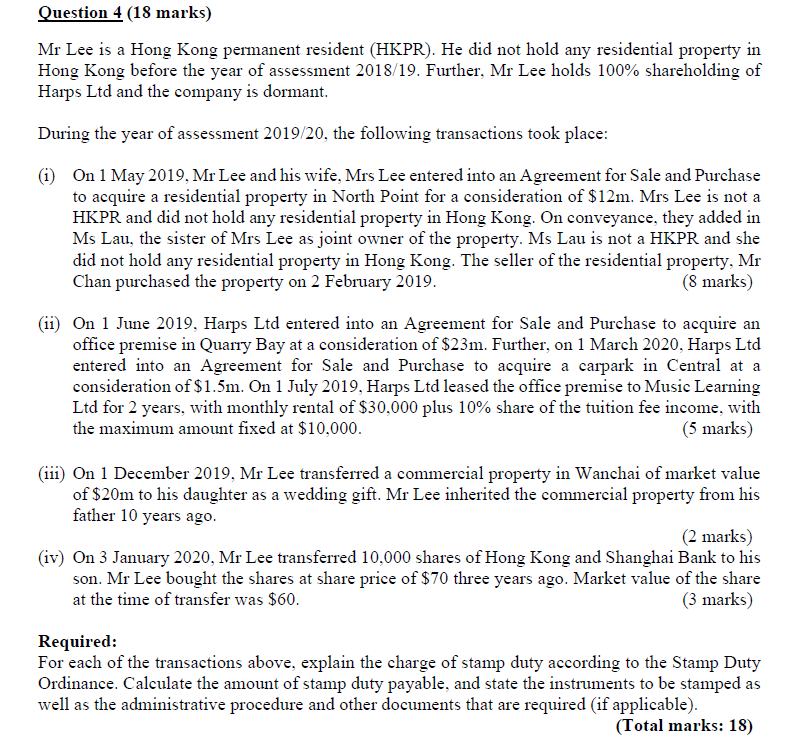

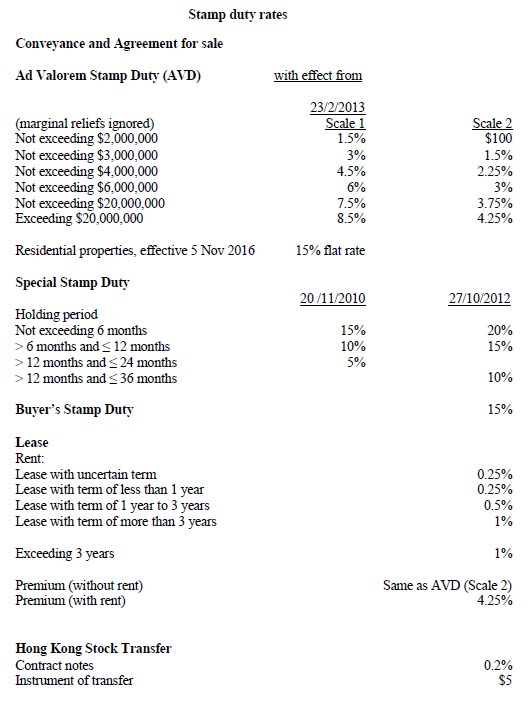

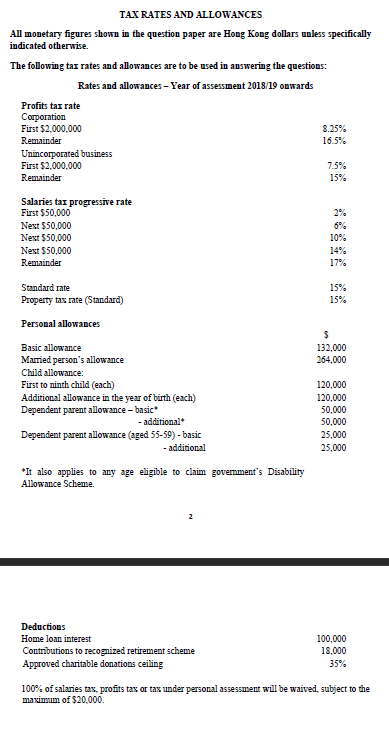

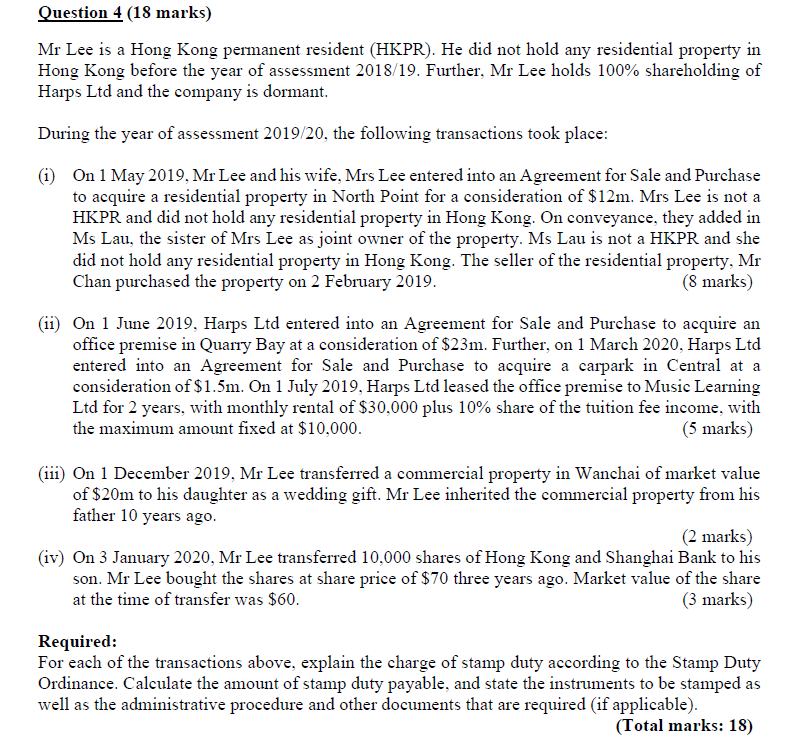

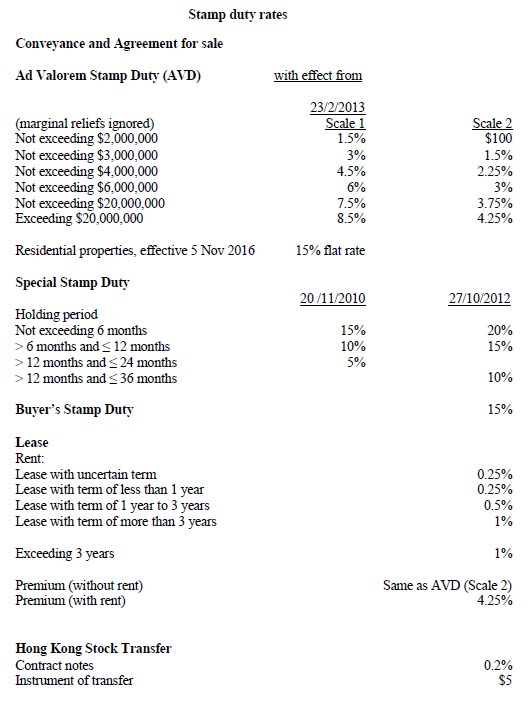

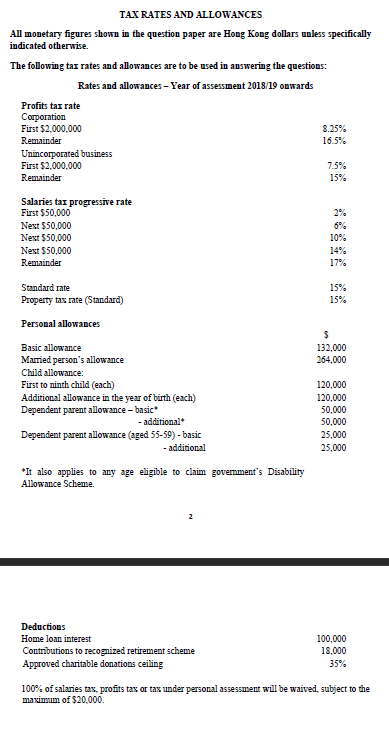

Question 4 (18 marks) Mr Lee is a Hong Kong permanent resident (HKPR). He did not hold any residential property in Hong Kong before the year of assessment 2018/19. Further, Mr Lee holds 100% shareholding of Harps Ltd and the company is dormant. During the year of assessment 2019/20, the following transactions took place: (1) On 1 May 2019, Mr Lee and his wife, Mrs Lee entered into an Agreement for Sale and Purchase to acquire a residential property in North Point for a consideration of $12m. Mrs Lee is not a HKPR and did not hold any residential property in Hong Kong. On conveyance, they added in Ms Lau, the sister of Mrs Lee as joint owner of the property. Ms Lau is not a HKPR and she did not hold any residential property in Hong Kong. The seller of the residential property, Mr Chan purchased the property on 2 February 2019. (8 marks) (ii) On 1 June 2019, Harps Ltd entered into an Agreement for Sale and Purchase to acquire an office premise in Quary Bay at a consideration of $23m. Further, on 1 March 2020, Harps Ltd entered into an Agreement for Sale and Purchase to acquire a carpark in Central at a consideration of $1.5m. On 1 July 2019, Harps Ltd leased the office premise to Music Learning