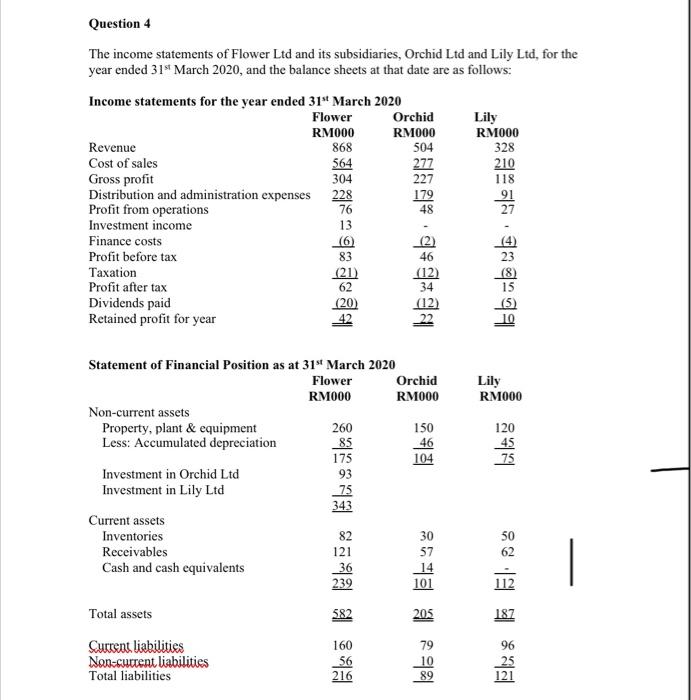

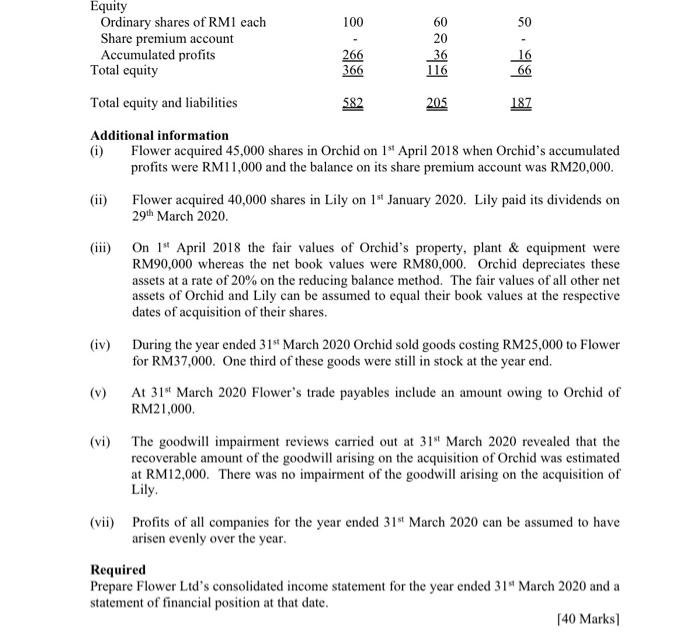

Question 4 210 The income statements of Flower Ltd and its subsidiaries, Orchid Ltd and Lily Ltd, for the year ended 31" March 2020, and the balance sheets at that date are as follows: Income statements for the year ended 31 March 2020 Flower Orchid Lily RM000 RM000 RM000 Revenue 868 504 328 Cost of sales 564 277 Gross profit 304 227 118 Distribution and administration expenses 228 179 91 Profit from operations 76 48 27 Investment income 13 Finance costs (6 Profit before tax 83 46 23 Taxation (21) (12) Profit after tax 62 34 Dividends paid (20) (12) Retained profit for year 42 22 10 - Lily RM000 120 45 75 Statement of Financial Position as at 31" March 2020 Flower Orchid RM000 RM000 Non-current assets Property, plant & equipment 260 150 Less: Accumulated depreciation 85 46 175 104 Investment in Orchid Ltd 93 Investment in Lily Ltd 75 343 Current assets Inventories 82 30 Receivables 121 57 Cash and cash equivalents 36 239 101 50 8 Total assets 582 205 187 96 Current liabilities Non-current liabilities Total liabilities 160 56 216 79 10 89 121 100 50 Equity Ordinary shares of RMI each Share premium account Accumulated profits Total equity 266 366 60 20 36 116 16 66 Total equity and liabilities 582 205 187 Additional information (i) Flower acquired 45,000 shares in Orchid on 19 April 2018 when Orchid's accumulated profits were RM11,000 and the balance on its share premium account was RM20,000. Flower acquired 40,000 shares in Lily on 19 January 2020. Lily paid its dividends on 29th March 2020. (iii) On 1" April 2018 the fair values of Orchid's property, plant & equipment were RM90,000 whereas the net book values were RM80,000. Orchid depreciates these assets at a rate of 20% on the reducing balance method. The fair values of all other net assets of Orchid and Lily can be assumed to equal their book values at the respective dates of acquisition of their shares. (1) (iv) During the year ended 31" March 2020 Orchid sold goods costing RM25,000 to Flower for RM37,000. One third of these goods were still in stock at the year end. v At 31" March 2020 Flower's trade payables include an amount owing to Orchid of RM21,000. (vi) The goodwill impairment reviews carried out at 31" March 2020 revealed that the recoverable amount of the goodwill arising on the acquisition of Orchid was estimated at RM12,000. There was no impairment of the goodwill arising on the acquisition of Lily. (vii) Profits of all companies for the year ended 31st March 2020 can be assumed to have arisen evenly over the year. Required Prepare Flower Ltd's consolidated income statement for the year ended 31" March 2020 and a statement of financial position at that date. [40 Marks/