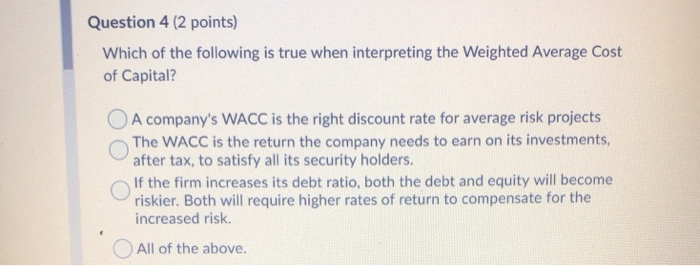

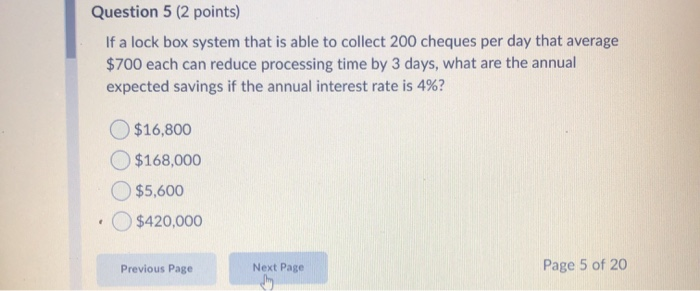

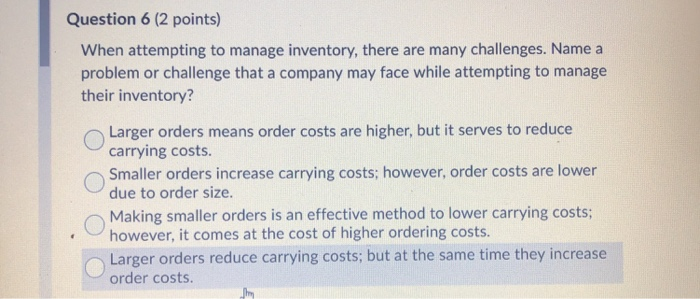

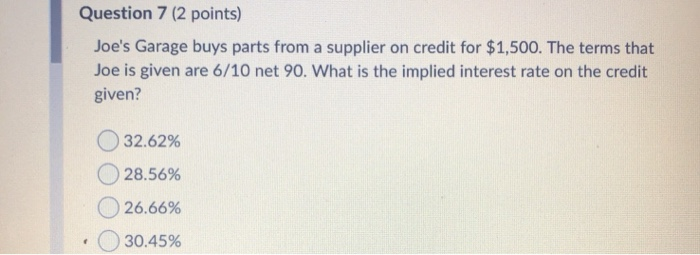

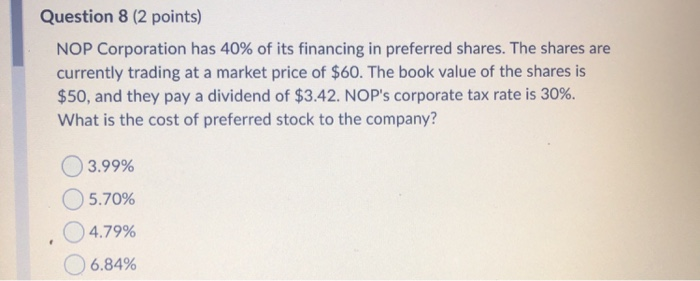

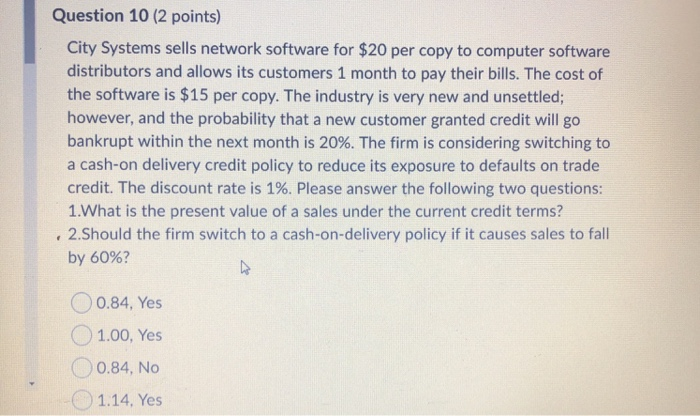

Question 4 (2 points) Which of the following is true when interpreting the Weighted Average Cost of Capital? A company's WACC is the right discount rate for average risk projects The WACC is the return the company needs to earn on its investments, after tax, to satisfy all its security holders. If the firm increases its debt ratio, both the debt and equity will become riskier. Both will require higher rates of return to compensate for the increased risk. All of the above. Question 5 (2 points) If a lock box system that is able to collect 200 cheques per day that average $700 each can reduce processing time by 3 days, what are the annual expected savings if the annual interest rate is 4%? $16,800 $168,000 $5,600 . $420,000 Previous Page Next Page Page 5 of 20 Question 6 (2 points) When attempting to manage inventory, there are many challenges. Name a problem or challenge that a company may face while attempting to manage their inventory? Larger orders means order costs are higher, but it serves to reduce carrying costs. Smaller orders increase carrying costs; however, order costs are lower due to order size. Making smaller orders is an effective method to lower carrying costs; however, it comes at the cost of higher ordering costs. Larger orders reduce carrying costs; but at the same time they increase order costs. Question 7 (2 points) Joe's Garage buys parts from a supplier on credit for $1,500. The terms that Joe is given are 6/10 net 90. What is the implied interest rate on the credit given? 32.62% 28.56% 26.66% 30.45% Question 8 (2 points) NOP Corporation has 40% of its financing in preferred shares. The shares are currently trading at a market price of $60. The book value of the shares is $50, and they pay a dividend of $3.42. NOP's corporate tax rate is 30%. What is the cost of preferred stock to the company? 3.99% 5.70% 04.79% 06.84% Question 10 (2 points) City Systems sells network software for $20 per copy to computer software distributors and allows its customers 1 month to pay their bills. The cost of the software is $15 per copy. The industry is very new and unsettled; however, and the probability that a new customer granted credit will go bankrupt within the next month is 20%. The firm is considering switching to a cash-on delivery credit policy to reduce its exposure to defaults on trade credit. The discount rate is 1%. Please answer the following two questions: 1. What is the present value of a sales under the current credit terms? 2. Should the firm switch to a cash-on-delivery policy if it causes sales to fall by 60%? 0.84, Yes 1.00, Yes O 0.84, NO 1.14. Yes