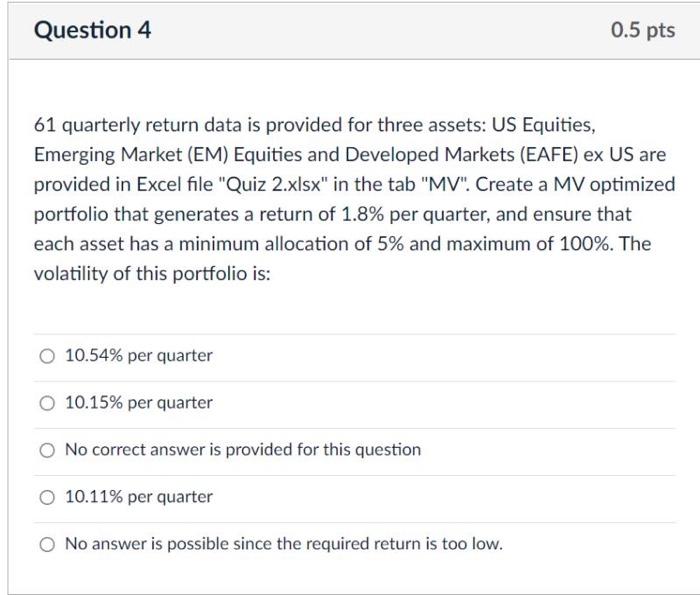

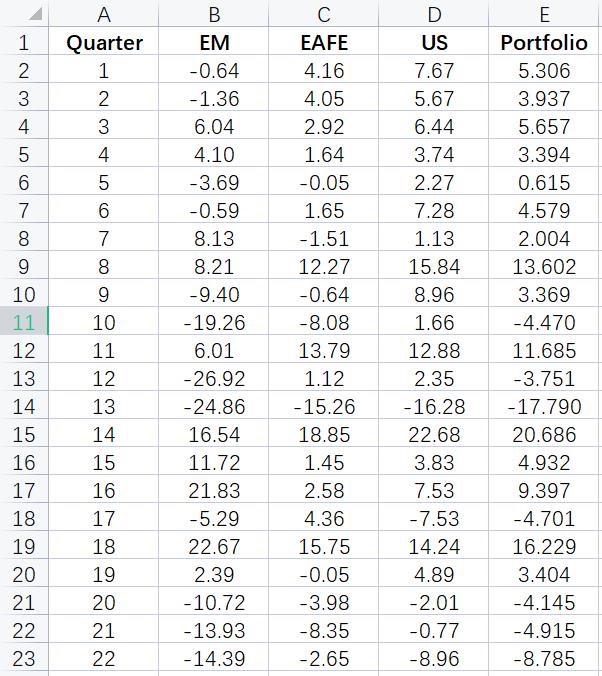

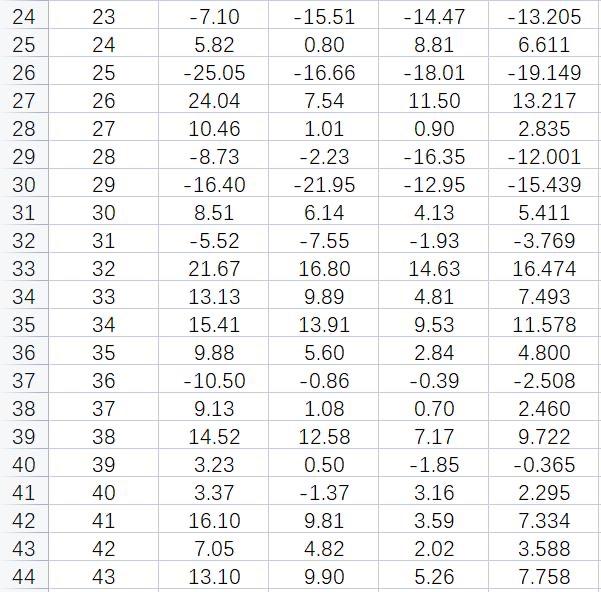

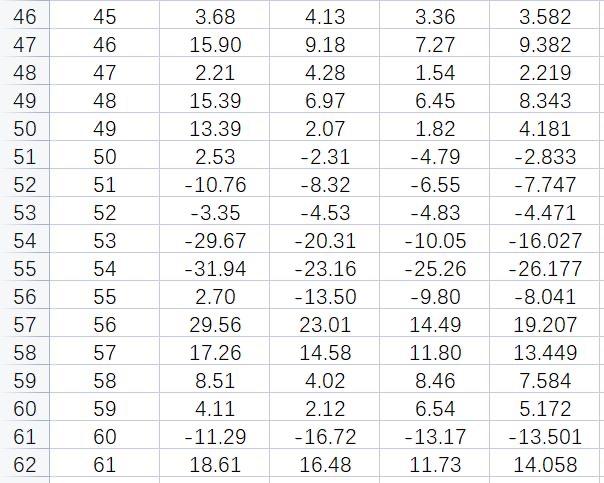

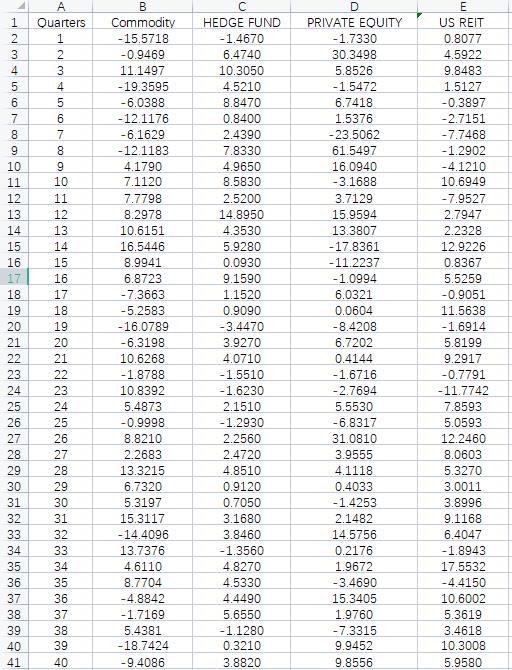

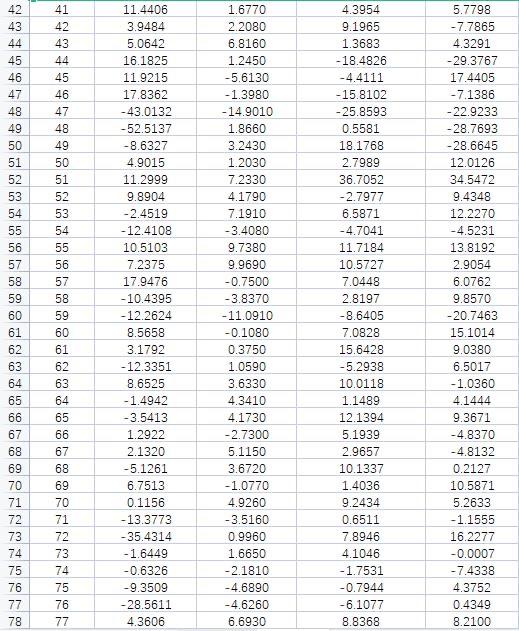

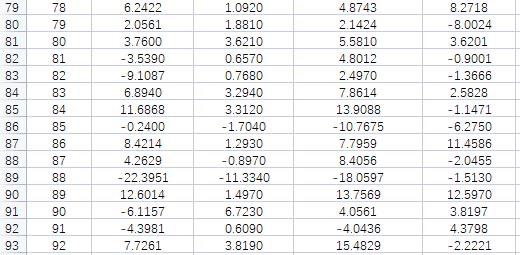

Question 4 0.5 pts 61 quarterly return data is provided for three assets: US Equities, Emerging Market (EM) Equities and Developed Markets (EAFE) ex US are provided in Excel file "Quiz 2.xlsx" in the tab "MV". Create a MV optimized portfolio that generates a return of 1.8% per quarter, and ensure that each asset has a minimum allocation of 5% and maximum of 100%. The volatility of this portfolio is: 10.54% per quarter 10.15% per quarter No correct answer is provided for this question O 10.11% per quarter No answer is possible since the required return is too low. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 A Quarter 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 B EM -0.64 -1.36 6.04 4.10 -3.69 -0.59 8.13 8.21 -9.40 -19.26 6.01 -26.92 -24.86 16.54 11.72 21.83 -5.29 22.67 2.39 -10.72 -13.93 -14.39 C EAFE 4.16 4.05 2.92 1.64 -0.05 1.65 -1.51 12.27 -0.64 -8.08 13.79 1.12 -15.26 18.85 1.45 2.58 4.36 15.75 -0.05 -3.98 -8.35 -2.65 D US 7.67 5.67 6.44 3.74 2.27 7.28 1.13 15.84 8.96 1.66 12.88 2.35 -16.28 22.68 3.83 7.53 -7.53 14.24 4.89 -2.01 -0.77 -8.96 E Portfolio 5.306 3.937 5.657 3.394 0.615 4.579 2.004 13.602 3.369 -4.470 11.685 -3.751 -17.790 20.686 4.932 9.397 -4.701 16.229 3.404 -4.145 -4.915 -8.785 WN 23 24 25 26 27 28 29 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 30 31 32 33 34 35 36 37 38 39 40 41 42 43 -7.10 5.82 -25.05 24.04 10.46 -8.73 -16.40 8.51 -5.52 21.67 13.13 15.41 9.88 - 10.50 9.13 14.52 3.23 3.37 16.10 7.05 13.10 -15.51 0.80 - 16.66 7.54 1.01 -2.23 -21.95 6.14 -7.55 16.80 9.89 13.91 5.60 -0.86 1.08 12.58 0.50 -1.37 9.81 4.82 9.90 - 14.47 8.81 - 18.01 11.50 0.90 -16.35 -12.95 4.13 -1.93 14.63 4.81 9.53 2.84 -0.39 0.70 7.17 -1.85 3.16 3.59 2.02 5.26 -13.205 6.611 -19.149 13.217 2.835 -12.001 -15.439 5.411 -3.769 16.474 7.493 11.578 4.800 -2.508 2.460 9.722 -0.365 2.295 7.334 3.588 7.758 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 3.68 15.90 2.21 15.39 13.39 2.53 -10.76 -3.35 -29.67 -31.94 2.70 29.56 17.26 8.51 4.11 - 11.29 18.61 4.13 9.18 4.28 6.97 2.07 -2.31 -8.32 -4.53 -20.31 -23.16 -13.50 23.01 14.58 4.02 2.12 -16.72 16.48 3.36 7.27 1.54 6.45 1.82 -4.79 -6.55 -4.83 -10.05 -25.26 -9.80 14.49 11.80 8.46 6.54 -13.17 11.73 3.582 9.382 2.219 8.343 4.181 -2.833 -7.747 -4.471 - 16.027 -26.177 -8.041 19.207 13.449 7.584 5.172 -13.501 14.058 A 5 NON 0 0 7 GRADO CONOWN Quarters 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 68898889 NOGOBRES B Commodity - 15.5718 -0.9469 11.1497 -19.3595 - 6.0388 - 12.1176 -6.1629 - 12.1183 4.1790 7.1120 7.7798 8.2978 10.6151 16.5446 8.9941 6.8723 -7.3663 -5.2583 - 16.0789 -6.3198 10.6268 -1.8788 10.8392 5.4873 -0.9998 8.8210 2.2683 13.3215 6.7320 5.3197 15.3117 - 14.4096 13.7376 4.6110 8.7704 -4.8842 -1.7169 5.4381 - 18.7424 -9.4086 888888888NOORSORDS HEDGE FUND -1.4670 6.4740 10.3050 4.5210 8.8470 0.8400 2.4390 7.8330 4.9650 8.5830 2.5200 14.8950 4.3530 5.9280 0.0930 9.1590 1.1520 0.9090 -3.4470 3.9270 4.0710 -1.5510 -1.6230 2.1510 -1.2930 2.2560 2.4720 4.8510 0.9120 0.7050 3.1680 3.8460 -1.3560 4.8270 4.5330 4.4490 5.6550 -1.1280 0.3210 3.8820 D PRIVATE EQUITY -1.7330 30.3498 5.8526 -1.5472 6.7418 1.5376 -23.5062 61.5497 16.0940 - 3.1688 3.7129 15.9594 13.3807 -17.8361 - 11.2237 - 1.0994 6.0321 0.0604 -8.4208 6.7202 0.4144 -1.6716 -2.7694 5.5530 -6.8317 31.0810 3.9555 41118 0.4033 -1.4253 2.1482 14.5756 0.2176 1.9672 -3.4690 15.3405 1.9760 -7.3315 9.9452 9.8556 24 E US REIT 0.8077 4.5922 9.8483 1.5127 -0.3897 -2.7151 -7.7468 - 1.2902 -4.1210 10.6949 -7.9527 2.7947 2.2328 12.9226 0.8367 5.5259 -0.9051 11.5638 -1.6914 5.8199 