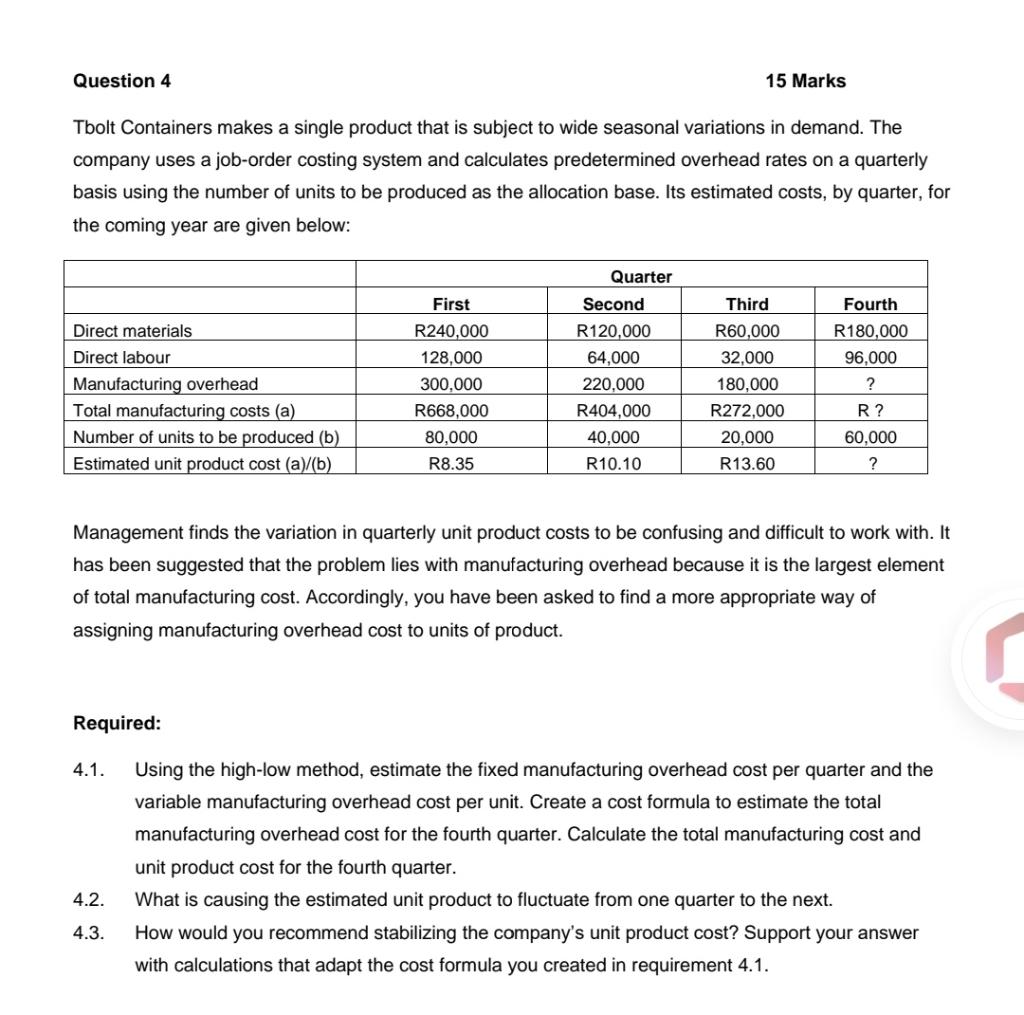

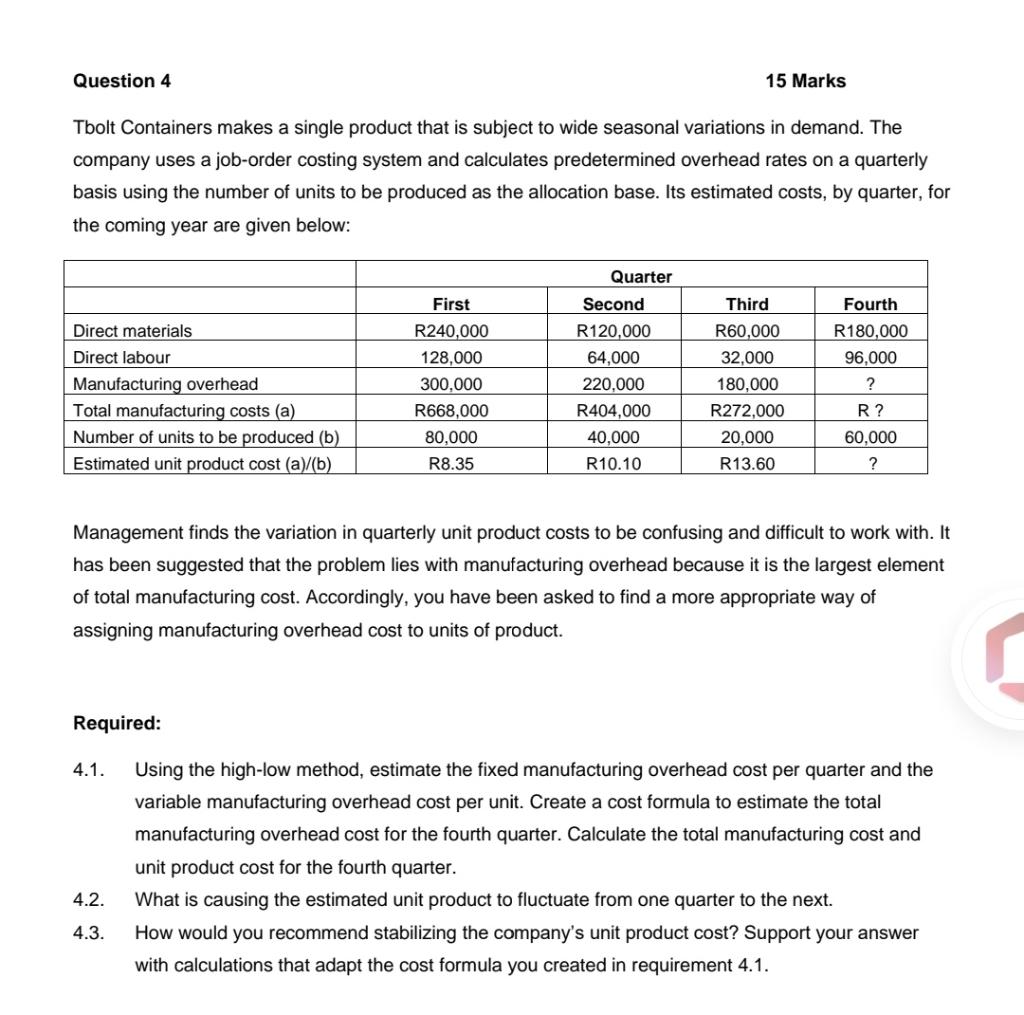

Question 4 15 Marks Tbolt Containers makes a single product that is subject to wide seasonal variations in demand. The company uses a job-order costing system and calculates predetermined overhead rates on a quarterly basis using the number of units to be produced as the allocation base. Its estimated costs, by quarter, for the coming year are given below: Quarter Direct materials First R240,000 128,000 300,000 R668,000 80,000 R8.35 Direct labour Manufacturing overhead Total manufacturing costs (a) Number of units to be produced (b) Estimated unit product cost (a)/(b) Second R120,000 64,000 220,000 R404,000 40,000 R10.10 Third R60,000 32,000 180,000 R272,000 20,000 R13.60 Fourth R180,000 96,000 ? R? 60,000 ? Management finds the variation in quarterly unit product costs to be confusing and difficult to work with. It has been suggested that the problem lies with manufacturing overhead because it is the largest element of total manufacturing cost. Accordingly, you have been asked to find a more appropriate way of assigning manufacturing overhead cost to units of product. Required: 4.1. Using the high-low method, estimate the fixed manufacturing overhead cost per quarter and the variable manufacturing overhead cost per unit. Create a cost formula to estimate the total manufacturing overhead cost for the fourth quarter. Calculate the total manufacturing cost and unit product cost for the fourth quarter. What is causing the estimated unit product to fluctuate from one quarter to the next. How would you recommend stabilizing the company's unit product cost? Support your answer with calculations that adapt the cost formula you created in requirement 4.1. 