Answered step by step

Verified Expert Solution

Question

1 Approved Answer

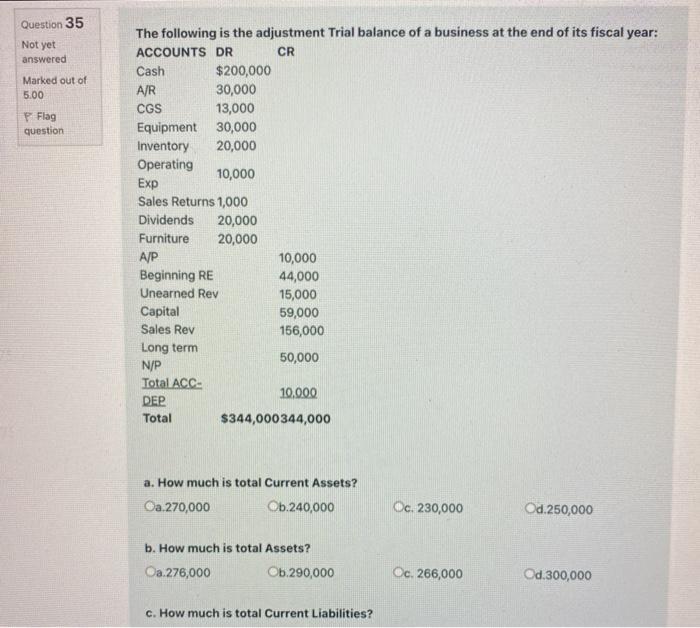

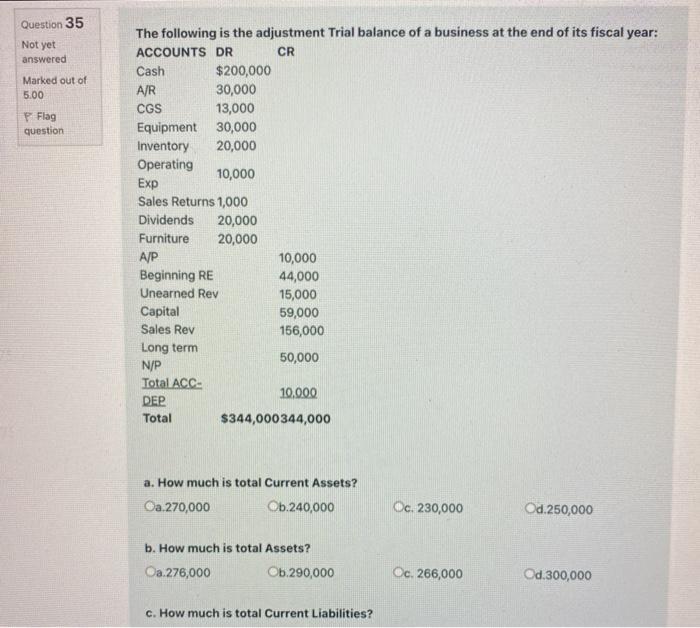

Question 35 Not yet answered Marked out of 5.00 P Flag question The following is the adjustment Trial balance of a business at the end

