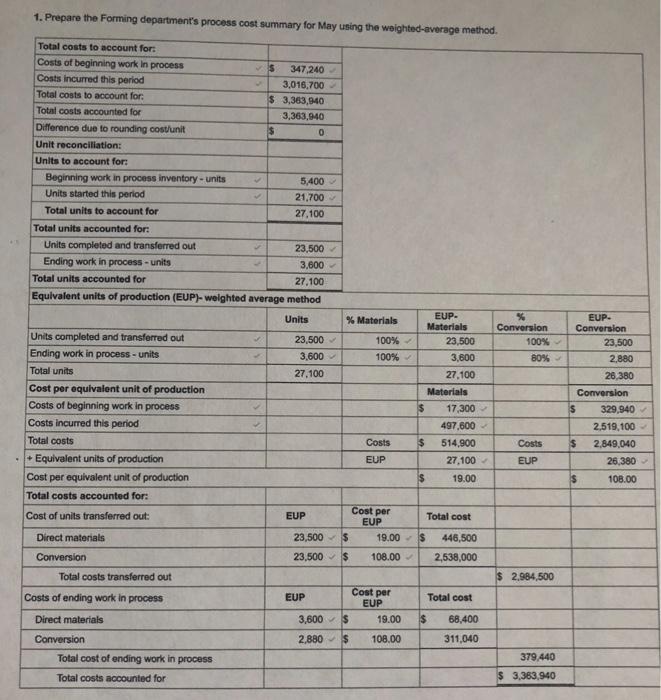

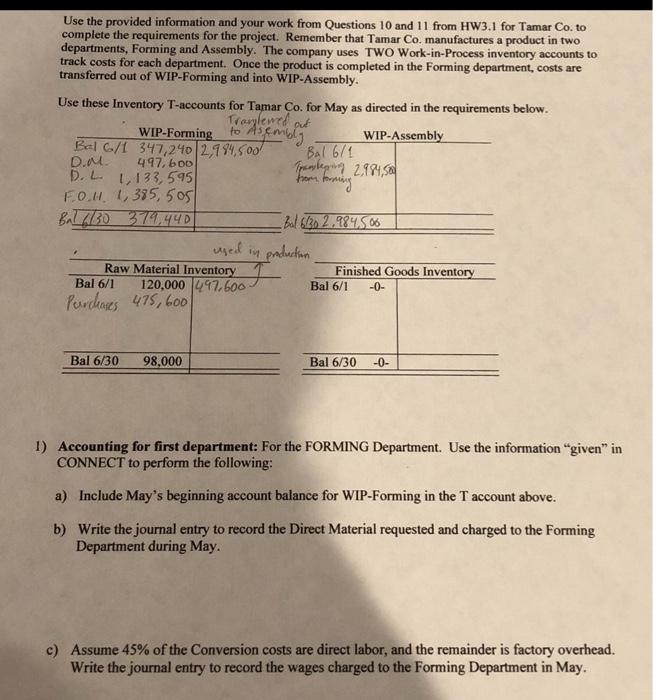

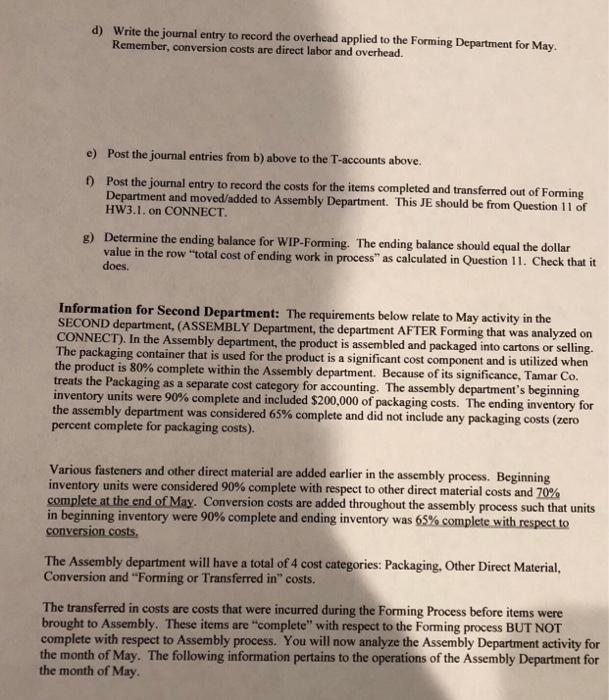

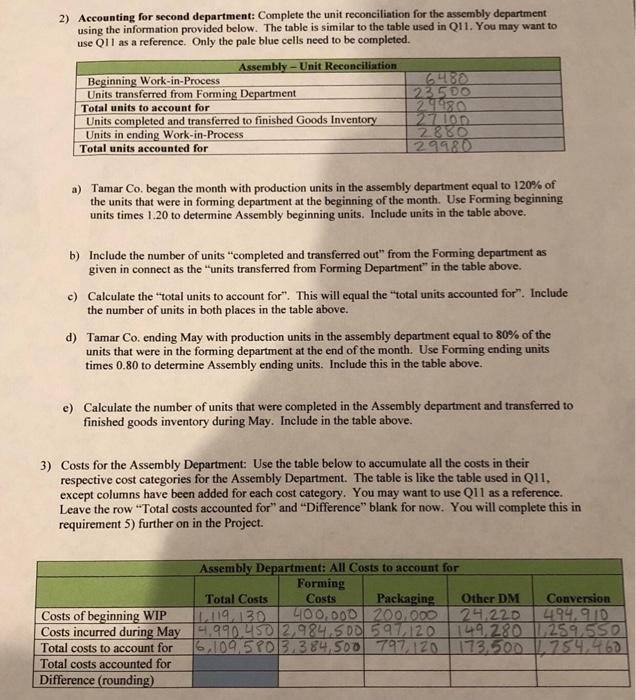

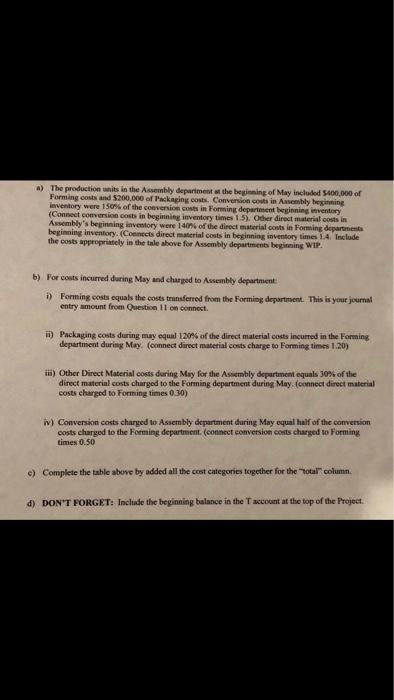

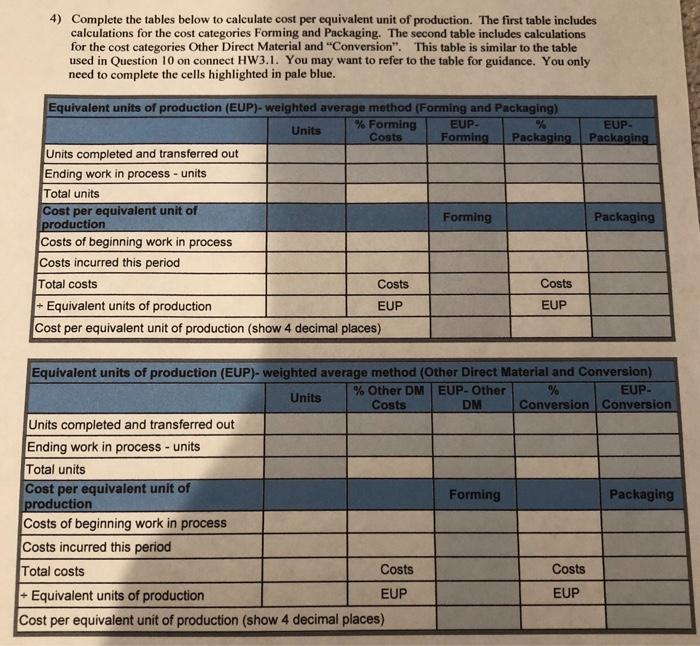

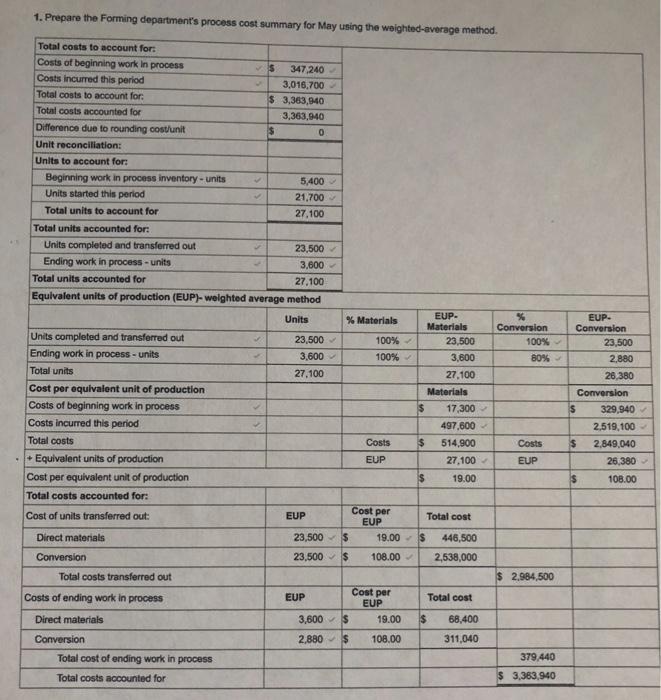

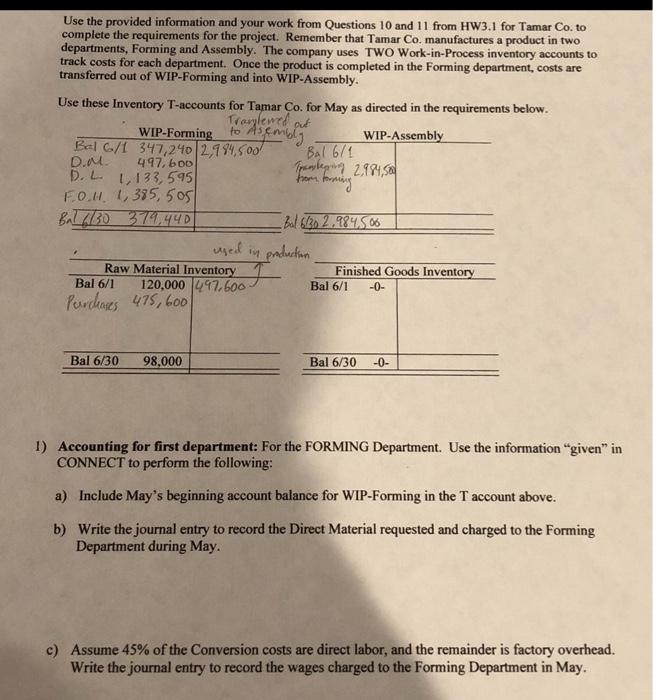

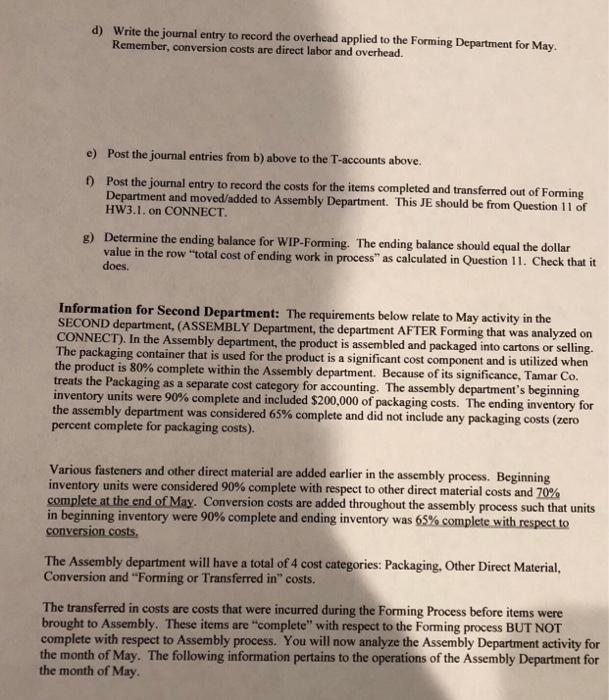

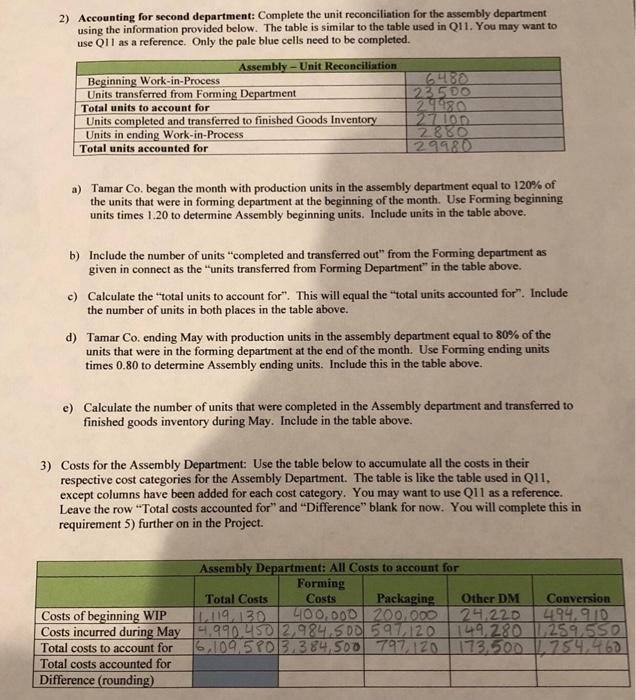

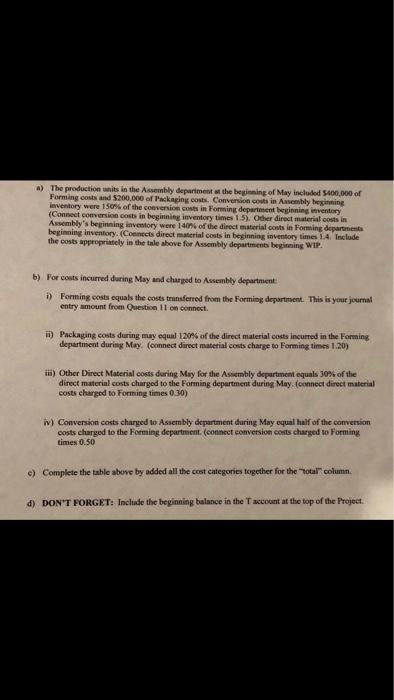

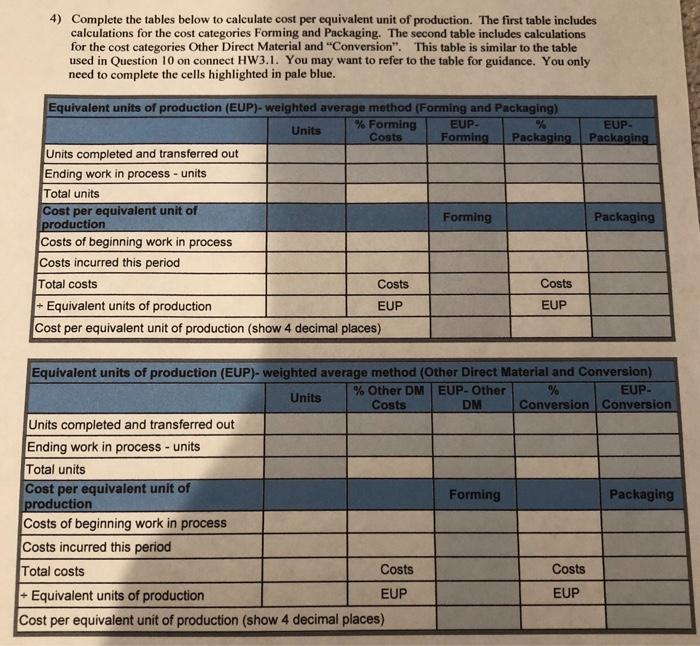

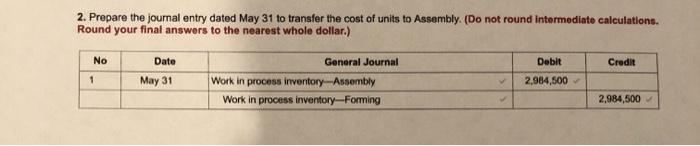

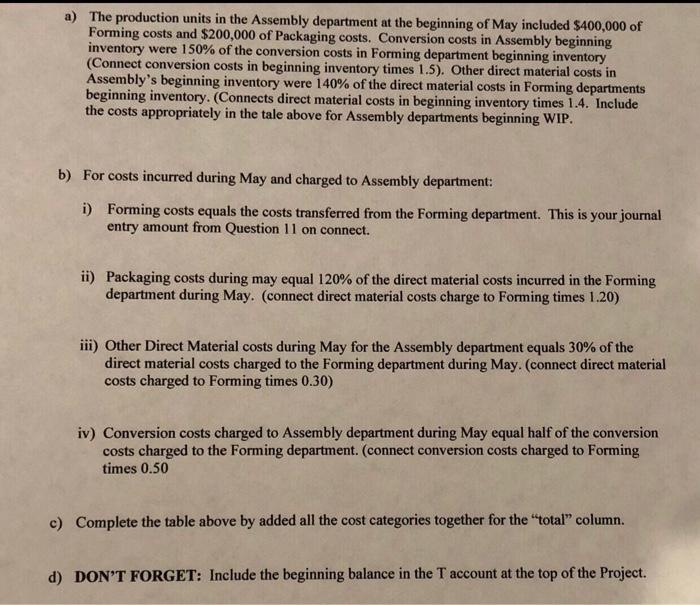

1. Prepare the Forming department's process cost summary for May using the weighted average method. Total costs to account for: Costs of beginning work in process $ 347,240 Costs incurred this period 3,016,700 Total costs to account for: $ 3,363,940 Total costs accounted for 3,363,940 Difference due to rounding cost/unit $ 0 Unit reconciliation: Units to account for: Beginning work in process inventory - units 5,400 Units started this period 21,700 Total units to account for 27.100 Total units accounted for: Units completed and transferred out 23,500 Ending work in process- units 3,600 Total units accounted for 27.100 Equivalent units of production (EUP)- weighted average method Units % Materials 23,500 3.600 27.100 100% 100% % Conversion 100% 80% EUP- Materials 23,500 3,600 27.100 Materials $ 17.300 497,600 $ 514.900 27,100 $ 19.00 EUP- Conversion 23,500 2,880 26,380 Conversion $ 329,940 2,519,100 $ 2,849,040 26,380 $ 108.00 Costs Costs EUP EUP Units completed and transferred out Ending work in process - units Total units Cost per equivalent unit of production Costs of beginning work in process Costs incurred this period Total costs + Equivalent units of production Cost per equivalent unit of production Total costs accounted for: Cost of units transferred out: Direct materials Conversion Total costs transferred out Costs of ending work in process Direct materials Conversion Total cost of ending work in process Cost per EUP Total cost EUP 23,500 $ 19.00 $ 446,500 23,500 $ 108.00 2,538,000 $ 2,984,500 Total cost Cost per EUP EUP 3,600 $ 19.00 2,880$ 108.00 $ 68,400 311,040 379 440 Total costs accounted for $ 3,363,940 to A3 Asembly Use the provided information and your work from Questions 10 and 11 from HW3.1 for Tamar Co.to complete the requirements for the project. Remember that Tamar Co. manufactures a product in two departments, Forming and Assembly. The company uses TWO Work-in-process inventory accounts to track costs for each department. Once the product is completed in the Forming department, costs are transferred out of WIP-Forming and into WIP-Assembly. Use these Inventory T-accounts for Tamar Co. for May as directed in the requirements below. Trorlewed out WIP-Forming WIP-Assembly Bal 6/1 347,240 2,994,500 Bal 6/1 D.M 497,600 Trambegin 2.981.59 D.L. 1, 133,595| FO.H. 385,505 Bal 2/30 379,440 - Bal 6130 2,984506 used in production Raw Material Inventory. I Finished Goods Inventory Bal 6/1 Bal 6/1 -0- Purchases 475, 600 Bal 6/30 98,000 Bal 6/30 -0- 1) Accounting for first department: For the FORMING Department. Use the information given" in CONNECT to perform the following: a) Include May's beginning