Question

Question 3.2 Homework. Unanswered. Due Sep 23rd, 11:59 PM Company A Acquired 90% of Company B's stock for $900,000 when the fair market value

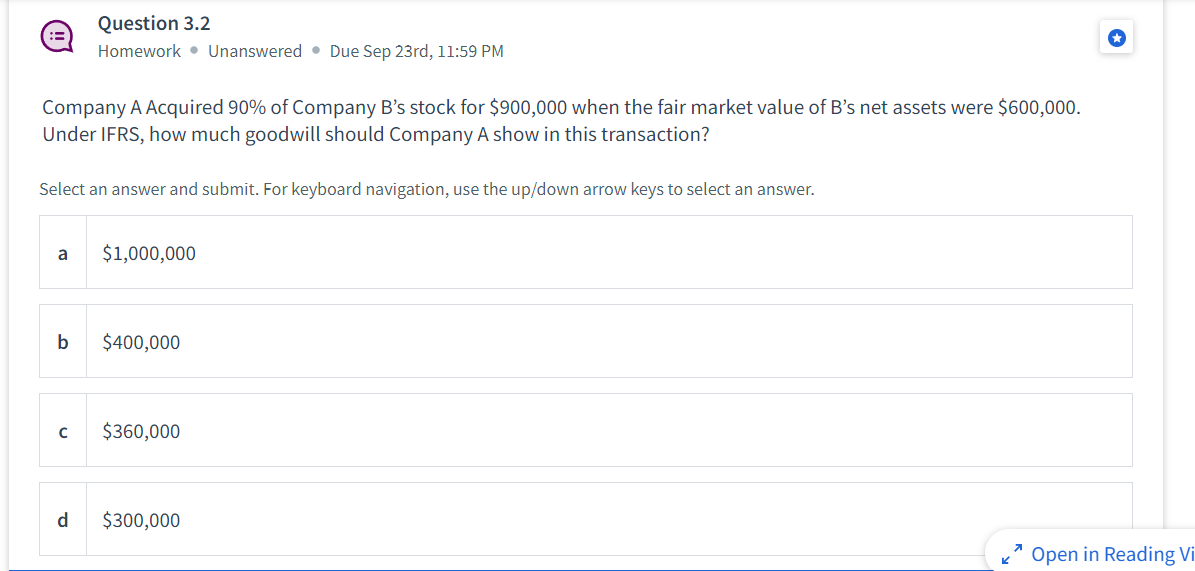

Question 3.2 Homework. Unanswered. Due Sep 23rd, 11:59 PM Company A Acquired 90% of Company B's stock for $900,000 when the fair market value of B's net assets were $600,000. Under IFRS, how much goodwill should Company A show in this transaction? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a $1,000,000 b $400,000 $360,000 d $300,000 K Open in Reading Vi

Step by Step Solution

3.37 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Answer d 300000 Solution To calculate the goodwill under IFRS in a business combination you use the formula Goodwill Consideration Transferred Fair Value of Net Assets Acquired In this case Consideration Transferred 900000 Fair Value of Net Assets Acquired 600000 Goodwill 900000 600 000 300000 So ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Susan S. Hamlen, Ronald J. Huefner, James A. Largay III

2nd edition

1934319309, 978-1934319307

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App