Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 32. CAS Required a. Prepare a comparative, multi-step income statement for Dansby Inc. b. Perform horizontal and vertical analyses and interpret the results. Round

question 32.

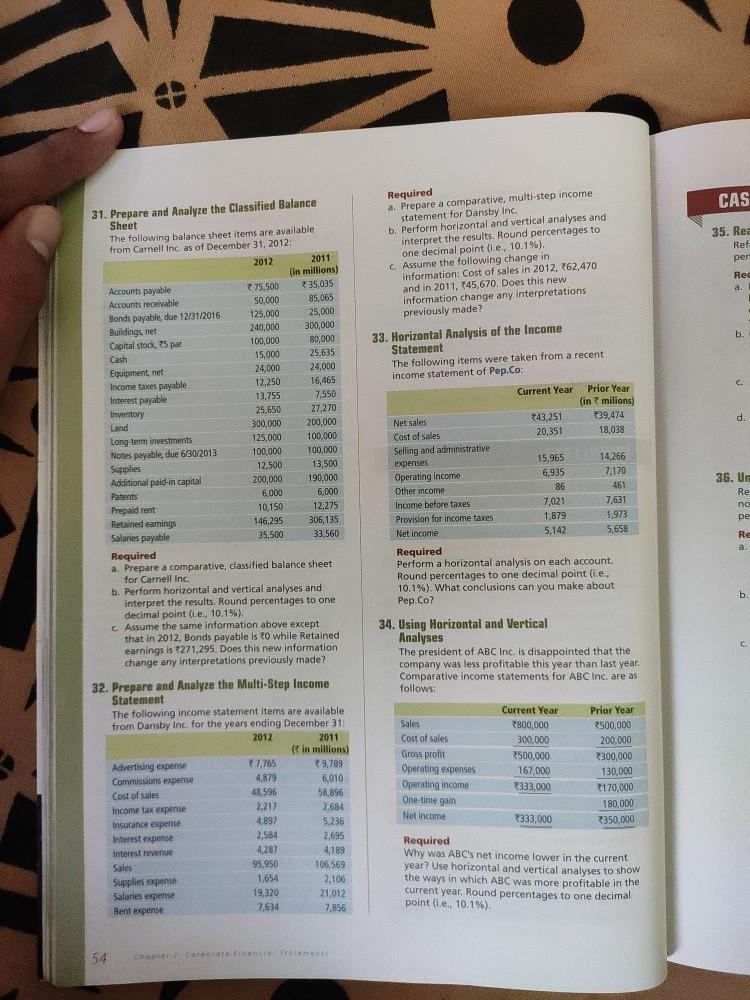

CAS Required a. Prepare a comparative, multi-step income statement for Dansby Inc. b. Perform horizontal and vertical analyses and interpret the results. Round percentages to one decimal point (e., 10.1%). Assume the following change in information: Cost of sales in 2012, 262,470 and in 2011, 45,670. Does this new information change any interpretations previously made? 35. Res Ref per Red a. b. 25,635 33. Horizontal Analysis of the Income Statement The following items were taken from a recent income statement of Pep.Co: c. d. Current Year Prior Year (in milions) *39,474 343,251 Net sales Cost of sales 20,351 18,038 Selling and administrative expenses 15,965 14,266 Operating income 6,935 7,170 Other income 86 461 Income before taxes 7,021 7,631 Provision for income taxes 1,879 1,973 Net Income 5,142 5,658 Required Perform a horizontal analysis on each account. Round percentages to one decimal point (ie, 10.1%). What conclusions can you make about Pep.Co? 36. Un Re no pe 31. Prepare and Analyze the Classified Balance Sheet The following balance sheet items are available from Carnelline as of December 31, 2012: 2012 2011 (in millions) Accounts payable 75.500 235,035 Accounts receivable 50,000 85065 Bonds payable, due 12/31/2016 125.000 25,000 Buildings net 240,000 300,000 Capital stock 35 par 100,000 80,000 Cash 15,000 Equipment net 24,000 24,000 Income taxes payable 12,250 16,465 Interest payable 13,755 7550 Inventory 25,650 27,270 Land 300,000 200,000 Long term investments 125,000 100,000 Notes payable due 6/302013 100,000 100.000 Supplies 12,500 13,500 Additional paid-in capital 200,000 190,000 Patents 6,000 6,000 Prepaid rent 10,150 12,275 Retained earnings 146,295 306,135 Salaries payable 35,500 33,560 Required a. Prepare a comparative, classified balance sheet for Carnell Inc b. Perform horizontal and vertical analyses and interpret the results. Round percentages to one decimal point Cie, 10.1%). Assume the same information above except that in 2012, Bonds payable is to while Retained earnings is 271,295. Does this new information change any interpretations previously made? 32. Prepare and Analyze the Multi-Step Income Statement The following income statement items are available from Dansby Inc. for the years ending December 31: 2012 2011 in millions) Advertising experise 7.765 9,789 Commissions expense 4,879 6,010 Cost of sales 48.596 58,896 Income tax expense 2.212 2,684 Insurance expense 4.897 5.236 Interestedense 2,584 2,695 Interest revenue 4,287 4,189 Sales 95,950 106,569 Supplies expense 1,654 2.106 Salaries expense 19,320 21,012 Rent expense 7.856 Re a a. b 34. Using Horizontal and Vertical Analyses The president of ABC Inc. is disappointed that the company was less profitable this year than last year. Comparative income statements for ABC Inc. are as follows: Current Year Prior Year Sales 2800,000 *500,000 Cost of sales 300.000 200,000 Gross profit 500,000 3300,000 Operating expenses 167,000 130,000 Operating income 333,000 2170,000 One-time gain 180,000 Net Income 333,000 2350,000 Required Why was ABC's net income lower in the current year? Use horizontal and vertical analyses to show the ways in which ABC was more profitable in the current year. Round percentages to one decimal point (.e., 10.1%), 54Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started