account balance for WIP-Forming in the T account above. b) Write the journal entry to record the Direct Material requested and charged to the Forming Department during May. c) Assume 45% of the Conversion costs are direct labor, and the remainder is factory overhead. Write the journal entry to record the wages charged to the Forming Department in May. d) Write the journal entry to record the overhead applied to the Forming Department for May. Remember, conversion costs are direct labor and overhead. e) Post the journal entries from b) above to the T-accounts above. ) Post the journal entry to record the costs for the items completed and transferred out of Forming Department and moved/added to Assembly Department. This JE should be from Question 11 of HW3.1. on CONNECT. g) Determine the ending balance for WIP-Forming. The ending balance should equal the dollar value in the row"total cost of ending work in process as calculated in Question 11. Check that it does. Information for Second Department: The requirements below relate to May activity in the SECOND department, (ASSEMBLY Department, the department AFTER Forming that was analyzed on CONNECT). In the Assembly department, the product is assembled and packaged into cartons or selling. The packaging container that is used for the product is a significant cost component and is utilized when the product is 80% complete within the Assembly department. Because of its significance, Tamar Co. treats the Packaging as a separate cost category for accounting. The assembly department's beginning inventory units were 90% complete and included $200,000 of packaging costs. The ending inventory for the assembly department was considered 65% complete and did not include any packaging costs (zero percent complete for packaging costs). Various fasteners and other direct material are added earlier in the assembly process. Beginning inventory units were considered 90% complete with respect to other direct material costs and 70% complete at the end of May. Conversion costs are added throughout the assembly process such that units in beginning inventory were 90% complete and ending inventory was 65% complete with respect to conversion costs, The Assembly department will have a total of 4 cost categories: Packaging. Other Direct Material, Conversion and "Forming or Transferred in" costs. The transferred in costs are costs that were incurred during the Forming Process before items were brought to Assembly. These items are complete" with respect to the Forming process BUT NOT complete with respect to Assembly process. You will now analyze the Assembly Department activity for the month of May. The following information pertains to the operations of the Assembly Department for the month of May. 2) Accounting for second department: Complete the unit reconciliation for the assembly department using the information provided below. The table is similar to the table used in Q11. You may want to use Q11 as a reference. Only the pale blue cells need to be completed. Assembly - Unit Reconciliation Beginning Work-in-Process Units transferred from Forming Department 23.500 Total units to account for Units completed and transferred to finished Goods Inventory 210 Units in