Ltd for 2 years, with monthly rental of $30,000 plus 10% share of the tuition fee income, with the maximum amount fixed at $10,000. (5 marks) (iii) On 1 December 2019, Mr Lee transferred a commercial property in Wanchai of market value of $20m to his daughter as a wedding gift. Mr Lee inherited the commercial property from his father 10 years ago. (2 marks) (iv) On 3 January 2020, Mr Lee transferred 10,000 shares of Hong Kong and Shanghai Bank to his son. Mr Lee bought the shares at share price of $70 three years ago. Market value of the share at the time of transfer was $60. (3 marks) Required: For each of the transactions above, explain the charge of stamp duty according to the Stamp Duty Ordinance. Calculate the amount of stamp duty payable, and state the instruments to be stamped as well as the administrative procedure and other documents that are required (if applicable). (Total marks: 18) Stamp duty rates Conveyance and Agreement for sale Ad Valorem Stamp Duty (AVD) with effect from 23/2/2013 (marginal reliefs ignored) Scale 1 Not exceeding $2,000,000 1.5% Not exceeding $3,000,000 3% Not exceeding $4,000,000 4.5% Not exceeding $6,000,000 6% Not exceeding $20,000,000 7.5% Exceeding $20,000,000 8.5% Residential properties, effective 5 Nov 2016 15% flat rate Special Stamp Duty 20/11/2010 Holding period Not exceeding 6 months 15% > 6 months and 12 months and 24 months 5% > 12 months and 6 months and 12 months and 24 months 5% > 12 months and