9.2917 -0.7791 - 11.7742 7.8593 5.0593 12.2460 8.0603 5.3270 3.0011 3.8996 9.1168 6.4047 -1.8943 17.5532 -4.4150 10.6002 5.3619 3.4618 10.3008 5.9580 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 41 42 43 44 45 46 47 48 49 50 51 52 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 53 54 55 56 57 58 59 60 61 62 63 64 65 11.4406 3.9484 5.0642 16.1825 11.9215 17.8362 -43.0132 -52.5137 -8.6327 4.9015 11.2999 9.8904 -2.4519 -12.4108 10.5103 7.2375 17.9476 -10.4395 - 12.2624 8.5658 3.1792 -12.3351 8.6525 -1.4942 -3.5413 1.2922 2.1320 -5.1261 6.7513 0.1156 -13.3773 -35.4314 -1.6449 -0.6326 -9.3509 - 28.5611 4.3606 1.6770 2.2080 6.8160 1.2450 -5.6130 -1.3980 - 14.9010 1.8660 3.2430 1.2030 7.2330 4.1790 7.1910 -3.4080 9.7380 9.9690 -0.7500 -3.8370 - 11.0910 -0.1080 0.3750 1.0590 3.6330 4.3410 4.1730 -2.7300 5.1150 3.6720 - 1.0770 4.9260 -3.5160 0.9960 1.6650 -2.1810 -4.6890 -4.6260 6.6930 4.3954 9.1965 1.3683 -18.4826 -4.4111 - 15.8102 -25.8593 0.5581 18.1768 2.7989 36.7052 -2.7977 6.5871 -4.7041 11.7184 10.5727 7.0448 2.8197 -8.6405 7.0828 15.6428 -5.2938 10.0118 1.1489 12.1394 5.1939 2.9657 10.1337 1.4036 9.2434 0.6511 7.8946 4.1046 -1.7531 -0.7944 -6.1077 8.8368 5.7798 -7.7865 4.3291 -29.3767 17.4405 -7.1386 - 22.9233 - 28.7693 - 28.6645 12.0126 34.5472 9.4348 12.2270 -4.5231 13.8192 2.9054 6.0762 9.8570 -20.7463 15.1014 9.0380 6.5017 -1.0360 4.1444 9.3671 -4.8370 -4.8132 0.2127 10.5871 5.2633 -1.1555 16.2277 -0.0007 - 7.4338 4.3752 0.4349 8.2100 66 73 67 68 69 70 71 72 73 74 75 76 77 74 75 76 78 78 79 80 81 82 83 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 84 85 86 87 88 89 90 91 92 6.2422 2.0561 3.7600 -3.5390 -9.1087 6.8940 11.6868 -0.2400 8.4214 4.2629 -22.3951 12.6014 -6.1157 -4.3981 7.7261 1.0920 1.8810 3.6210 0.6570 0.7680 3.2940 3.3120 -1.7040 1.2930 -0.8970 - 11.3340 1.4970 6.7230 0.6090 3.8190 4.8743 2.1424 5.5810 4.8012 2.4970 7.8614 13.9088 - 10.7675 7.7959 8.4056 - 18.0597 