ending Work-in-Process 2880 Total units accounted for 2980 a) Tamar Co, began the month with production units in the assembly department equal to 120% of the units that were in forming department at the beginning of the month. Use Forming beginning units times 1.20 to determine Assembly beginning units. Include units in the table above. b) Include the number of units "completed and transferred out from the Forming department as given in connect as the units transferred from Forming Department" in the table above. c) Calculate the "total units to account for". This will equal the total units accounted for". Include the number of units in both places in the table above. d) Tamar Co. ending May with production units in the assembly department equal to 80% of the units that were in the forming department at the end of the month. Use Forming ending units times 0.80 to determine Assembly ending units. Include this in the table above. e) Calculate the number of units that were completed in the Assembly department and transferred to finished goods inventory during May. Include in the table above. 3) Costs for the Assembly Department: Use the table below to accumulate all the costs in their respective cost categories for the Assembly Department. The table is like the table used in Q11. except columns have been added for each cost category. You may want to use Q11 as a reference. Leave the row "Total costs accounted for" and "Difference" blank for now. You will complete this in requirement 5) further on in the Project. Assembly Department: All Costs to account for Forming Total Costs Costs Packaging Other DM Conversion Costs of beginning WIP 11, 119, 130 400, DOD 200.ODO 24.220 494.910 Costs incurred during May 9.990.4502,984.5DD 591,120 149,280 1259550 Total costs to account for 16,1095703,384,500 797,120 173.500 754,460 Total costs accounted for Difference (rounding) a) The production units in the Assembly department at the beginning of May included 400,000 of Forming costs and $200.000 of Packaging costs. Conversion costs in Assembly beginning Inventory were 150% of the conversion costs in Forming department beginning inventory (Connect conversion costs in beginning inventory times 1.5). Other direct material costs in Assembly's beginning investory were 140% of the direct material costs in Forming departments beginning inventory. (Connect direct material costs in beginning inventory times 1.4. Include the costs appropriately in the tale above for Assembly departments beginning WIP b) For costs incurred during May and charged to Assembly department i) Forming costs equals the costs transferred from the Forming department. This is your journal entry amount from Question Il on connect ) Packaging costs during may equal 120% of the direct material costs incurred in the Forming department during May (connect direct material costs charge to Forming times 1.20) ii) Other Direct Material costs during May for the Assembly department equals 30% of the direct material costs charged to the Forming department during May (connect direct material costs charged to Forming times 0.30) iv) Conversion costs charged to Assembly department during May equal half of the conversion costs charged to the Forming department (connect conversion costs charged to Forming times 0.50 e) Complete the table above by added all the cost categories together for the total column. d) DON'T FORGET: Include the beginning balance in the account at the top of the Project 4) Complete the tables below to calculate cost per equivalent unit of production. The first table includes calculations for the cost categories Forming and Packaging. The second table includes calculations for the cost categories Other Direct Material and "Conversion". This table is similar to the table used in Question 10 on connect HW3.1. You may want to refer to the table for guidance. You only need to complete the cells highlighted in pale blue. EUP- Packaging Equivalent units of production (EUP)-weighted average method (Forming and Packaging) % Forming EUP % Units Costs Forming Packaging Units completed and transferred out Ending work in process - units Total units Cost per equivalent unit of Forming production Costs of beginning work in process Costs incurred this period Total costs Costs Costs Equivalent units of production EUP EUP Cost per equivalent unit of production (show 4 decimal places) Packaging Equivalent units of production (EUP)-weighted average method (Other Direct Material and Conversion) % Other DM EUP-Other EUP- Units Costs DM Conversion Conversion Units completed and transferred out Ending work in process - units Total units Cost per equivalent unit of Forming Packaging production Costs of beginning work in process Costs incurred this period Total costs Costs Costs Equivalent units of production EUP EUP Cost per equivalent unit of production (show 4 decimal places) + 2. Prepare the journal entry dated May 31 to transfer the cost of units to Assembly. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar.) No Credit Date May 31 General Journal Work in process inventory Assembly Work in process inventory-Forming Debit 2,964,500 1 2,984,500 a) The production units in the Assembly department at the beginning of May included $400,000 of Forming costs and $200,000 of Packaging costs. Conversion costs in Assembly beginning inventory were 150% of the conversion costs in Forming department beginning inventory (Connect conversion costs in beginning inventory times 1.5). Other direct material costs in Assembly's beginning inventory were 140% of the direct material costs in Forming departments beginning inventory. (Connects direct material costs in beginning inventory times 1.4. Include the costs appropriately in the tale above for Assembly departments beginning WIP. b) For costs incurred during May and charged to Assembly department: i) Forming costs equals the costs transferred from the Forming department. This is your journal entry amount from Question 11 on connect. ii) Packaging costs during may equal 120% of the direct material costs incurred in the Forming department during May. (connect direct material costs charge to Forming times 1.20) iii) Other Direct Material costs during May for the Assembly department equals 30% of the direct material costs charged to the Forming department during May. (connect direct material costs charged to Forming times 0.30) iv) Conversion costs charged to Assembly department during May equal half of the conversion costs charged to the Forming department. (connect conversion costs charged to Forming times 0.50 c) Complete the table above by added all the cost categories together for the "total" column. d) DON'T FORGET: Include the beginning balance in the T account at the top of the Project. 