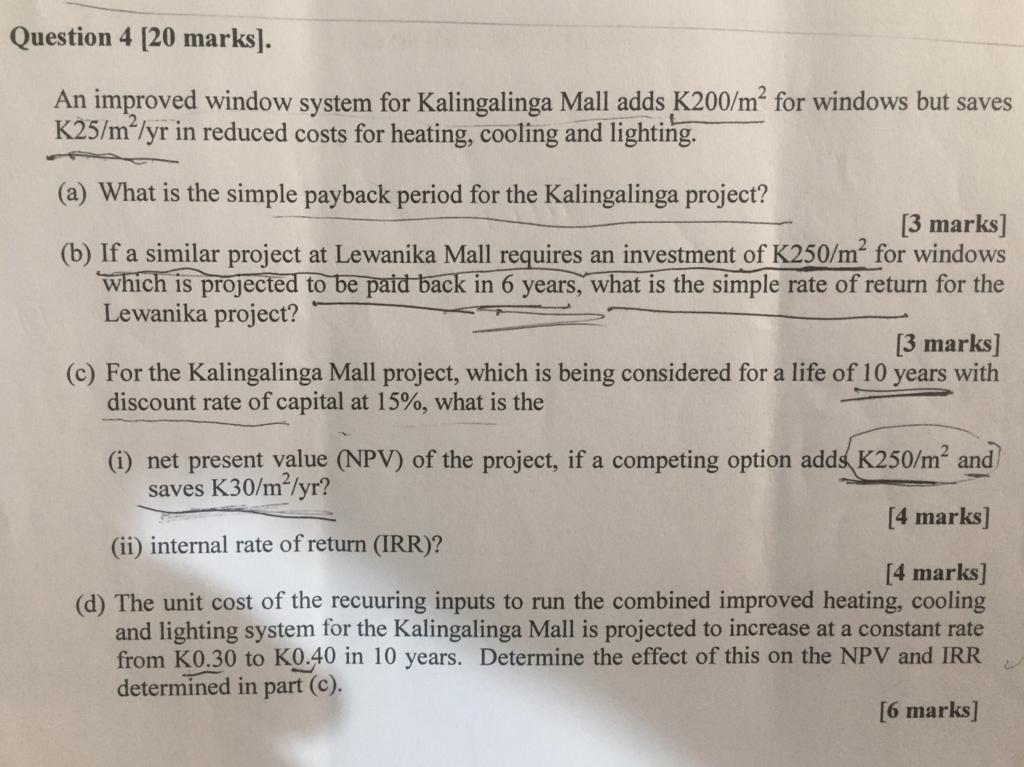

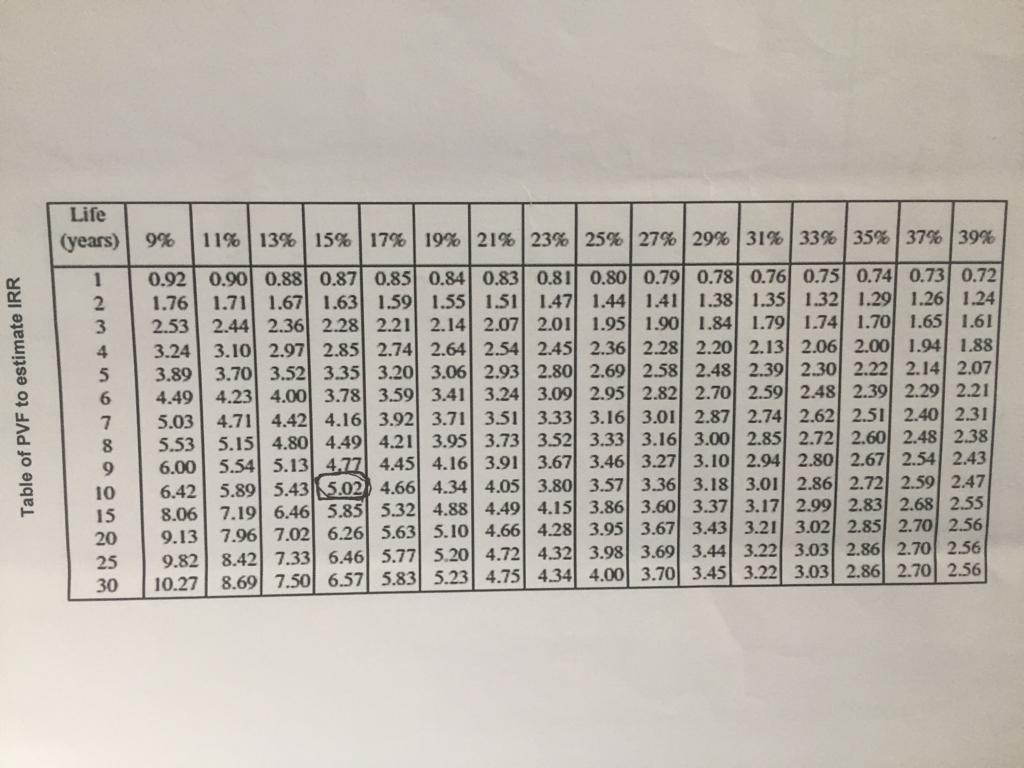

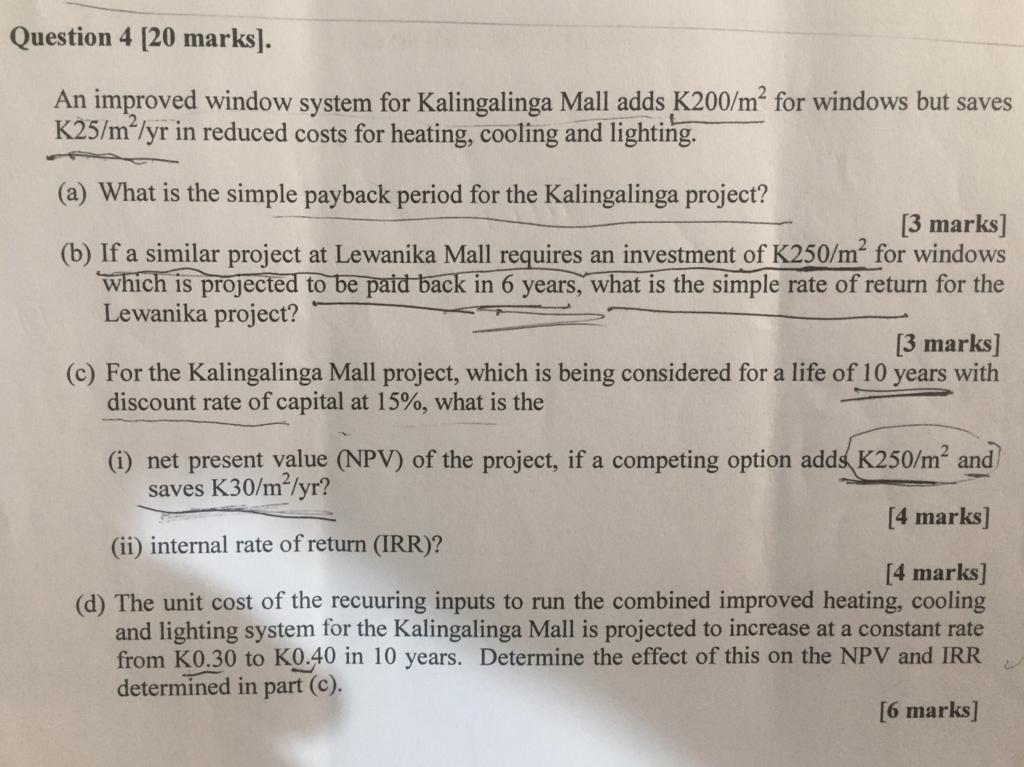

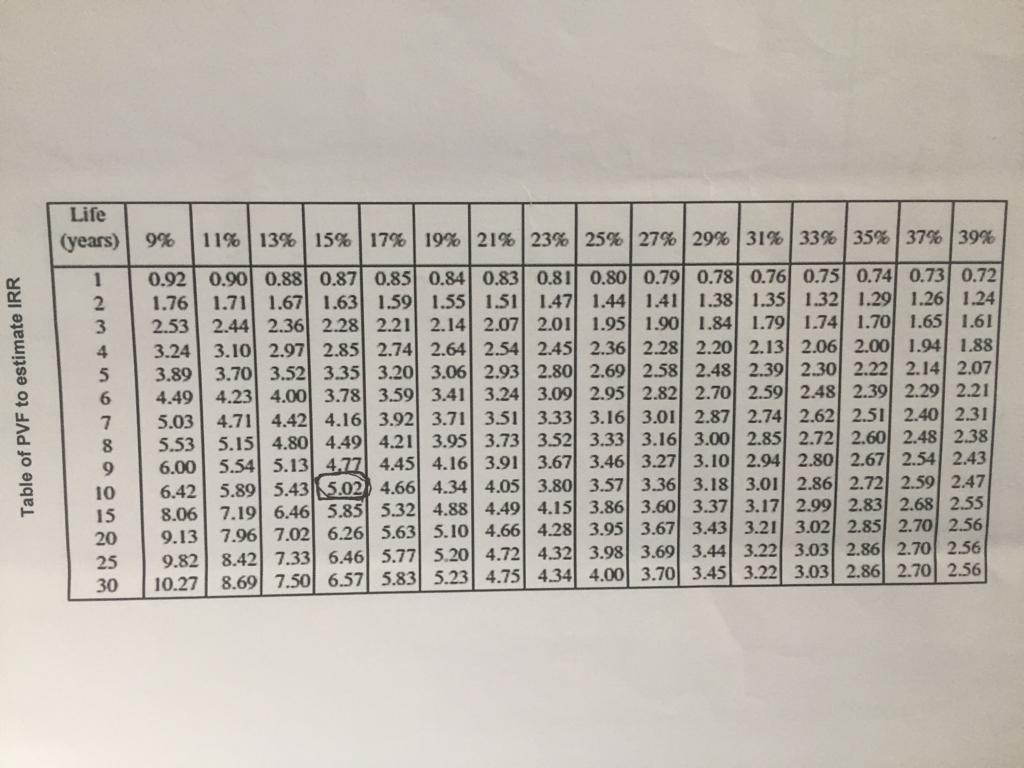

Question 4 [20 marks). An improved window system for Kalingalinga Mall adds K200/m for windows but saves K25/m_/yr in reduced costs for heating, cooling and lighting. (a) What is the simple payback period for the Kalingalinga project? [3 marks] (b) If a similar project at Lewanika Mall requires an investment of K250/m for windows which is projected to be paid back in 6 years, what is the simple rate of return for the Lewanika project? [3 marks] (c) For the Kalingalinga Mall project, which is being considered for a life of 10 years with discount rate of capital at 15%, what is the (i) net present value (NPV) of the project, if a competing option adds K250/m