13.7569 4.0561 -4.0436 15.4829 8.2718 -8.0024 3.6201 -0.9001 -1.3666 2.5828 -1.1471 -6.2750 11.4586 -2.0455 -1.5130 12.5970 3.8197 4.3798 -2.2221 Question 4 0.5 pts 61 quarterly return data is provided for three assets: US Equities, Emerging Market (EM) Equities and Developed Markets (EAFE) ex US are provided in Excel file "Quiz 2.xlsx" in the tab "MV". Create a MV optimized portfolio that generates a return of 1.8% per quarter, and ensure that each asset has a minimum allocation of 5% and maximum of 100%. The volatility of this portfolio is: 10.54% per quarter 10.15% per quarter No correct answer is provided for this question O 10.11% per quarter No answer is possible since the required return is too low. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 A Quarter 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 B EM -0.64 -1.36 6.04 4.10 -3.69 -0.59 8.13 8.21 -9.40 -19.26 6.01 -26.92 -24.86 16.54 11.72 21.83 -5.29 22.67 2.39 -10.72 -13.93 -14.39 C EAFE 4.16 4.05 2.92 1.64 -0.05 1.65 -1.51 12.27 -0.64 -8.08 13.79 1.12 -15.26 18.85 1.45 2.58 4.36 15.75 -0.05 -3.98 -8.35 -2.65 D US 7.67 5.67 6.44 3.74 2.27 7.28 1.13 15.84 8.96 1.66 12.88 2.35 -16.28 22.68 3.83 7.53 -7.53 14.24 4.89 -2.01 -0.77 -8.96 E Portfolio 5.306 3.937 5.657 3.394 0.615 4.579 2.004 13.602 3.369 -4.470 11.685 -3.751 -17.790 20.686 4.932 9.397 -4.701 16.229 3.404 -4.145 -4.915 -8.785 WN 23 24 25 26 27 28 29 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 30 31 32 33 34 35 36 37 38 39 40 41 42 43 -7.10 5.82 -25.05 24.04 10.46 -8.73 -16.40 8.51 -5.52 21.67 13.13 15.41 9.88 - 10.50 9.13 14.52 3.23 3.37 16.10 7.05 13.10 -15.51 0.80 - 16.66 7.54 1.01 -2.23 -21.95 6.14 -7.55 16.80 9.89 13.91 5.60 -0.86 1.08 12.58 0.50 -1.37 9.81 4.82 9.90 - 14.47 8.81 - 18.01 11.50 0.90 -16.35 -12.95 4.13 -1.93 14.63 4.81 9.53 2.84 -0.39 0.70 7.17 -1.85 3.16 3.59 2.02 5.26 -13.205 6.611 -19.149 13.217 2.835 -12.001 -15.439 5.411 -3.769 16.474 