1. Prepare the Forming department's process cost summary for May using the weighted average method. Total costs to account for: Costs of beginning work in process $ 347,240 Costs incurred this period 3,016,700 Total costs to account for: $ 3,363,940 Total costs accounted for 3,363,940 Difference due to rounding cost/unit $ 0 Unit reconciliation: Units to account for: Beginning work in process inventory - units 5,400 Units started this period 21,700 Total units to account for 27.100 Total units accounted for: Units completed and transferred out 23,500 Ending work in process- units 3,600 Total units accounted for 27.100 Equivalent units of production (EUP)- weighted average method Units % Materials 23,500 3.600 27.100 100% 100% % Conversion 100% 80% EUP- Materials 23,500 3,600 27.100 Materials $ 17.300 497,600 $ 514.900 27,100 $ 19.00 EUP- Conversion 23,500 2,880 26,380 Conversion $ 329,940 2,519,100 $ 2,849,040 26,380 $ 108.00 Costs Costs EUP EUP Units completed and transferred out Ending work in process - units Total units Cost per equivalent unit of production Costs of beginning work in process Costs incurred this period Total costs + Equivalent units of production Cost per equivalent unit of production Total costs accounted for: Cost of units transferred out: Direct materials Conversion Total costs transferred out Costs of ending work in process Direct materials Conversion Total cost of ending work in process Cost per EUP Total cost EUP 23,500 $ 19.00 $ 446,500 23,500 $ 108.00 2,538,000 $ 2,984,500 Total cost Cost per EUP EUP 3,600 $ 19.00 2,880$ 108.00 $ 68,400 311,040 379 440 Total costs accounted for $ 3,363,940 to A3 Asembly Use the provided information and your work from Questions 10 and 11 from HW3.1 for Tamar Co.to complete the requirements for the project. Remember that Tamar Co. manufactures a product in two departments, Forming and Assembly. The company uses TWO Work-in-process inventory accounts to track costs for each department. Once the product is completed in the Forming department, costs are transferred out of WIP-Forming and into WIP-Assembly. Use these Inventory T-accounts for Tamar Co. for May as directed in the requirements below. Trorlewed out WIP-Forming WIP-Assembly Bal 6/1 347,240 2,994,500 Bal 6/1 D.M 497,600 Trambegin 2.981.59 D.L. 1, 133,595| FO.H. 385,505 Bal 2/30 379,440 - Bal 6130 2,984506 used in production Raw Material Inventory. I Finished Goods Inventory Bal 6/1 Bal 6/1 -0- Purchases 475, 600 Bal 6/30 98,000 Bal 6/30 -0- 1) Accounting for first department: For the FORMING Department. Use the information given" in CONNECT to perform the following: a) Include May's beginning account balance for WIP-Forming in the T account above. b) Write the journal entry to record the Direct Material requested and charged to the Forming Department during May. c) Assume 45% of the Conversion costs are direct labor, and the remainder is factory overhead. Write the journal entry to