4.2. 4.3. Question 4 15 Marks Tbolt Containers makes a single product that is subject to wide seasonal variations in demand. The company uses a job-order costing system and calculates predetermined overhead rates on a quarterly basis using the number of units to be produced as the allocation base. Its estimated costs, by quarter, for the coming year are given below: Quarter Direct materials First R240,000 128,000 300,000 R668,000 80,000 R8.35 Direct labour Manufacturing overhead Total manufacturing costs (a) Number of units to be produced (b) Estimated unit product cost (a)/(b) Second R120,000 64,000 220,000 R404,000 40,000 R10.10 Third R60,000 32,000 180,000 R272,000 20,000 R13.60 Fourth R180,000 96,000 ? R? 60,000 ? Management finds the variation in quarterly unit product costs to be confusing and difficult to work with. It has been suggested that the problem lies with manufacturing overhead because it is the largest element of total manufacturing cost. Accordingly, you have been asked to find a more appropriate way of assigning manufacturing overhead cost to units of product. Required: 4.1. Using the high-low method, estimate the fixed manufacturing overhead cost per quarter and the variable manufacturing overhead cost per unit. Create a cost formula to estimate the total manufacturing overhead cost for the fourth quarter. Calculate the total manufacturing cost and unit product cost for the fourth quarter. What is causing the estimated unit product to fluctuate from one quarter to the next. How would you recommend stabilizing the company's unit product cost? Support your answer with calculations that adapt the cost formula you created in requirement 4.1. 4.2. 4.3