Answered step by step

Verified Expert Solution

Question

1 Approved Answer

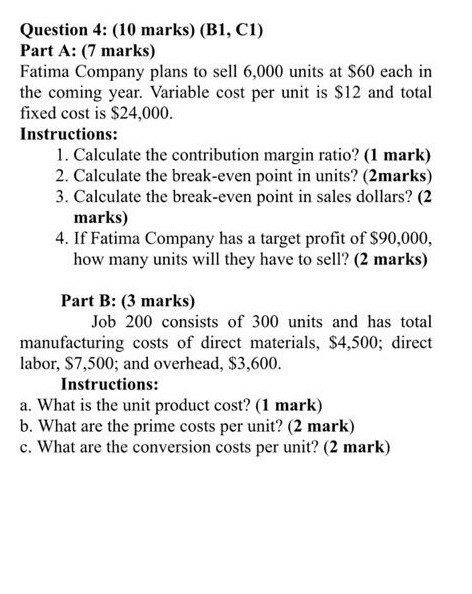

Question 4: (10 marks) (B1, C1) Part A: (7 marks) Fatima Company plans to sell 6,000 units at $60 each in the coming year. Variable

Question 4: (10 marks) (B1, C1) Part A: (7 marks) Fatima Company plans to sell 6,000 units at $60 each in the coming year. Variable cost per unit is $12 and total fixed cost is $24,000. Instructions: 1. Calculate the contribution margin ratio? (1 mark) 2. Calculate the break-even point in units? (2marks) 3. Calculate the break-even point in sales dollars? (2 marks) 4. If Fatima Company has a target profit of $90,000, how many units will they have to sell? (2 marks) Part B: (3 marks) Job 200 consists of 300 units and has total manufacturing costs of direct materials, $4,500; direct labor, $7,500; and overhead, $3,600. Instructions: a. What is the unit product cost? (1 mark) b. What are the prime costs per unit? (2 mark) c. What are the conversion costs per unit? (2 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started