and saves K30/m-/yr? [4 marks] (ii) internal rate of return (IRR)? [4 marks] (d) The unit cost of the recuuring inputs to run the combined improved heating, cooling and lighting system for the Kalingalinga Mall is projected to increase at a constant rate from K0.30 to K0.40 in 10 years. Determine the effect of this on the NPV and IRR determined in part (C). [6 marks] Life (years) 9% 11% 13% 15% 17% 19% 21% 23% 25% 27% 29% 31% 33% 35% 37% 39% IRR Table of PVF to estimate 1 2. 3 4 5 6 7. 8 9 10 15 20 25 30 0.92 0.90 0.88 0.87 0.85 0.84 0.83 0.81 0.80 0.79) 0.78 0.76 0.750 0.74 0.73 0.72 1.76 1.71 1.67 1.63 1.59 1.550 1.51 1.47 1.44 1.41 1.38 1.35 1.32 1.29 1.26 1.24 2.53 2.44 2.36 2.28 2.21 2.14 2.07 2.01 1.950 1.90 1.84 1.79 1.74 1.70 1.65 1.61 3.24 3.10 2.97 2.850 2.74 2.64 2.54 2.45 2.36 2.28) 2.20 2.13 2.06 2.00 1.94 1.88 3.89 3.70 3.52 3.35 3.20 3.06 2.93| 2.80 2.69 2.58 2.48 2.39 2.30 2.22] 2.14 2.07 4.49 4.23] 4.00 3.78] 3.59 3.41 3.24 3.09 2.95] 2.82 2.70 2.59) 2.48) 2.39 2.29 2.21 5.03 4.71 4.42 4.16 3.92 3.71 3.51 3.33 3.16 3.01 2.87 2.74 2.62 2.51 2.40 2.31 5.53 5.15 4.80 4.49 4.21 3.95 3.73 3.52 3.33 3.16 3.00 2.85 2.72 2.60 2.48 2.38 6.00 5.54 5.13 4.77) 4.45| 4.16 3.91 3.67 3.46 3.27 3.10 2.94 2.80 2.67 2.54 2.43 6.42 5.89 5.435.02 4.66) 4.34 4.05 3.80 3.57 3.36 3.18 3.01 2.86] 2.72) 2.59 2.47 8.06 7.19 6.46 5.85 5.32] 4.88 4.49 4.15 3.86 3.60 3.37 3.17 2.99) 2.83) 2.68 2.55 9.13 7.96] 7.02] 6.26] 5.63 5.10 4.66) 4.28 3.95 3.67 3.43 3.21 3.02) 2.850 2.70 2.56 9.82 8.42 7.33 6.46 5.77 5.20 4.72 4.32 3.98 3.69 3.44 3.22 3.03 2.86 2.70 2.56 10.27 8.69 7.50 6.57 5.83 5.23 4.75 4.34 4.00 3.70 3.45 3.22 3.03 2.86 2.70 2.56