Answered step by step

Verified Expert Solution

Question

1 Approved Answer

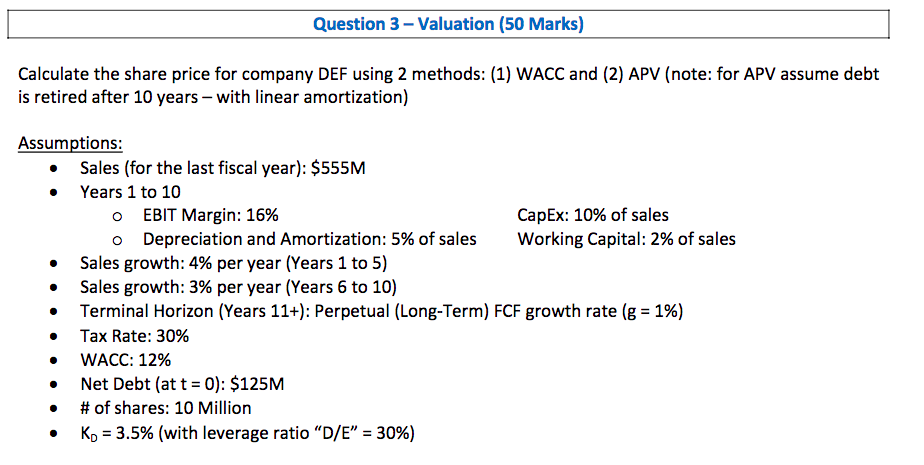

Question 3-Valuation (50 Marks) Calculate the share price for company DEF using 2 methods: (1) is retired after 10 years- with linear amortization) WACC and

Question 3-Valuation (50 Marks) Calculate the share price for company DEF using 2 methods: (1) is retired after 10 years- with linear amortization) WACC and (2) APV (note: for APV assume debt Assumptions . Sales (for the last fiscal year): $555M e Years 1 to 10 EBIT Margin: 16% Depreciation and Amortization: 5% of sales CapEx: 10% of sales working Capital: 2% of sales o Sales growth: 4% per year (Years 1 to 5) . Sales growth:3%peraear1+)Perpetual(Long-Term) FCF . Terminal Horizon (Years 119: Perpetual (Long-Term) FCF growth rate (8-1%) Tax Rate: 30% . WACC: 12% .Net Debt (att 0): $125M # of shares: 10 Million KOF 3.5% (with leverage ratio "D/E"-30%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started