Answered step by step

Verified Expert Solution

Question

1 Approved Answer

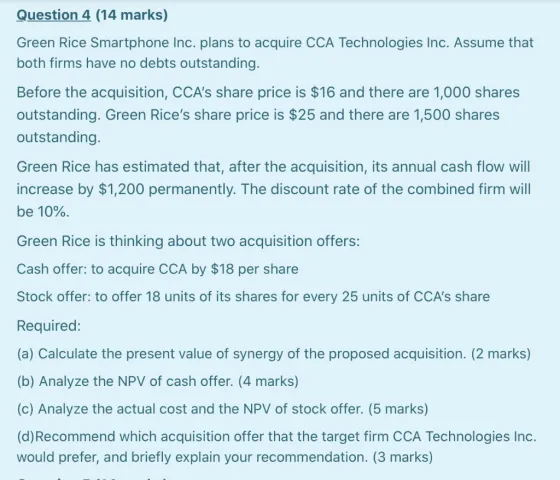

Question 4 (14 marks) Green Rice Smartphone Inc. plans to acquire CCA Technologies Inc. Assume that both firms have no debts outstanding. Before the

Question 4 (14 marks) Green Rice Smartphone Inc. plans to acquire CCA Technologies Inc. Assume that both firms have no debts outstanding. Before the acquisition, CCA's share price is $16 and there are 1,000 shares outstanding. Green Rice's share price is $25 and there are 1,500 shares outstanding. Green Rice has estimated that, after the acquisition, its annual cash flow will increase by $1,200 permanently. The discount rate of the combined firm will be 10%. Green Rice is thinking about two acquisition offers: Cash offer: to acquire CCA by $18 per share Stock offer: to offer 18 units of its shares for every 25 units of CCA's share Required: (a) Calculate the present value of synergy of the proposed acquisition. (2 marks) (b) Analyze the NPV of cash offer. (4 marks) (c) Analyze the actual cost and the NPV of stock offer. (5 marks) (d) Recommend which acquisition offer that the target firm CCA Technologies Inc. would prefer, and briefly explain your recommendation. (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Acquisition Analysis for CCA Technologies Inc Assumptions No outstanding debts for both firms CCA sh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started