record the wages charged to the Forming Department in May. d) Write the journal entry to record the overhead applied to the Forming Department for May. Remember, conversion costs are direct labor and overhead. e) Post the journal entries from b) above to the T-accounts above. ) Post the journal entry to record the costs for the items completed and transferred out of Forming Department and moved/added to Assembly Department. This JE should be from Question 11 of HW3.1. on CONNECT. g) Determine the ending balance for WIP-Forming. The ending balance should equal the dollar value in the row"total cost of ending work in process as calculated in Question 11. Check that it does. Information for Second Department: The requirements below relate to May activity in the SECOND department, (ASSEMBLY Department, the department AFTER Forming that was analyzed on CONNECT). In the Assembly department, the product is assembled and packaged into cartons or selling. The packaging container that is used for the product is a significant cost component and is utilized when the product is 80% complete within the Assembly department. Because of its significance, Tamar Co. treats the Packaging as a separate cost category for accounting. The assembly department's beginning inventory units were 90% complete and included $200,000 of packaging costs. The ending inventory for the assembly department was considered 65% complete and did not include any packaging costs (zero percent complete for packaging costs). Various fasteners and other direct material are added earlier in the assembly process. Beginning inventory units were considered 90% complete with respect to other direct material costs and 70% complete at the end of May. Conversion costs are added throughout the assembly process such that units in beginning inventory were 90% complete and ending inventory was 65% complete with respect to conversion costs, The Assembly department will have a total of 4 cost categories: Packaging. Other Direct Material, Conversion and "Forming or Transferred in" costs. The transferred in costs are costs that were incurred during the Forming Process before items were brought to Assembly. These items are complete" with respect to the Forming process BUT NOT complete with respect to Assembly process. You will now analyze the Assembly Department activity for the month of May. The following information pertains to the operations of the Assembly Department for the month of May. 2) Accounting for second department: Complete the unit reconciliation for the assembly department using the information provided below. The table is similar to the table used in Q11. You may want to use Q11 as a reference. Only the pale blue cells need to be completed. Assembly - Unit Reconciliation Beginning Work-in-Process Units transferred from Forming Department 23.500 Total units to account for Units completed and transferred to finished Goods Inventory 210 Units in ending Work-in-Process 2880 Total units accounted for 2980 a) Tamar Co, began the month with production units in the assembly department equal to 120% of the units that were in forming department at the beginning of the month. Use Forming beginning units times 1.20 to determine Assembly beginning