Answered step by step

Verified Expert Solution

Question

1 Approved Answer

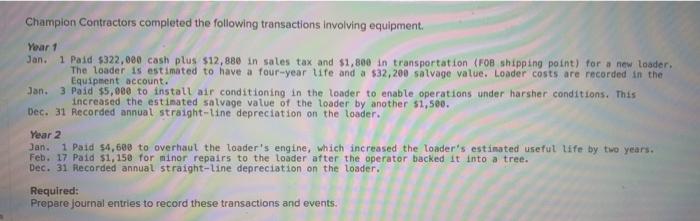

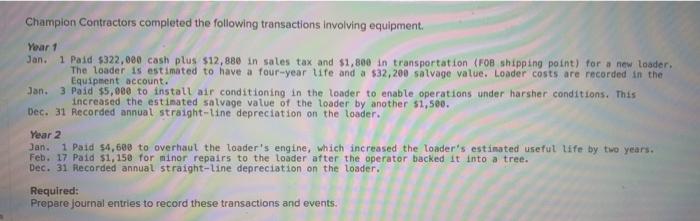

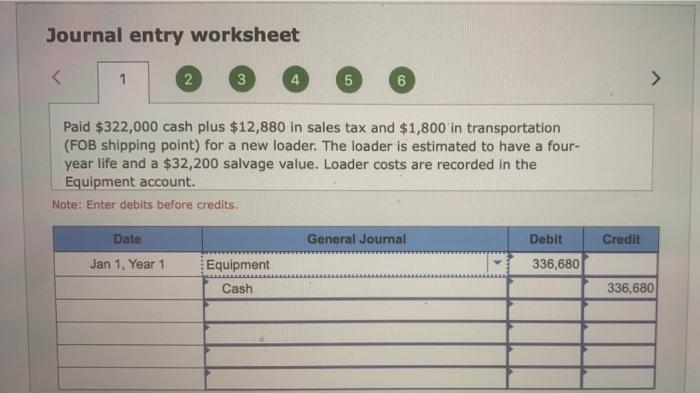

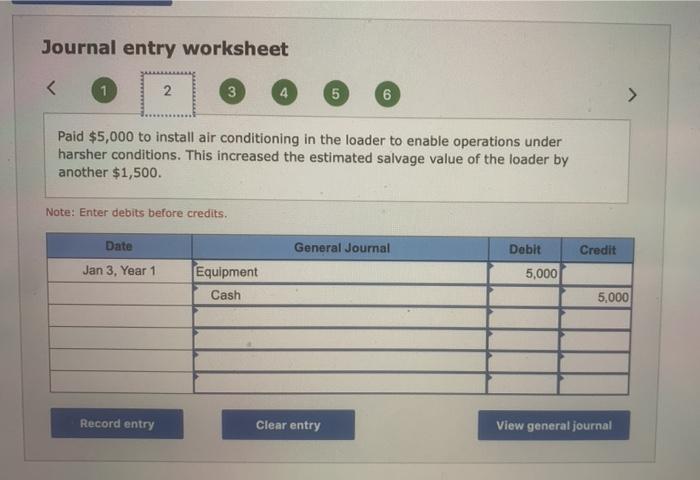

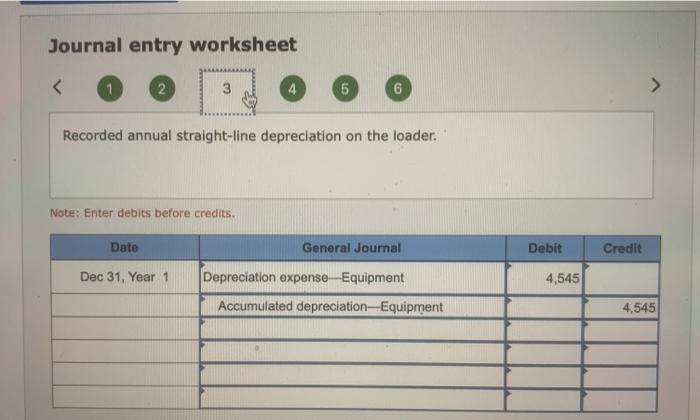

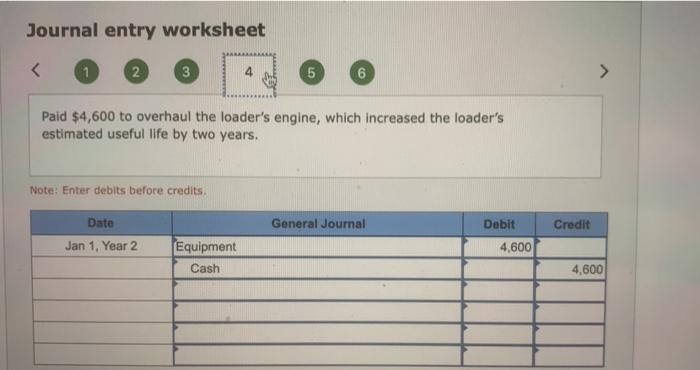