7.493 11.578 4.800 -2.508 2.460 9.722 -0.365 2.295 7.334 3.588 7.758 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 3.68 15.90 2.21 15.39 13.39 2.53 -10.76 -3.35 -29.67 -31.94 2.70 29.56 17.26 8.51 4.11 - 11.29 18.61 4.13 9.18 4.28 6.97 2.07 -2.31 -8.32 -4.53 -20.31 -23.16 -13.50 23.01 14.58 4.02 2.12 -16.72 16.48 3.36 7.27 1.54 6.45 1.82 -4.79 -6.55 -4.83 -10.05 -25.26 -9.80 14.49 11.80 8.46 6.54 -13.17 11.73 3.582 9.382 2.219 8.343 4.181 -2.833 -7.747 -4.471 - 16.027 -26.177 -8.041 19.207 13.449 7.584 5.172 -13.501 14.058 A 5 NON 0 0 7 GRADO CONOWN Quarters 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 68898889 NOGOBRES B Commodity - 15.5718 -0.9469 11.1497 -19.3595 - 6.0388 - 12.1176 -6.1629 - 12.1183 4.1790 7.1120 7.7798 8.2978 10.6151 16.5446 8.9941 6.8723 -7.3663 -5.2583 - 16.0789 -6.3198 10.6268 -1.8788 10.8392 5.4873 -0.9998 8.8210 2.2683 13.3215 6.7320 5.3197 15.3117 - 14.4096 13.7376 4.6110 8.7704 -4.8842 -1.7169 5.4381 - 18.7424 -9.4086 888888888NOORSORDS HEDGE FUND -1.4670 6.4740 10.3050 4.5210 8.8470 0.8400 2.4390 7.8330 4.9650 8.5830 2.5200 14.8950 4.3530 5.9280 0.0930 9.1590 1.1520 0.9090 -3.4470 3.9270 4.0710 -1.5510 -1.6230 2.1510 -1.2930 2.2560 2.4720 4.8510 0.9120 0.7050 3.1680 3.8460 -1.3560 4.8270 4.5330 4.4490 5.6550 -1.1280 0.3210 3.8820 D PRIVATE EQUITY -1.7330 30.3498 5.8526 -1.5472 6.7418 1.5376 -23.5062 61.5497 16.0940 - 3.1688 3.7129 15.9594 13.3807 -17.8361 - 11.2237 - 1.0994 6.0321 0.0604 -8.4208 6.7202 0.4144 -1.6716 -2.7694 5.5530 -6.8317 31.0810 3.9555 41118 0.4033 -1.4253 2.1482 14.5756 0.2176 1.9672 -3.4690 15.3405 1.9760 -7.3315 9.9452 9.8556 24 E US REIT 0.8077 4.5922 9.8483 1.5127 -0.3897 -2.7151 -7.7468 - 1.2902 -4.1210 10.6949 -7.9527 2.7947 2.2328 12.9226 0.8367 5.5259 -0.9051 11.5638 -1.6914 5.8199 9.2917 -0.7791 - 11.7742 7.8593 5.0593 12.2460 8.0603 5.3270 3.0011 3.8996 9.1168 6.4047 -1.8943 17.5532 -4.4150 10.6002 5.3619 3.4618 10.3008 