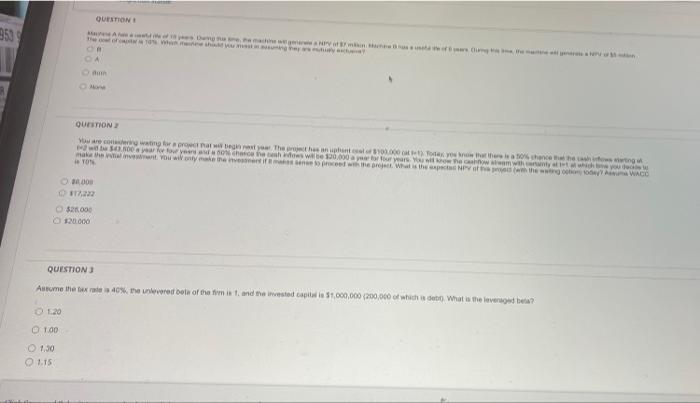

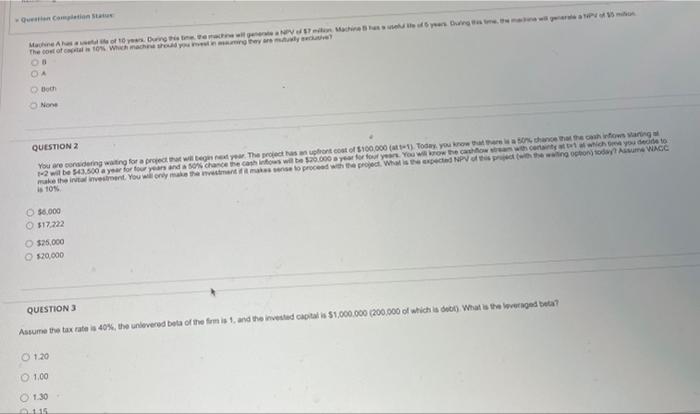

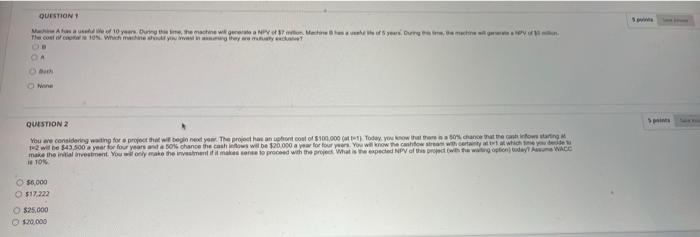

QUESTION 350 QUESTION You are wating to browse the following www.arrow show 130.000 euro ou make the want you want to see who WACO TON 000 22 52100 120.000 QUESTION Assume the tax rate 40% the unlevered bol of the fom i 1. and the invested Gap 1,000,000 (200,000 of which to What is the loved ba? 120 100 1.30 1.15 Completion State Machine Aloft wing machines Machines with other The cost of all is to Which macho you are we? OB Both None QUESTION 2 You are considering waiting for a project will not year. The projects uphort cost of $100,000 (1H1) Tocay, you know that shows are 12 will be $43.500 a year for four years and chance the cash now will be 120.000 year for four years. You won the cashion worth you decide to make the intalnestment. You will only makes the man was to proceed the project. What is CNPV of rewing Consume WACC is 10% $6.000 517222 $25.000 $20,000 QUESTION Assume the tax rates 40%, the unlovered bota of the firm is 1, and the invested capitalis 51.000.000 200.000 of which is b) What is the vegeta? 1.20 1.00 1.30 115 QUESTION 10 years out the machine will get a NPV Wehehyeers Our The cos i 10. With my CA Spins QUESTION 2 You are considering waiting for project that will begin tow. The project cost of $100.000) Today you wachache con infowaring will be 43.500 a year bor four years a chance the cashows will be 120.000 awforfour ors. You will know how stron with which you make the initial restent. You will only make them makes to proceed with the project. What is expected NPV of this with the wing in the WACC 10 10 $6.000 $17.222 $25.000 B120.000 QUESTION Assume the tax rate is 10%. the unlovered bota of the time is 1 and the invited capital 51.000.000 200.000 of which is obt. What is the loved 1.20 100 1.30 1.15 QUESTION 350 QUESTION You are wating to browse the following www.arrow show 130.000 euro ou make the want you want to see who WACO TON 000 22 52100 120.000 QUESTION Assume the tax rate 40% the unlevered bol of the fom i 1. and the invested Gap 1,000,000 (200,000 of which to What is the loved ba? 120 100 1.30 1.15 Completion State Machine Aloft wing machines Machines with other The cost of all is to Which macho you are we? OB Both None QUESTION 2 You are considering waiting for a project will not year. The projects uphort cost of $100,000 (1H1) Tocay, you know that shows are 12 will be $43.500 a year for four years and chance the cash now will be 120.000 year for four years. You won the cashion worth you decide to make the intalnestment. You will only makes the man was to proceed the project. What is CNPV of rewing Consume WACC is 10% $6.000 517222 $25.000 $20,000 QUESTION Assume the tax rates 40%, the unlovered bota of the firm is 1, and the invested capitalis 51.000.000 200.000 of which is b) What is the vegeta? 1.20 1.00 1.30 115 QUESTION 10 years out the machine will get a NPV Wehehyeers Our The cos i 10. With my CA Spins QUESTION 2 You are considering waiting for project that will begin tow. The project cost of $100.000) Today you wachache con infowaring will be 43.500 a year bor four years a chance the cashows will be 120.000 awforfour ors. You will know how stron with which you make the initial restent. You will only make them makes to proceed with the project. What is expected NPV of this with the wing in the WACC 10 10 $6.000 $17.222 $25.000 B120.000 QUESTION Assume the tax rate is 10%. the unlovered bota of the time is 1 and the invited capital 51.000.000 200.000 of which is obt. What is the loved 1.20 100 1.30 1.15