Question

Pattie started her business on 1 November 2021 as a trader in chairs. Her transactions during her first month were as follows (in date

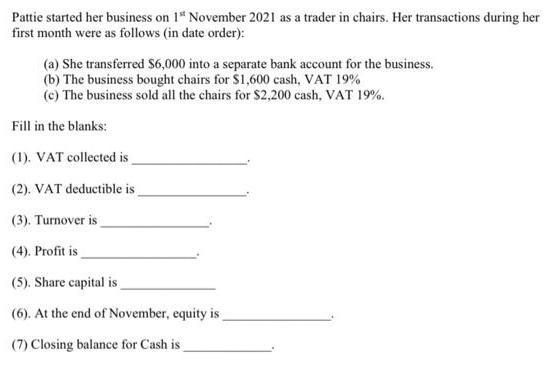

Pattie started her business on 1 November 2021 as a trader in chairs. Her transactions during her first month were as follows (in date order): (a) She transferred $6,000 into a separate bank account for the business. (b) The business bought chairs for $1,600 cash, VAT 19% (c) The business sold all the chairs for $2,200 cash, VAT 19%. Fill in the blanks: (1). VAT collected is (2). VAT deductible is (3). Turnover is (4). Profit is (5). Share capital is (6). At the end of November, equity is (7) Closing balance for Cash is

Step by Step Solution

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Robert Libby, Patricia Libby, Daniel Short, George Kanaan, M

5th Canadian edition

9781259105692, 978-1259103285

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App