Question

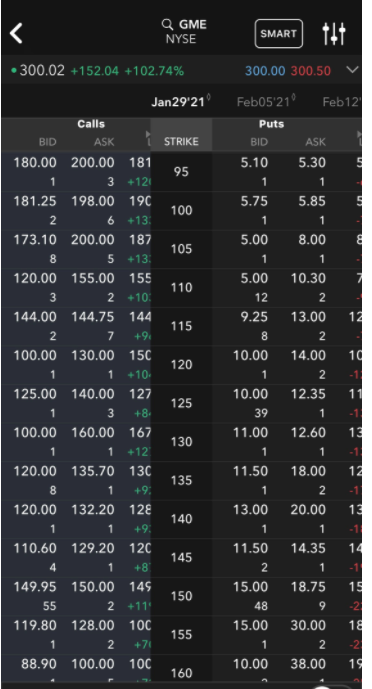

Question 4 (1 point) Question 4 (1 point): The attached image shows the GME option prices on Wednesday, Jan 27, 2021 at 9:48AM, a heated

Question 4 (1 point)

Question 4 (1 point): The attached image shows the GME option prices on Wednesday, Jan 27, 2021 at 9:48AM, a heated and chaotic moment during the epic short squeeze. The expiration date is 01/29/2021 which is two days away. $300.02 on the upper left corner was the stock price of GME. The bid and ask prices of the GME stock are 300 and 300.50, respectively, showing in the upper right corner. The bid and ask prices for calls and puts with different strike prices are listed.

Pick one strike price. Could you identify a violation of option price boundaries or the put-call parity we learned in Lecture 3? Also, please come up with an arbitrage strategy to profit from this violation.

Question 5 (1 point)

Question 5 (1 point): Why don't experienced traders take advantage of this arbitrage opportunity and trade away the mispricing? Please give some possible reasons at that time.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started