Answered step by step

Verified Expert Solution

Question

1 Approved Answer

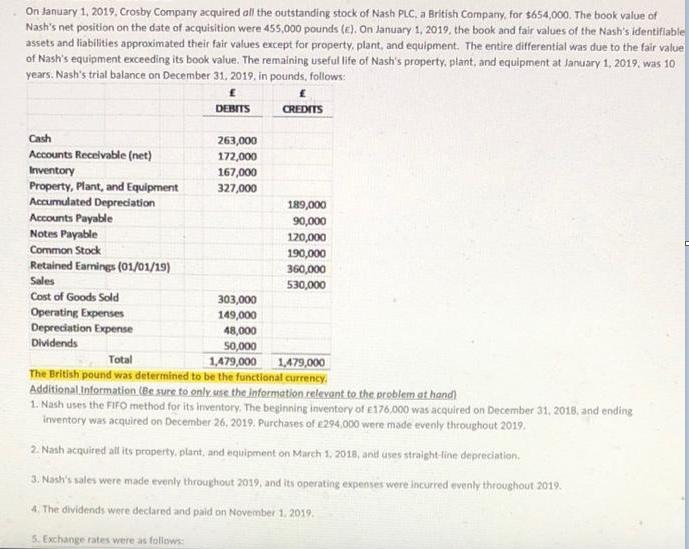

On lanuary 1, 2019, Crosby Company acquired all the outstanding stock of Nash PLC, a British Company, for $654,000. The book value of Nash's

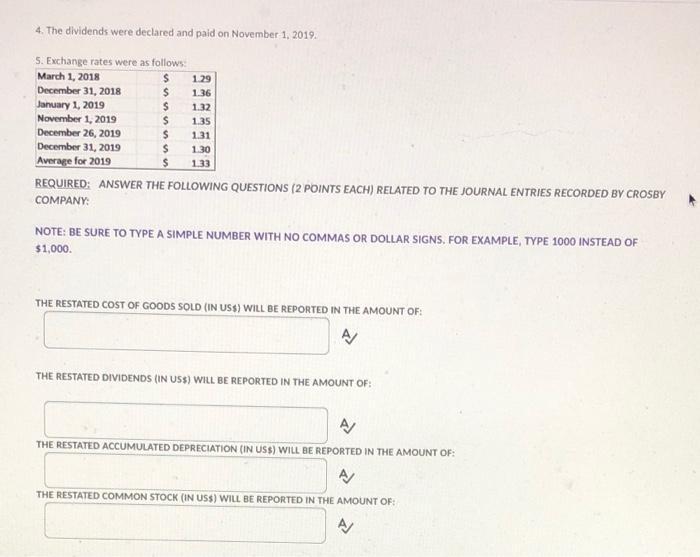

On lanuary 1, 2019, Crosby Company acquired all the outstanding stock of Nash PLC, a British Company, for $654,000. The book value of Nash's net position on the date of acquisition were 455,000 pounds (e). On lanuary 1, 2019, the book and fair values of the Nash's identifiable assets and liabilities approximated their fair values except for property, plant, and equipment. The entire differential was due to the fair value of Nash's equipment exceeding its book value. The remaining useful life of Nash's property, plant, and equipment at January 1, 2019. was 10 years. Nash's trial balance on December 31, 2019, in pounds, follows: DEBITS CREDITS Cash 263,000 Accounts Receivable (net) 172,000 167,000 327,000 Inventory Property, Plant, and Equipment Accumulated Depreciation Accounts Payable 189,000 90,000 120,000 Notes Payable Common Stock 190,000 Retained Earnings (01/01/19) Sales 360,000 530,000 Cost of Goods Sold 303,000 Operating Expenses Depreciation Expense Dividends 149,000 48,000 50,000 1,479,000 1,479,000 Total The British pound was determined to be the functional currency. Additional Information.(@e sure to only.use the information relevant.to the problem at hand) 1. Nash uses the FIF0 method for its inventory. The beginning inventory of e176,000 was acquired on December 31, 2018, and ending inventory was acquired o n December 26, 2019. Purchases of e294,000 were made evenly throughout 2019. 2. Nash acquired all its property, plant, and equipment on March 1, 2018, anid uses straight -line depreciation. 3. Nash's sales were made evenly throughout 2019, and its operating expenses were incurred evenly throughout 2019. 4. The dividends were declared and paid on November 1. 2019. 5. Exchange rates were as follows 4. The dividends were declared and paid on November 1, 2019. 5. Exchange rates were as follows: March 1, 2018 1.29 December 31, 2018 1.36 January 1, 2019 November 1, 2019 1.32 1.35 December 26, 2019 1.31 December 31, 2019 1.30 Average for 2019 1.33 REQUIRED: ANSWER THE FOLLOWING QUESTIONS (2 POINTS EACH) RELATED TO THE JOURNAL ENTRIES RECORDED BY CROSBY COMPANY: NOTE: BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000. THE RESTATED COST OF GOODS SOLD (IN USS) WILL BE REPORTED IN THE AMOUNT OF: THE RESTATED DIVIDENDS (IN USS) WILL BE REPORTED IN THE AMOUNT OF: THE RESTATED ACCUMULATED DEPRECIATION (IN USS) WILL BE REPORTED IN THE AMOUNT OF: THE RESTATED COMMON STOCK (IN USS) WILL BE REPORTED IN THE AMOUNT OF:

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 The cost of Goods sold is 420990 Calculation The average Exchange rate is 133 since the purchase i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started