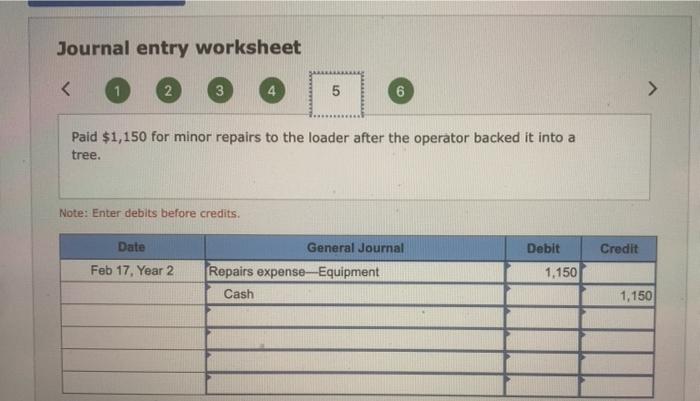

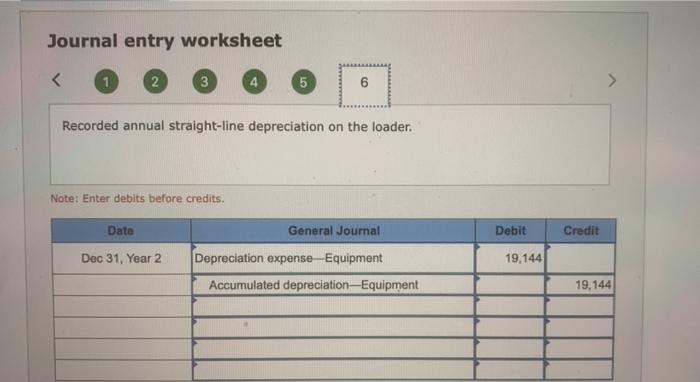

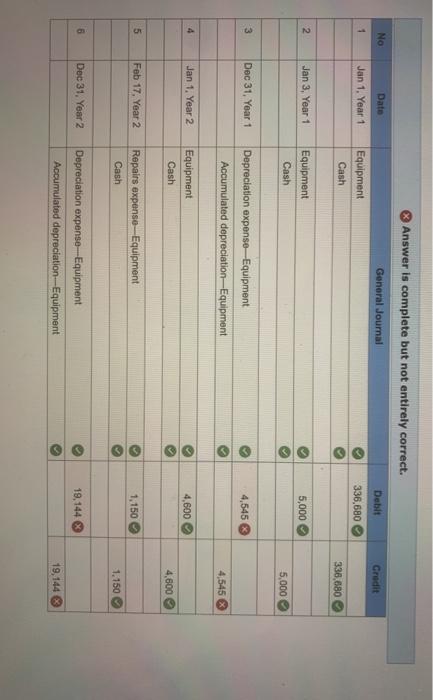

question 3&6. thank you! Champion Contractors completed the following transactions involving equipment Year 1 Jan. 1 Paid 5322,000 cash plus $12,880 in sales tax and

question 3&6.

thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started