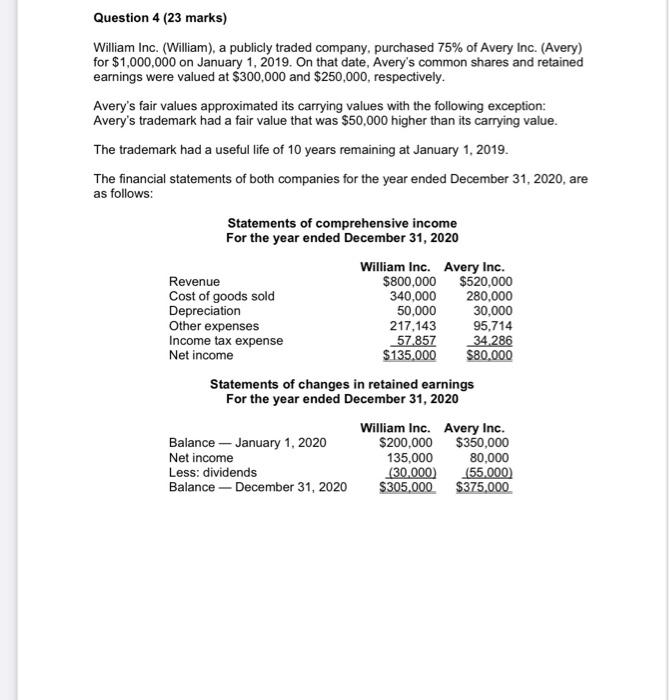

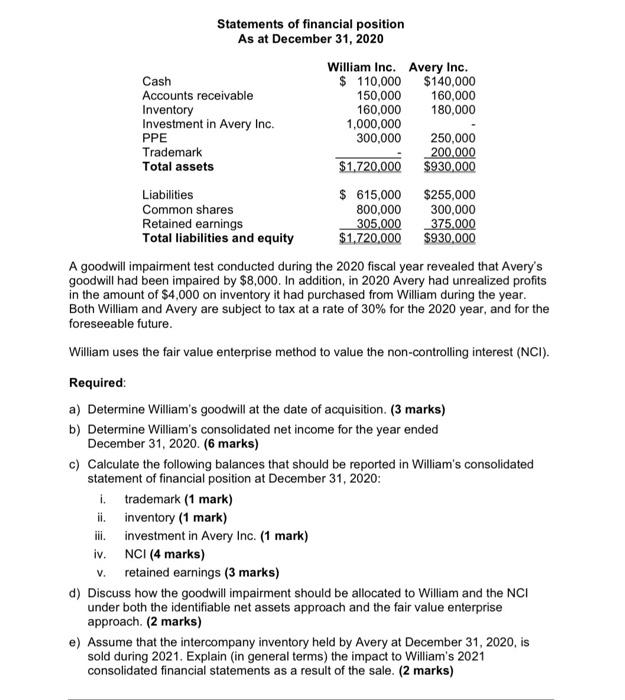

Question 4 (23 marks) William Inc. (William), a publicly traded company, purchased 75% of Avery Inc. (Avery) for $1,000,000 on January 1, 2019. On that date, Avery's common shares and retained earnings were valued at $300,000 and $250,000, respectively. Avery's fair values approximated its carrying values with the following exception: Avery's trademark had a fair value that was $50,000 higher than its carrying value. The trademark had a useful life of 10 years remaining at January 1, 2019. The financial statements of both companies for the year ended December 31, 2020, are as follows: Statements of comprehensive income For the year ended December 31, 2020 Revenue Cost of goods sold Depreciation Other expenses Income tax expense Net income William Inc. Avery Inc. $800,000 $520,000 340,000 280,000 50,000 30,000 217.143 95,714 57.857 34.286 $135.000 $80,000 Statements of changes in retained earnings For the year ended December 31, 2020 Balance - January 1, 2020 Net income Less: dividends Balance - December 31, 2020 William Inc. Avery Inc. $200,000 $350,000 135,000 80,000 (30.000) (55.000) $305,000 $375,000 Statements of financial position As at December 31, 2020 Cash Accounts receivable Inventory Investment in Avery Inc. PPE Trademark Total assets William Inc. Avery Inc. $ 110,000 $140,000 150,000 160,000 160,000 180,000 1,000,000 300,000 250,000 200,000 $1.720,000 $930,000 Liabilities Common shares Retained earnings Total liabilities and equity $ 615,000 800,000 305.000 $1.720,000 $255,000 300,000 375.000 $930,000 A goodwill impairment test conducted during the 2020 fiscal year revealed that Avery's goodwill had been impaired by $8,000. In addition, in 2020 Avery had unrealized profits in the amount of $4,000 on inventory it had purchased from William during the year. Both William and Avery are subject to tax at a rate of 30% for the 2020 year, and for the foreseeable future. William uses the fair value enterprise method to value the non-controlling interest (NCI). Required: a) Determine William's goodwill at the date of acquisition. (3 marks) b) Determine William's consolidated net income for the year ended December 31, 2020. (6 marks) c) Calculate the following balances that should be reported in William's consolidated statement of financial position at December 31, 2020: i. trademark (1 mark) ii. inventory (1 mark) ili investment in Avery Inc. (1 mark) iv. NCI (4 marks) retained earnings (3 marks) d) Discuss how the goodwill impairment should be allocated to William and the NCI under both the identifiable net assets approach and the fair value enterprise approach. (2 marks) e) Assume that the intercompany inventory held by Avery at December 31, 2020, is sold during 2021. Explain (in general terms) the impact to William's 2021 consolidated