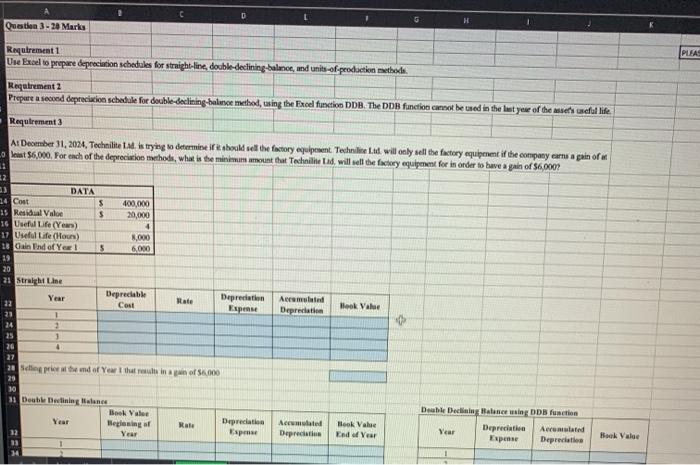

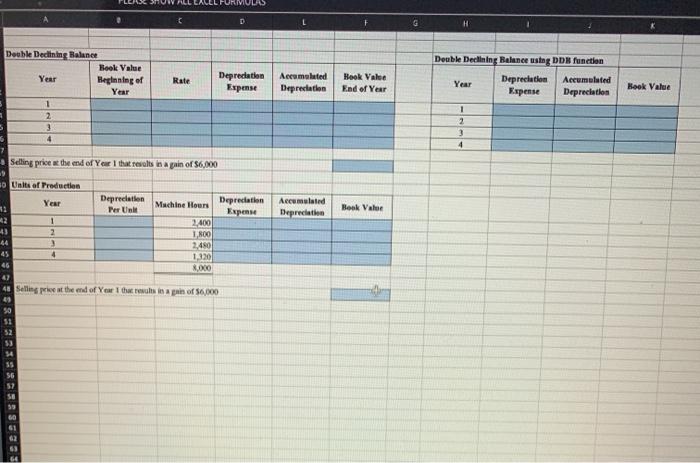

Question 3.20 Marks Uning Eted Using Kred to prepare depreciation schedules The Technikad. has purchased a new piece of factory equipment on Juary 1, 2004, od wishes to compare three depreciation methode: right line, double-declining balance, and units of production The equipments $400,000 and has an estimated useful life of four years, or 8.000 machine bours. At the end of four years, the equipment is estimated to have a residual value of $20,000. Requtrements 1. Use Excel to propere depreciation schedules for straight-line, double declining balance, and unisof production methods 2. Prepare a second depreciation schedule for double-declining balance method, using the Excel function DDR The DD function not be used in the last year of the sel Me. 3. At December 31, 2004, Technie Lid trying to determine if it should sell the factory equipment Technilite Lid will only sell the factory equipm if the company as a pain of at $6,000 For each of the depreciation methods, what is the minimum not that Technilised will sell the factory upent for in onder to have a pain of $6.000 Exel Skills 1. Create formulas wih bsolute and relative cell references 2. For the cells counting number format 3. Use the Excel function on to callate double-declining balance depreciation H Question 3.20 Marks PLEAS Requirement1 Use Excel to prepare depreciation schedules for straight-line, double-declining-balance, and units-of-peodation methods Requirement 2 Prepare a second depreciation schedule for double-declining balance method, using the Excel function DDB. The DDB function cannot be used in the last year of the se's useful life Requirements A: Dember 31, 2024. Technilite 1.. is trying to determine if should sell the factory equipment Technied will only sell the factory equipment if the company care a pain of - Wet $6,000. For each of the depreciation methods, what is the minimum amount that Technilitem will sell the factory equipment for in order to have a pain of $6,000? 11 2 DATA 24 Cost 5 400,000 15 Residual Valoe $ 20,000 16 Useful Life (Years) 4 17 Useful Life (Hons) 8,000 20 Cain Ind of Ye 1 5 6.000 19 20 21 Straight Line Year Deprecabile Depreciation 22 Rate Armed Cost Expense Bok Value Depreciation 21 1 24 2 1 26 4 27 20 Scopri temd of Year that reading of 56.000 10 Double Declining Walance Book Valee Year Beasing Rate Depreciation Espese Aceved Deprecate Year Deble Declining Balance using DD function Year Depreciation Accommutated Expense Depreciate Book Value End Year Book Value C D H Double Declining Balance Book Value Year Beginning of Year Rate Depreciation Expense Accumulated Deprecation Book Valse End of Year Deuble Declining Balance using DD function Year Depreciation Accumulated Expense Depreciation Book Value 3 2 3 4 1 2 3 4 Selling price at the end of Year I that results in a pain of $6,000 Accumulated Depreciation Book Value 30 Units of Production Year Depreciation Machine Hours Depreciation Per Unit Expense 1 2,400 43 2 1,800 44 3 2,480 45 4 1,320 46 8,000 47 48 Selling price at the end of Year the result in a pain of 56,000 51 52 53 SS 56 SE GO 61