Answered step by step

Verified Expert Solution

Question

1 Approved Answer

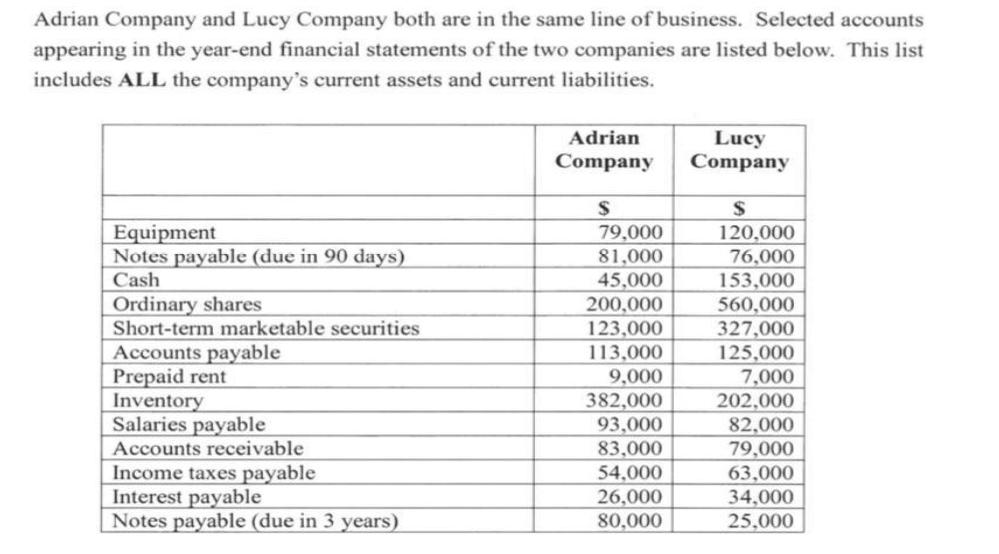

Adrian Company and Lucy Company both are in the same line of business. Selected accounts appearing in the year-end financial statements of the two

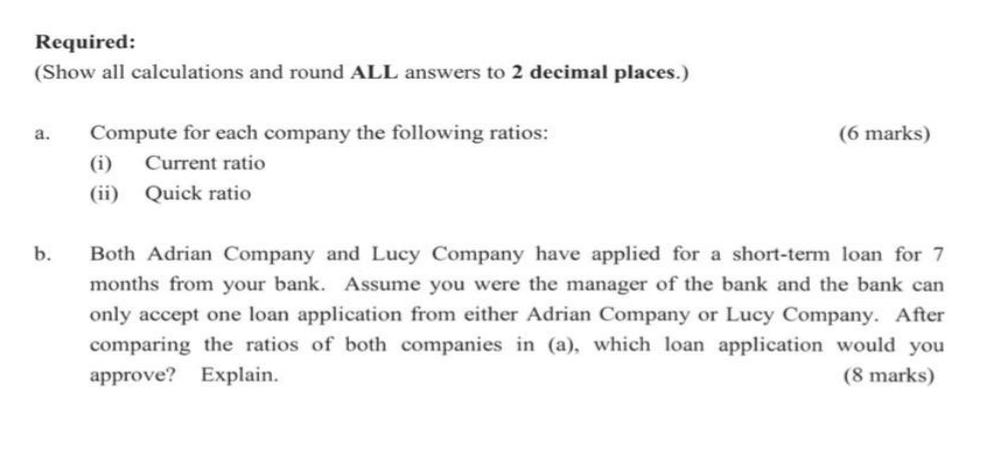

Adrian Company and Lucy Company both are in the same line of business. Selected accounts appearing in the year-end financial statements of the two companies are listed below. This list includes ALL the company's current assets and current liabilities. Lucy Company Adrian Company Equipment Notes payable (due in 90 days) Cash Ordinary shares Short-term marketable securities Accounts payable Prepaid rent Inventory Salaries payable 79,000 120,000 81,000 45,000 200,000 76,000 153,000 560,000 327,000 125,000 7,000 123,000 113,000 9,000 382,000 93,000 83,000 202,000 82,000 Accounts receivable Income taxes payable Interest payable Notes payable (due in 3 years) 54,000 26,000 80,000 79,000 63,000 34,000 25,000 Required: (Show all calculations and round ALL answers to 2 decimal places.) a. Compute for each company the following ratios: (6 marks) (i) Current ratio (ii) Quick ratio b. Both Adrian Company and Lucy Company have applied for a short-term loan for 7 months from your bank. Assume you were the manager of the bank and the bank can only accept one loan application from either Adrian Company or Lucy Company. After comparing the ratios of both companies in (a), which loan application would you approve? Explain. (8 marks)

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Current Ratio Current ratio shows the ability of the firm to pay its current liabilities It shows it...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started