units. Include units in the table above. b) Include the number of units "completed and transferred out from the Forming department as given in connect as the units transferred from Forming Department" in the table above. c) Calculate the "total units to account for". This will equal the total units accounted for". Include the number of units in both places in the table above. d) Tamar Co. ending May with production units in the assembly department equal to 80% of the units that were in the forming department at the end of the month. Use Forming ending units times 0.80 to determine Assembly ending units. Include this in the table above. e) Calculate the number of units that were completed in the Assembly department and transferred to finished goods inventory during May. Include in the table above. 3) Costs for the Assembly Department: Use the table below to accumulate all the costs in their respective cost categories for the Assembly Department. The table is like the table used in Q11. except columns have been added for each cost category. You may want to use Q11 as a reference. Leave the row "Total costs accounted for" and "Difference" blank for now. You will complete this in requirement 5) further on in the Project. Assembly Department: All Costs to account for Forming Total Costs Costs Packaging Other DM Conversion Costs of beginning WIP 11, 119, 130 400, DOD 200.ODO 24.220 494.910 Costs incurred during May 9.990.4502,984.5DD 591,120 149,280 1259550 Total costs to account for 16,1095703,384,500 797,120 173.500 754,460 Total costs accounted for Difference (rounding) a) The production units in the Assembly department at the beginning of May included 400,000 of Forming costs and $200.000 of Packaging costs. Conversion costs in Assembly beginning Inventory were 150% of the conversion costs in Forming department beginning inventory (Connect conversion costs in beginning inventory times 1.5). Other direct material costs in Assembly's beginning investory were 140% of the direct material costs in Forming departments beginning inventory. (Connect direct material costs in beginning inventory times 1.4. Include the costs appropriately in the tale above for Assembly departments beginning WIP b) For costs incurred during May and charged to Assembly department i) Forming costs equals the costs transferred from the Forming department. This is your journal entry amount from Question Il on connect ) Packaging costs during may equal 120% of the direct material costs incurred in the Forming department during May (connect direct material costs charge to Forming times 1.20) ii) Other Direct Material costs during May for the Assembly department equals 30% of the direct material costs charged to the Forming department during May (connect direct material costs charged to Forming times 0.30) iv) Conversion costs charged to Assembly department during May equal half of the conversion costs charged to the Forming department (connect conversion costs charged to Forming times 0.50 e) Complete the table above by added all the cost categories together for the total column. d) DON'T FORGET: Include the beginning balance in the account at the top of the Project 4) Complete the tables below to calculate cost per