Answered step by step

Verified Expert Solution

Question

1 Approved Answer

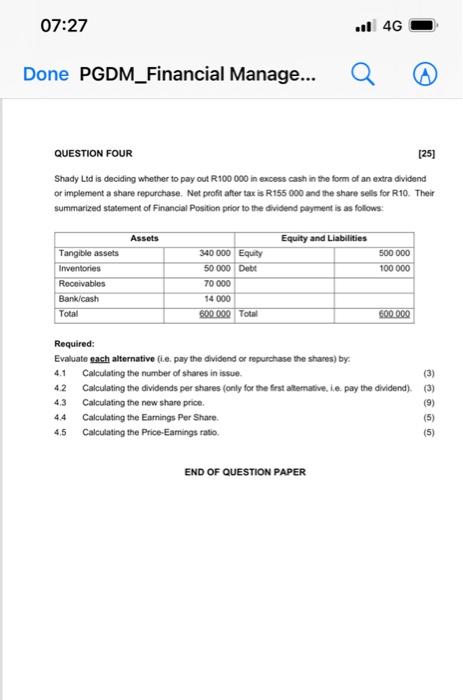

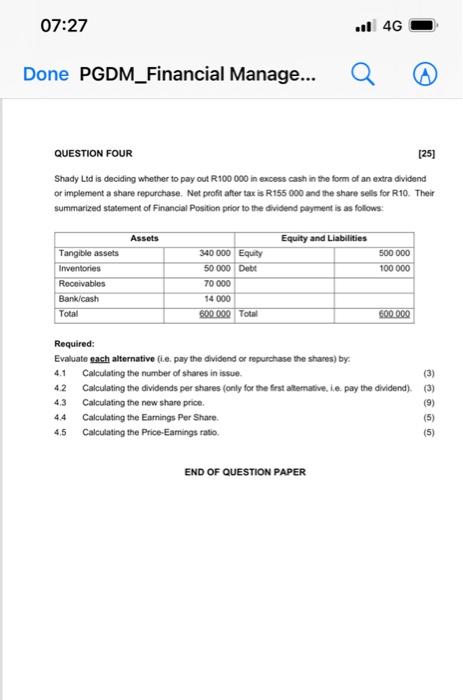

Question 4 07:27 ..1 4G Done PGDM_Financial Manage... QUESTION FOUR [25] Shady Ltd is deciding whether to pay out R100 000 in excess cash in

Question 4

07:27 ..1 4G Done PGDM_Financial Manage... QUESTION FOUR [25] Shady Ltd is deciding whether to pay out R100 000 in excess cash in the form of an extra dividend or implement a share repurchase. Net profit after tax is R155 000 and the share sells for R10. Their summarized statement of Financial Position prior to the dividend payment is as follows: Assets Equity and Liabilities 500 000 100 000 Tangible assets Inventories Receivables Bank/cash Total 340 000 Equity 50 000 Debt 70 000 14 000 600.000 Total 600.000 Required: Evaluate each alternative (i.e. pay the dividend or repurchase the shares) by Calculating the number of shares in issue Calculating the dividends per shares (only for the first alterative. Le pay the dividend) (3) Calculating the new share price. Calculating the Earnings Per Share. (5) Calculating the Price-Earnings ratio (5) 42 4.3 4.4 4.5 (9) END OF QUESTION PAPER

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started