Question

Question 4 (15 marks) Pacific Limited is a retailer of commercial gadgets. At the end of each year, the divisional managers are evaluated for the

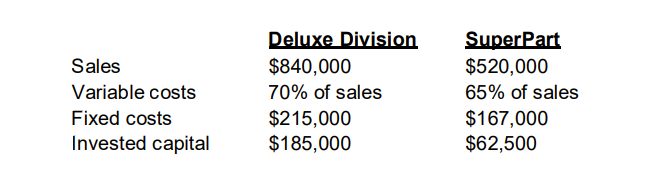

Question 4 (15 marks) Pacific Limited is a retailer of commercial gadgets. At the end of each year, the divisional managers are evaluated for the performances of their divisions and bonuses are awarded according to their achievement based on the ROI. Last year, thecompany as a whole produced an ROI of 14 per cent. During the past week, the management of the companys Deluxe Division was contacted about the possibility of buying the operations of a competitor, SuperPart, which wished to cease its retail operations. The following data relate to recent performance of both the Deluxe Division and SuperPart.

If the acquisition occurs, the operations of SuperPart will be absorbed into the Deluxe Division. The operations of Superpart will need to be upgraded to meet the high standards of Pacific Limited which would require an additional $37,500 of invested capital.

Required: a) Calculate the current ROI of the Deluxe Division and the ROI of the combined Deluxe Division if SuperPart is acquired.

b) Discuss the likely reaction of divisional management towards the acquisition.

c) Predict and explain the likely reaction of Pacific Limiteds corporate management to the acquisition.

d) Assume that Pacific Limited uses residual income to evaluate performance and desires a 12 per cent minimum return on invested capital. Calculate the current residual income of the Deluxe Division and the combined Divisions residual income if Superpart is acquired. Evaluate the divisional management reaction towards the acquisition.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started