Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 36 (4 points) You are planning to retire in 35 years. Twice per year for the next 35 years beginning six months from now,

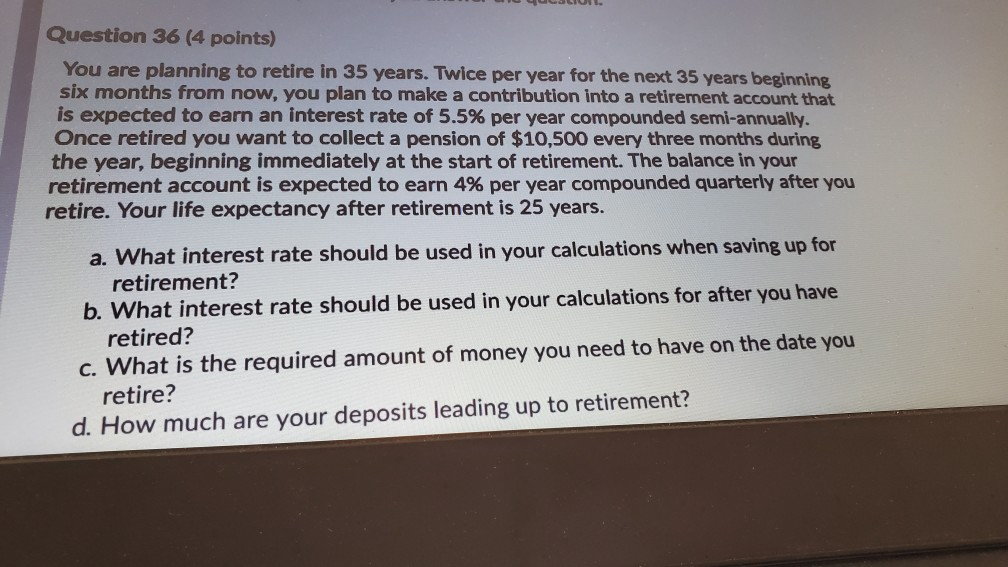

Question 36 (4 points) You are planning to retire in 35 years. Twice per year for the next 35 years beginning six months from now, you plan to make a contribution into a retirement account that is expected to earn an interest rate of 5.5% per year compounded semi-annually. Once retired you want to collect a pension of $10,500 every three months during the year, beginning immediately at the start of retirement. The balance in your retirement account is expected to earn 4% per year compounded quarterly after you retire. Your life expectancy after retirement is 25 years. a. What interest rate should be used in your calculations when saving up for retirement? b. What interest rate should be used in your calculations for after you have retired? c. What is the required amount of money you need to have on the date you retire? d. How much are your deposits leading up to retirement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started