5.9580 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 41 42 43 44 45 46 47 48 49 50 51 52 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 53 54 55 56 57 58 59 60 61 62 63 64 65 11.4406 3.9484 5.0642 16.1825 11.9215 17.8362 -43.0132 -52.5137 -8.6327 4.9015 11.2999 9.8904 -2.4519 -12.4108 10.5103 7.2375 17.9476 -10.4395 - 12.2624 8.5658 3.1792 -12.3351 8.6525 -1.4942 -3.5413 1.2922 2.1320 -5.1261 6.7513 0.1156 -13.3773 -35.4314 -1.6449 -0.6326 -9.3509 - 28.5611 4.3606 1.6770 2.2080 6.8160 1.2450 -5.6130 -1.3980 - 14.9010 1.8660 3.2430 1.2030 7.2330 4.1790 7.1910 -3.4080 9.7380 9.9690 -0.7500 -3.8370 - 11.0910 -0.1080 0.3750 1.0590 3.6330 4.3410 4.1730 -2.7300 5.1150 3.6720 - 1.0770 4.9260 -3.5160 0.9960 1.6650 -2.1810 -4.6890 -4.6260 6.6930 4.3954 9.1965 1.3683 -18.4826 -4.4111 - 15.8102 -25.8593 0.5581 18.1768 2.7989 36.7052 -2.7977 6.5871 -4.7041 11.7184 10.5727 7.0448 2.8197 -8.6405 7.0828 15.6428 -5.2938 10.0118 1.1489 12.1394 5.1939 2.9657 10.1337 1.4036 9.2434 0.6511 7.8946 4.1046 -1.7531 -0.7944 -6.1077 8.8368 5.7798 -7.7865 4.3291 -29.3767 17.4405 -7.1386 - 22.9233 - 28.7693 - 28.6645 12.0126 34.5472 9.4348 12.2270 -4.5231 13.8192 2.9054 6.0762 9.8570 -20.7463 15.1014 9.0380 6.5017 -1.0360 4.1444 9.3671 -4.8370 -4.8132 0.2127 10.5871 5.2633 -1.1555 16.2277 -0.0007 - 7.4338 4.3752 0.4349 8.2100 66 73 67 68 69 70 71 72 73 74 75 76 77 74 75 76 78 78 79 80 81 82 83 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 84 85 86 87 88 89 90 91 92 6.2422 2.0561 3.7600 -3.5390 -9.1087 6.8940 11.6868 -0.2400 8.4214 4.2629 -22.3951 12.6014 -6.1157 -4.3981 7.7261 1.0920 1.8810 3.6210 0.6570 0.7680 3.2940 3.3120 -1.7040 1.2930 -0.8970 - 11.3340 1.4970 6.7230 0.6090 3.8190 4.8743 2.1424 5.5810 4.8012 2.4970 7.8614 13.9088 - 10.7675 7.7959 8.4056 - 18.0597 13.7569 4.0561 -4.0436 15.4829 8.2718 -8.0024 3.6201 -0.9001 -1.3666 2.5828 -1.1471 -6.2750 11.4586 -2.0455 -1.5130 12.5970 3.8197 4.3798 -2.2221