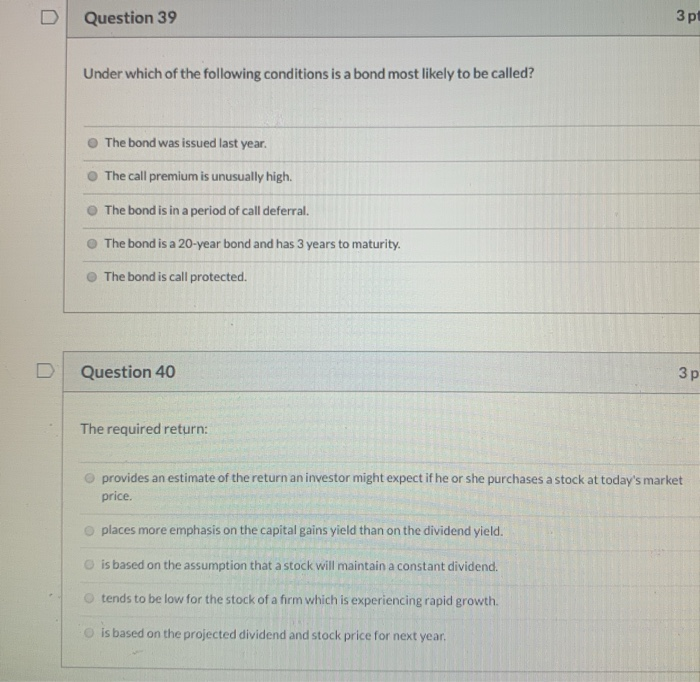

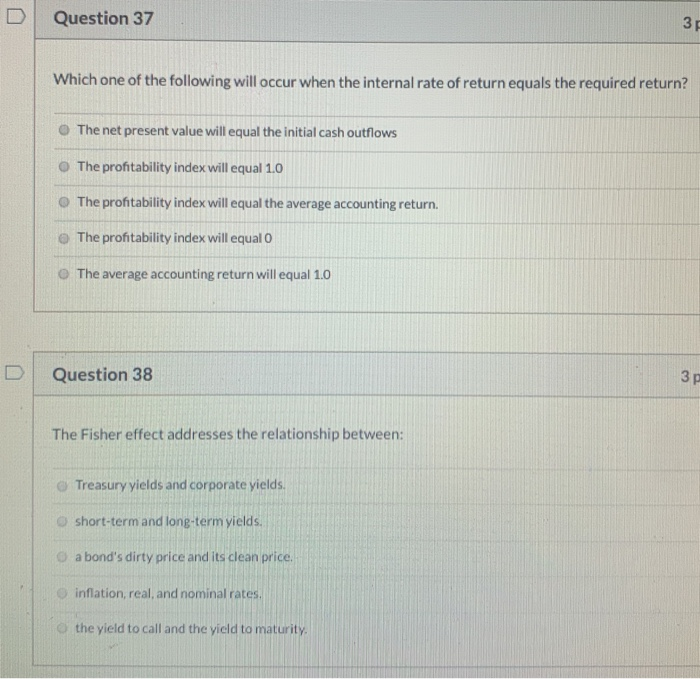

Question 39 3 pt Under which of the following conditions is a bond most likely to be called? The bond was issued last year. The call premium is unusually high. The bond is in a period of call deferral. The bond is a 20-year bond and has 3 years to maturity. The bond is call protected. Question 40 3 p The required return: provides an estimate of the return an investor might expect if he or she purchases a stock at today's market price. places more emphasis on the capital gains yield than on the dividend yield. is based on the assumption that a stock will maintain a constant dividend. tends to be low for the stock of a firm which is experiencing rapid growth is based on the projected dividend and stock price for next year. Question 37 35 Which one of the following will occur when the internal rate of return equals the required return? The net present value will equal the initial cash outflows The profitability index will equal 1.0 The profitability index will equal the average accounting return. The profitability index will equal O The average accounting return will equal 1.0 Question 38 3p The Fisher effect addresses the relationship between: Treasury yields and corporate yields. short-term and long-term yields. a bond's dirty price and its clean price. inflation, real, and nominal rates, the yield to call and the yield to maturity Question 39 3 pt Under which of the following conditions is a bond most likely to be called? The bond was issued last year. The call premium is unusually high. The bond is in a period of call deferral. The bond is a 20-year bond and has 3 years to maturity. The bond is call protected. Question 40 3 p The required return: provides an estimate of the return an investor might expect if he or she purchases a stock at today's market price. places more emphasis on the capital gains yield than on the dividend yield. is based on the assumption that a stock will maintain a constant dividend. tends to be low for the stock of a firm which is experiencing rapid growth is based on the projected dividend and stock price for next year. Question 37 35 Which one of the following will occur when the internal rate of return equals the required return? The net present value will equal the initial cash outflows The profitability index will equal 1.0 The profitability index will equal the average accounting return. The profitability index will equal O The average accounting return will equal 1.0 Question 38 3p The Fisher effect addresses the relationship between: Treasury yields and corporate yields. short-term and long-term yields. a bond's dirty price and its clean price. inflation, real, and nominal rates, the yield to call and the yield to maturity