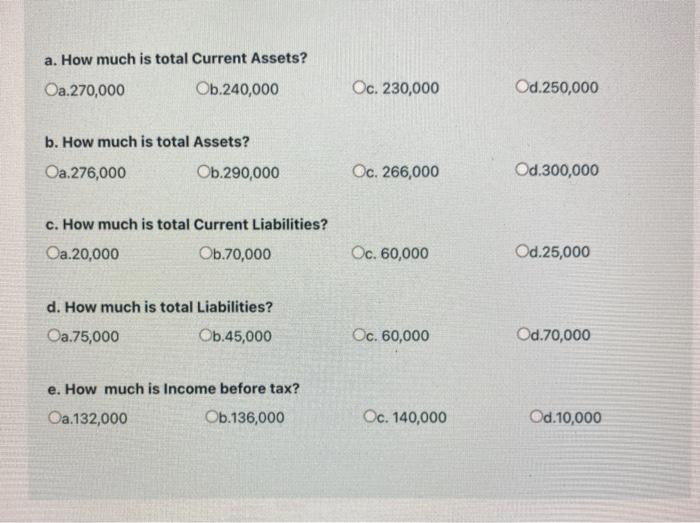

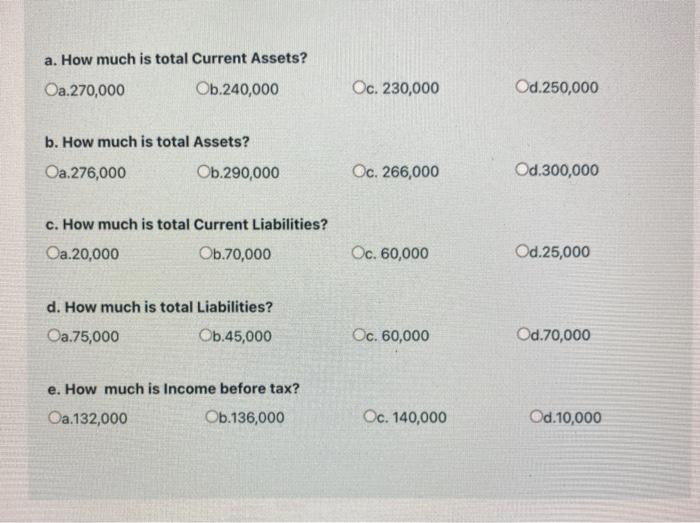

Question 35 Not yet answered Marked out of 5.00 P Flag question The following is the adjustment Trial balance of a business at the end of its fiscal year: ACCOUNTS DR CR Cash $200,000 A/R 30,000 CGS 13,000 Equipment 30,000 Inventory 20,000 Operating 10,000 Exp Sales Returns 1,000 Dividends 20,000 Furniture 20,000 A/P 10,000 Beginning RE 44,000 Unearned Rev 15,000 Capital 59,000 Sales Rev 156,000 Long term N/P 50,000 Total ACC- 10,000 DEP Total $344,000344,000 a. How much is total Current Assets? Ca.270,000 Ob.240,000 Oc. 230,000 Od.250,000 b. How much is total Assets? Oa.276,000 Ob.290,000 Oc. 266,000 Od 300,000 c. How much is total Current Liabilities? a. How much is total Current Assets? Oa.270,000 Ob.240,000 Oc. 230,000 Od.250,000 b. How much is total Assets? Oa.276,000 Ob.290,000 Oc. 266,000 Od.300,000 c. How much is total Current Liabilities? Oa.20,000 Ob.70,000 Oc. 60,000 Od 25,000 d. How much is total Liabilities? Oa.75,000 Ob.45,000 Oc. 60,000 Od.70,000 e. How much is Income before tax? Oa.132,000 Ob.136,000 Oc. 140,000 Od. 10,000

Question 35 Not yet answered Marked out of 5.00 P Flag question The following is the adjustment Trial balance of a business at the end of its fiscal year: ACCOUNTS DR CR Cash $200,000 A/R 30,000 CGS 13,000 Equipment 30,000 Inventory 20,000 Operating 10,000 Exp Sales Returns 1,000 Dividends 20,000 Furniture 20,000 A/P 10,000 Beginning RE 44,000 Unearned Rev 15,000 Capital 59,000 Sales Rev 156,000 Long term N/P 50,000 Total ACC- 10,000 DEP Total $344,000344,000 a. How much is total Current Assets? Ca.270,000 Ob.240,000 Oc. 230,000 Od.250,000 b. How much is total Assets? Oa.276,000 Ob.290,000 Oc. 266,000 Od 300,000 c. How much is total Current Liabilities? a. How much is total Current Assets? Oa.270,000 Ob.240,000 Oc. 230,000 Od.250,000 b. How much is total Assets? Oa.276,000 Ob.290,000 Oc. 266,000 Od.300,000 c. How much is total Current Liabilities? Oa.20,000 Ob.70,000 Oc. 60,000 Od 25,000 d. How much is total Liabilities? Oa.75,000 Ob.45,000 Oc. 60,000 Od.70,000 e. How much is Income before tax? Oa.132,000 Ob.136,000 Oc. 140,000 Od. 10,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started