Question

Question 36 General Fund Entries and Financial Statements The Town of Amherst, NY finances its operations from revenues collected from property taxes, waste management fees,

Question 36

General Fund Entries and Financial Statements

The Town of Amherst, NY finances its operations from revenues collected from property taxes, waste management fees, municipal court fines, and interest on investments. Amherst maintains only a general fund. The following information is available for the year ended December 31, 2013.

1. Following is the general fund trial balance on January 1, 2013:

| Dr (Cr) | |

|---|---|

| Investments | $6,000,000 |

| Cash | 3,500,000 |

| Waste management supplies | 380,000 |

| Accounts receivable-waste management | 400,000 |

| Fund balance-nonspendable | (380,000) |

| Fund balance-unassigned | (9,900,000) |

| Total | $0 |

2. The budget for 2013, adopted by the town board, follows:

| Property taxes | $2,700,000 |

| Waste management costs | 6,700,000 |

| Court costs | 1,150,000 |

| Waste management revenues | 3,500,000 |

| Court fines | 1,000,000 |

| Salaries and operating expenditures | 750,000 |

| Investment income | 250,000 |

| Supplies expenditures | 350,000 |

| Miscellaneous expenditures | 150,000 |

3. All property taxes were collected in cash. Waste management costs, all paid in cash, were $6,680,000. Court costs, all paid in cash, were $1,120,000. 4. Waste management revenues billed during the year: $3,600,000. All outstanding waste management bills on January 1, 2013, were collected during 2013. All 2013 billings were paid with the exception of $210,000 which were mailed to customers the last week of the year. 5. Court fines all collected in cash were $920,000. Salaries and operating expenditures, all paid in cash, were $745,000. Investment income accumulating in the investments account until investments mature: $235,000. No investments matured in 2013. 6. Miscellaneous expenditures, all paid in cash, were $149,000. 7. Waste management supplies on hand at year-end were $40,000. The town uses the consumption method to report supplies.

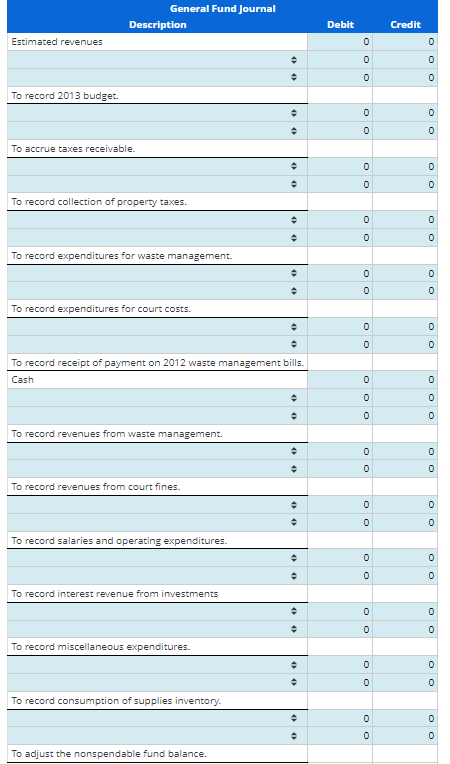

For all numerical answers, enter all zeros - do not abbreviate to millions or thousands. a. Prepare 2013 journal entries to record the above events and to close the books for the year.

b. Prepare a statement of revenues, expenditures, and changes in fund balances for 2013 and the balance sheet at December 31, 2013, for Amherst's general fund.

Use a negative sign with your answer for excess of revenues over (under) expenditures, if "under" applies. Otherwise, do not use negative signs with your answers.

| Town of Amherst General Fund Statement of Revenues, Expenditures, and Changes in Fund Balance For the Year Ended December 31, 2013 | |

|---|---|

| Revenues: | |

| Property taxes | Answer |

| Waste management service | Answer |

| Court fines | Answer |

| Interest | Answer |

| Answer | |

| Expenditures: | |

| Waste management department | Answer |

| Court costs | Answer |

| Salaries and operating expenditures | Answer |

| Supplies | Answer |

| Miscellaneous | Answer |

| Total expenditures | Answer |

| Excess of revenues over (under) expenditures | Answer |

| Fund balance -- January 1, 2013 | Answer |

| Fund balance -- December 31, 2013 | Answer |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started