 Interest on defined benefit obligation....... 24,000 Past service Costs.........mmmmmm 60,000 Expected and actual return on plan assets.... 82.500 Contributions to plan.......404:18:1010BIRTH 200,000 The pension expense to be reported for 2020 is O 1) $ 406,500. O 2) $ 324,000. ( 3) $ 241,500. O 4) $ 524,000. ( 5) $ 193,500. Question 33 (1.5 points) Precented below is pension information related to Banana Ine for the calendar yearQuestion 33 (1.5 points) Presented below is pension information related to Banana Inc. for the calendar year 2020. The corporation uses ASPE. Current service costs. $50,000 Contributions to the plan. 55,000 Actual return on plan assets 45,000 Accrued benefit obligation (beginning of year)... 600,000 Fair value of plan assets (beginning of year).. 400.000 Interest cost on the obligation. 10% The pension expense to be reported for 2020 is 1) $ 50,000, 2) $ 65,000. ( 3) $ 70,000. O 4) $ 80,000. ( 5) $ 110,000. + 1 - O O Yhe Left: 1:19:38 Liyi Ku: 5) 2020 net income to be understated $ 16,000 and December 31, 2020 retained earnings to be understated $ 5,000. Question 21 (1.5 points) Presented below is pension information related to Sofa Inc. for the calendar year 2020. Current service Costs.......#12498:1949:191985:1249549 $288,000 Interest on accrued benefit obligation......me 216,000 Expected and actual return on plan assets.. 72,000 Past service Costs....HER 48,000 The pension expense to be reported for 2020 is A ( 1) $ 576,000. O 2) $ 432,000. 3) $ 522,000. ( 4) $ 648,000. ( 5) $ 480,000. Question 22 (1.5 points) When a lessee is accounting for a capital (finance) leaseQuestion 19 (1.5 points] The following information pertains to Rembrandt Inc.'s pension plan for calendar 2020: Defined benefit obligation at Jan 1/20.. $96.000 Interest (discount) rate. 10%% Current service costs. $24,000 Pension benefits paid retirees. $22.000 The corporation uses IFRS. If no change in actuarial estimates occurred during 2020. Rembrandt's defined benefit obligation at December 31, 2020 would be O 1) $ 107,600. O 2) $ 85,600. 3) $ 100,000. 4) $ 109.600. 5) $ 114,400. Question 20 (1.5 points) At December 31, 2020, Grant Corp's auditor discovered the following errors: 1. Accrued salaries payable of $ 11,000 were NOT recorded at December 31, 2019. 2. Office supplies on hand of $ 5.000 at December 31, 2020 had been treated as + 11 O I A VQuestion 13 (1.5 points) Presented below is pension information related to Mango Led. at December 31. 2020. The corporation uses IFRS. Defined benefit obligation.. $3,500,000 Cr Discount rate 105 Plan assets (at fair value).. $2.550,000 Dr Past service costs.. $100,000 Contributions to plan... $200,000 The amount to be reported as the net defined benefit liability at December 31, 2020 ( 1) $ 950,000. 2) $ 1,000,000. O 3) $ 1,100,000. O 4) $ 700,000. ( 5) $ 3,500,000. Question 14 (1.5 points) Duncan Corp. purchased a building. paying part of the purchase price in cash and + 11 O En A V