Answered step by step

Verified Expert Solution

Question

1 Approved Answer

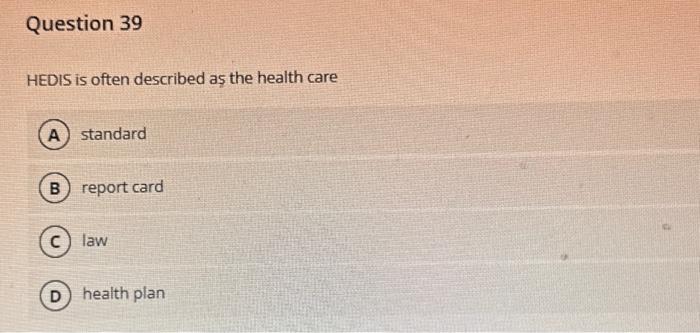

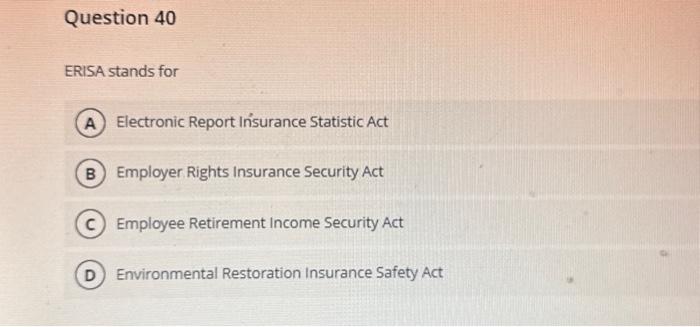

Question 39 HEDIS is often described as the health care A standard B report card C) law D) health plan Question 40 ERISA stands

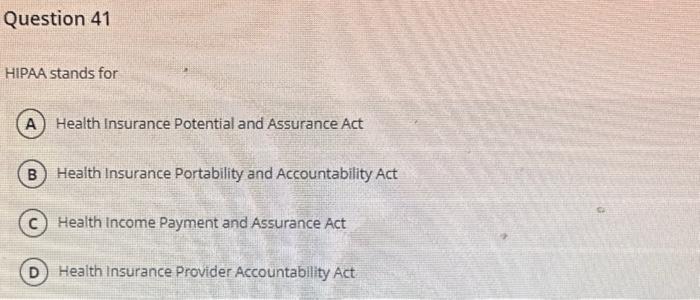

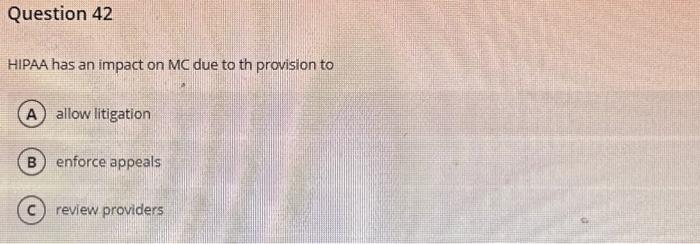

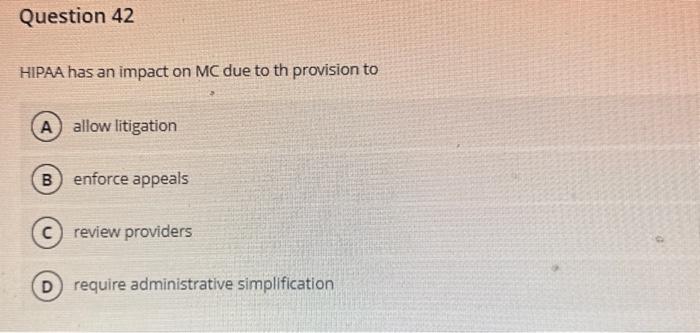

Question 39 HEDIS is often described as the health care A standard B report card C) law D) health plan Question 40 ERISA stands for A Electronic Report Insurance Statistic Act B Employer Rights Insurance Security Act C Employee Retirement Income Security Act D Environmental Restoration Insurance Safety Act Question 41 HIPAA stands for A) Health Insurance Potential and Assurance Act B) Health Insurance Portability and Accountability Act Health Income Payment and Assurance Act Health Insurance Provider Accountability Act Question 42 HIPAA has an impact on MC due to th provision to A allow litigation B) enforce appeals C) review providers Question 42 HIPAA has an impact on MC due to th provision to A allow litigation B) enforce appeals c) review providers D) require administrative simplification

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below These are questions related to US healt...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started