financial statements as a result of the sale. (2 marks) V. William Inc. (William), a publicly traded company, purchased 75% of Avery Inc. (Avery) for $1,000,000 on January 1, 2019. On that date, Avery's common shares and retained earnings were valued at $300,000 and $250,000, respectively. Avery's fair values approximated its carrying values with the following exception: Avery's trademark had a fair value that was $50,000 higher than its carrying value. The trademark had a useful life of 10 years remaining at January 1, 2019, The financial statements of both companies for the year ended December 31, 2020, are as follows: Statements of comprehensive income For the year ended December 31, 2020 Revenue Cost of goods sold Depreciation Other expenses Income tax expense Net income William Inc. Avery Inc. $800,000 $520,000 340,000 280,000 50,000 30,000 217.143 95,714 57.857 34 286 $135.000 $80.000 Statements of changes in retained earnings For the year ended December 31, 2020 Balance - January 1, 2020 Net income Less: dividends Balance - December 31, 2020 William Inc. Avery Inc. $200,000 $350.000 135,000 80,000 130.000 155.000) $305.000 5375.000 Statements of financial position As at December 31, 2020 Cash Accounts receivable Inventory Investment in Avery Inc. PPE Trademark Total assets William Inc. Avery Inc. $ 110,000 $140,000 150,000 160,000 160,000 180,000 1,000,000 300,000 250,000 200.000 $11720,000 $930.000 Llabilities Common shares Retained earnings Total liabilities and equity $ 615,000 800,000 305.000 $11720.000 $255,000 300,000 375 000 $930.000 A goodwill impairment test conducted during the 2020 fiscal year revealed that Avery's goodwill had been impaired by $8,000. In addition, in 2020 Avery had unrealized profits in the amount of $4,000 on inventory it had purchased from William during the year. Both William and Avery are subject to tax at a rate of 30% for the 2020 year, and for the foreseeable future William uses the fair value enterprise method to value the non-controlling interest (NCI) Required: 1 11 a) Determine William's goodwill at the date of acquisition (3 marks) b) Determine William's consolidated net income for the year ended December 31, 2020 (6 marks) c) Calculate the following balances that should be reported in Williams-consolidated statement of financial position at December 31, 2020: trademark (1 mark) inventory (1 mark) II investment in Avery Inc. (1 mark) NCI (4 marks) retained earnings (3 marks) d) Discuss how the goodwill impairment should be allocated to William and the NCI under both the identifiable net assets approach and the fair value enterprise approach(2 marks) e) Assume that the intercompany inventory held by Avery at December 31, 2020, is sold during 2021. Explain (in general terms) the impact to William's 2021 consolidated financial statements as a result of the sale. (2 marks) iv