Answered step by step

Verified Expert Solution

Question

1 Approved Answer

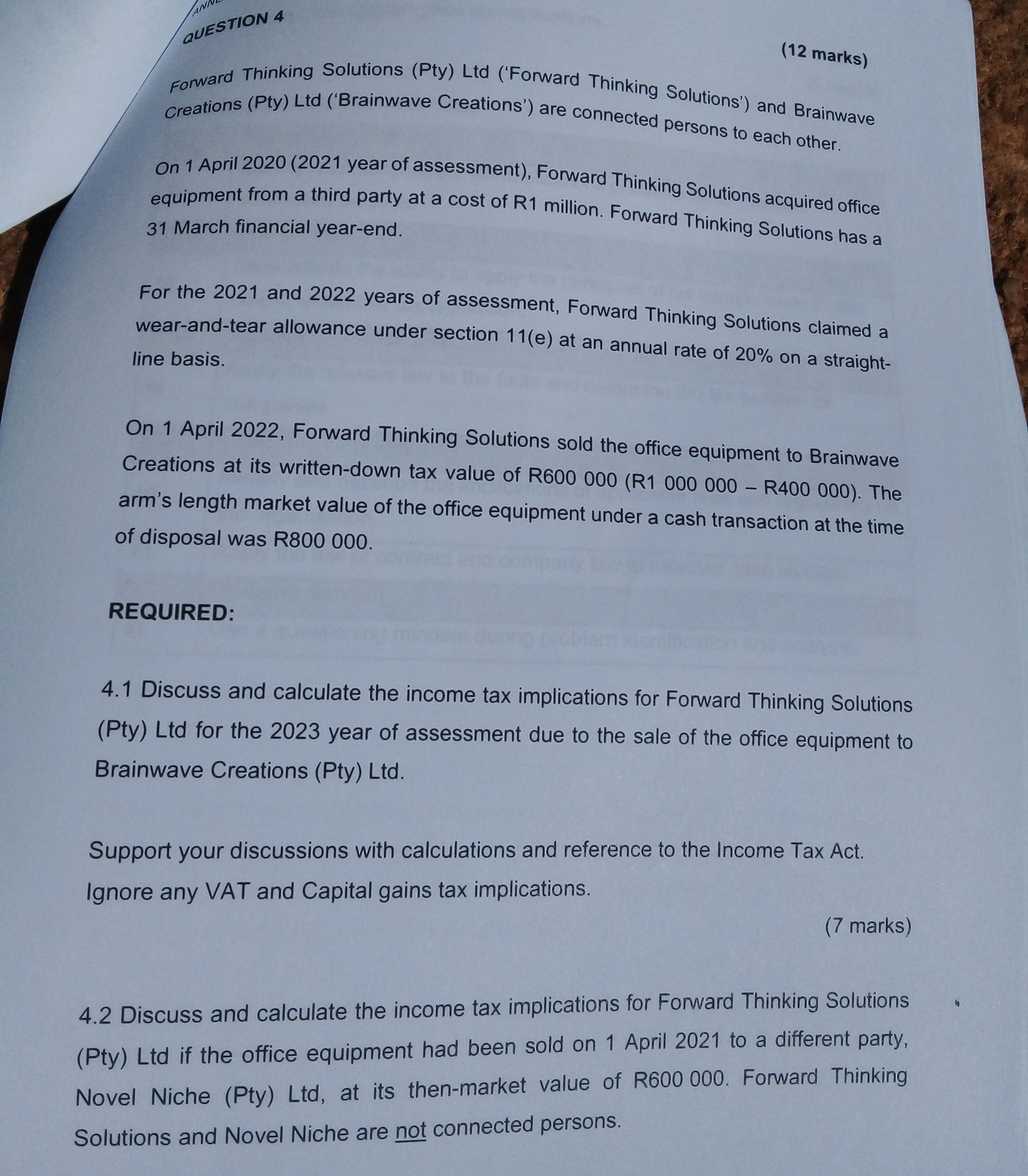

QUESTION 4 (12 marks) Forward Thinking Solutions (Pty) Ltd ('Forward Thinking Solutions') and Brainwave Creations (Pty) Ltd ('Brainwave Creations') are connected persons to each other.

QUESTION 4 (12 marks) Forward Thinking Solutions (Pty) Ltd ('Forward Thinking Solutions') and Brainwave Creations (Pty) Ltd ('Brainwave Creations') are connected persons to each other. On 1 April 2020 (2021 year of assessment), Forward Thinking Solutions acquired office equipment from a third party at a cost of R1 million. Forward Thinking Solutions has a 31 March financial year-end. For the 2021 and 2022 years of assessment, Forward Thinking Solutions claimed a wear-and-tear allowance under section 11(e) at an annual rate of 20% on a straightline basis. On 1 April 2022, Forward Thinking Solutions sold the office equipment to Brainwave Creations at its written-down tax value of R600 000 (R1 000000R400000 ). The arm's length market value of the office equipment under a cash transaction at the time of disposal was R800 000. REQUIRED: 4.1 Discuss and calculate the income tax implications for Forward Thinking Solutions (Pty) Ltd for the 2023 year of assessment due to the sale of the office equipment to Brainwave Creations (Pty) Ltd. Support your discussions with calculations and reference to the Income Tax Act. Ignore any VAT and Capital gains tax implications. (7 marks) 4.2 Discuss and calculate the income tax implications for Forward Thinking Solutions (Pty) Ltd if the office equipment had been sold on 1 April 2021 to a different party, Novel Niche (Pty) Ltd, at its then-market value of R600000. Forward Thinking Solutions and Novel Niche are not connected persons. Ignore any VAT and Capital gains tax implications

QUESTION 4 (12 marks) Forward Thinking Solutions (Pty) Ltd ('Forward Thinking Solutions') and Brainwave Creations (Pty) Ltd ('Brainwave Creations') are connected persons to each other. On 1 April 2020 (2021 year of assessment), Forward Thinking Solutions acquired office equipment from a third party at a cost of R1 million. Forward Thinking Solutions has a 31 March financial year-end. For the 2021 and 2022 years of assessment, Forward Thinking Solutions claimed a wear-and-tear allowance under section 11(e) at an annual rate of 20% on a straightline basis. On 1 April 2022, Forward Thinking Solutions sold the office equipment to Brainwave Creations at its written-down tax value of R600 000 (R1 000000R400000 ). The arm's length market value of the office equipment under a cash transaction at the time of disposal was R800 000. REQUIRED: 4.1 Discuss and calculate the income tax implications for Forward Thinking Solutions (Pty) Ltd for the 2023 year of assessment due to the sale of the office equipment to Brainwave Creations (Pty) Ltd. Support your discussions with calculations and reference to the Income Tax Act. Ignore any VAT and Capital gains tax implications. (7 marks) 4.2 Discuss and calculate the income tax implications for Forward Thinking Solutions (Pty) Ltd if the office equipment had been sold on 1 April 2021 to a different party, Novel Niche (Pty) Ltd, at its then-market value of R600000. Forward Thinking Solutions and Novel Niche are not connected persons. Ignore any VAT and Capital gains tax implications Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started