Answered step by step

Verified Expert Solution

Question

1 Approved Answer

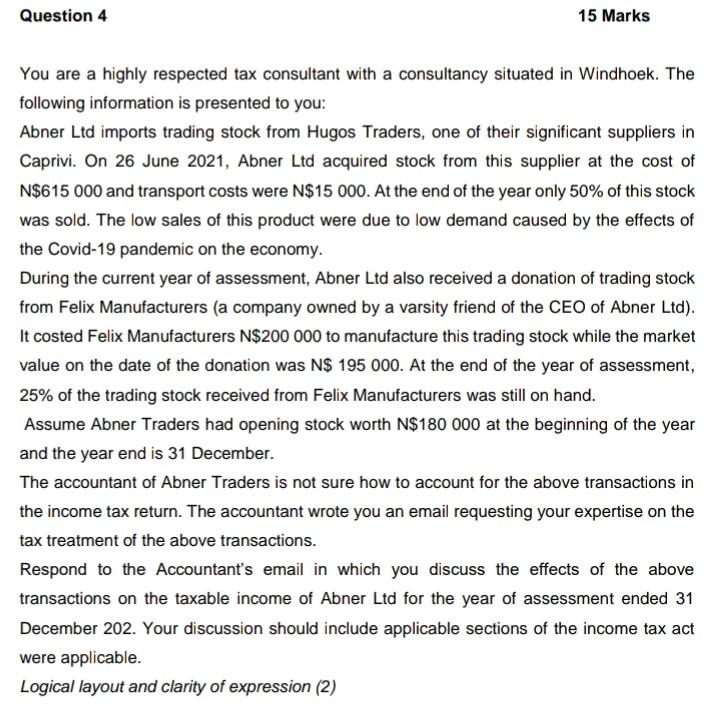

Question 4 15 Marks You are a highly respected tax consultant with a consultancy situated in Windhoek. The following information is presented to you:

Question 4 15 Marks You are a highly respected tax consultant with a consultancy situated in Windhoek. The following information is presented to you: Abner Ltd imports trading stock from Hugos Traders, one of their significant suppliers in Caprivi. On 26 June 2021, Abner Ltd acquired stock from this supplier at the cost of N$615 000 and transport costs were N$15 000. At the end of the year only 50% of this stock was sold. The low sales of this product were due to low demand caused by the effects of the Covid-19 pandemic on the economy. During the current year of assessment, Abner Ltd also received a donation of trading stock from Felix Manufacturers (a company owned by a varsity friend of the CEO of Abner Ltd). It costed Felix Manufacturers N$200 000 to manufacture this trading stock while the market value on the date of the donation was N$ 195 000. At the end of the year of assessment, 25% of the trading stock received from Felix Manufacturers was still on hand. Assume Abner Traders had opening stock worth $180 000 at the beginning of the year and the year end is 31 December. The accountant of Abner Traders is not sure how to account for the above transactions in the income tax return. The accountant wrote you an email requesting your expertise on the tax treatment of the above transactions. Respond to the Accountant's email in which you discuss the effects of the above transactions on the taxable income of Abner Ltd for the year of assessment ended 31 December 202. Your discussion should include applicable sections of the income tax act were applicable. Logical layout and clarity of expression (2)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started