equivalent unit of production. The first table includes calculations for the cost categories Forming and Packaging. The second table includes calculations for the cost categories Other Direct Material and "Conversion". This table is similar to the table used in Question 10 on connect HW3.1. You may want to refer to the table for guidance. You only need to complete the cells highlighted in pale blue. EUP- Packaging Equivalent units of production (EUP)-weighted average method (Forming and Packaging) % Forming EUP % Units Costs Forming Packaging Units completed and transferred out Ending work in process - units Total units Cost per equivalent unit of Forming production Costs of beginning work in process Costs incurred this period Total costs Costs Costs Equivalent units of production EUP EUP Cost per equivalent unit of production (show 4 decimal places) Packaging Equivalent units of production (EUP)-weighted average method (Other Direct Material and Conversion) % Other DM EUP-Other EUP- Units Costs DM Conversion Conversion Units completed and transferred out Ending work in process - units Total units Cost per equivalent unit of Forming Packaging production Costs of beginning work in process Costs incurred this period Total costs Costs Costs Equivalent units of production EUP EUP Cost per equivalent unit of production (show 4 decimal places) + 2. Prepare the journal entry dated May 31 to transfer the cost of units to Assembly. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar.) No Credit Date May 31 General Journal Work in process inventory Assembly Work in process inventory-Forming Debit 2,964,500 1 2,984,500 a) The production units in the Assembly department at the beginning of May included $400,000 of Forming costs and $200,000 of Packaging costs. Conversion costs in Assembly beginning inventory were 150% of the conversion costs in Forming department beginning inventory (Connect conversion costs in beginning inventory times 1.5). Other direct material costs in Assembly's beginning inventory were 140% of the direct material costs in Forming departments beginning inventory. (Connects direct material costs in beginning inventory times 1.4. Include the costs appropriately in the tale above for Assembly departments beginning WIP. b) For costs incurred during May and charged to Assembly department: i) Forming costs equals the costs transferred from the Forming department. This is your journal entry amount from Question 11 on connect. ii) Packaging costs during may equal 120% of the direct material costs incurred in the Forming department during May. (connect direct material costs charge to Forming times 1.20) iii) Other Direct Material costs during May for the Assembly department equals 30% of the direct material costs charged to the Forming department during May. (connect direct material costs charged to Forming times 0.30) iv) Conversion costs charged to Assembly department during May equal half of the conversion costs charged to the Forming department. (connect conversion costs charged to Forming times 0.50 c) Complete the table above by added all the cost categories together for the "total" column. d) DON'T FORGET: Include the beginning balance in the T account at the top of the Project