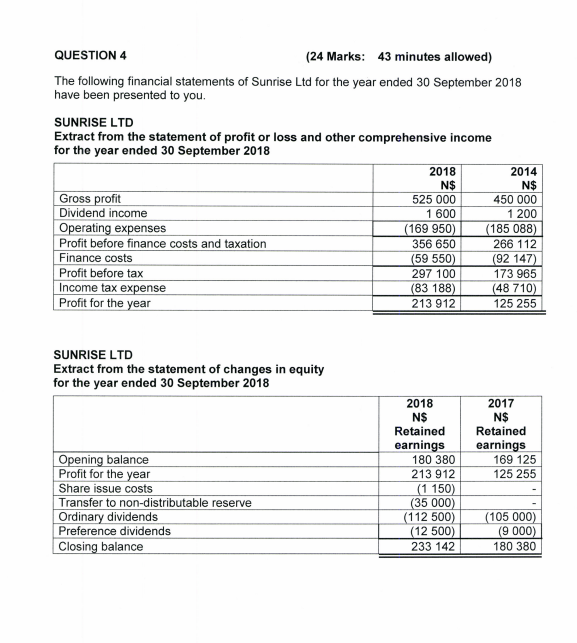

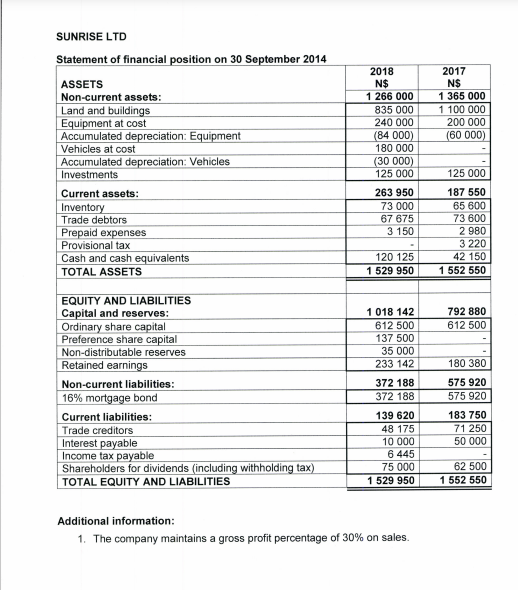

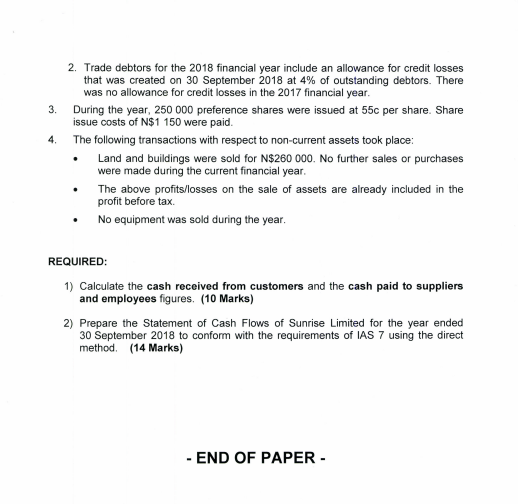

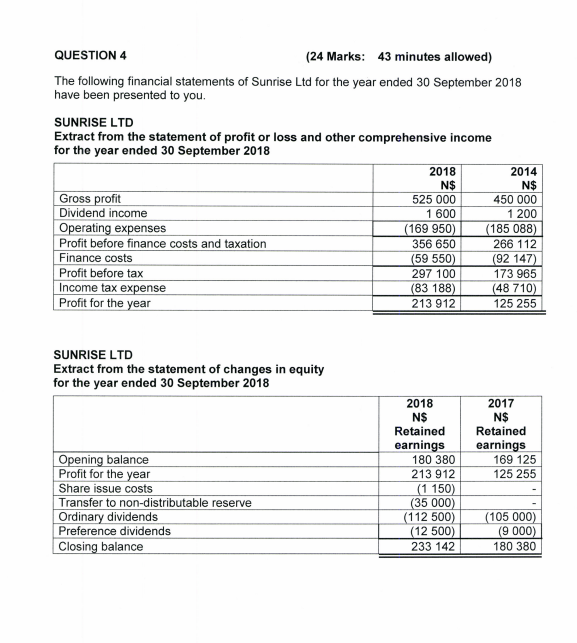

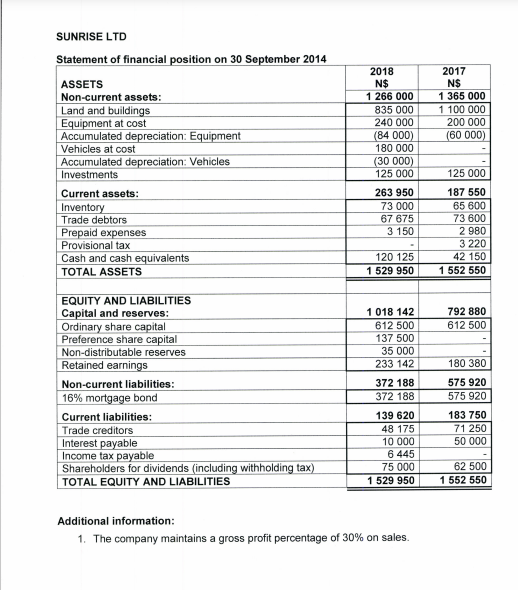

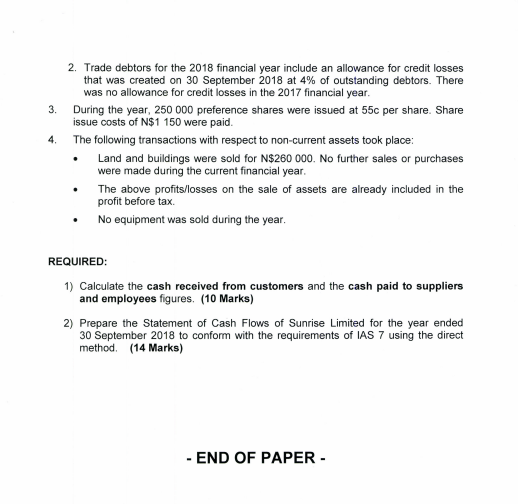

QUESTION 4 (24 Marks: 43 minutes allowed) The following financial statements of Sunrise Ltd for the year ended 30 September 2018 have been presented to you. SUNRISE LTD Extract from the statement of profit or loss and other comprehensive income for the year ended 30 September 2018 2018 2014 N$ N$ Gross profit 525 000 450 000 Dividend income 1 600 1 200 Operating expenses (169 950) (185 088) Profit before finance costs and taxation 356 650 266 112 Finance costs (59 550) (92 147) Profit before tax 297 100 173 965 Income tax expense (83 188) (48 710) Profit for the year 213 912 125 255 SUNRISE LTD Extract from the statement of changes in equity for the year ended 30 September 2018 2018 N$ Retained earnings 180 380 213 912 (1 150) (35 000) (112 500) (12 500) 233 142 2017 N$ Retained earnings 169 125 125 255 Opening balance Profit for the year Share issue costs Transfer to non-distributable reserve Ordinary dividends Preference dividends Closing balance (105 000) (9 000) 180 380 SUNRISE LTD Statement of financial position on 30 September 2014 ASSETS Non-current assets: Land and buildings Equipment at cost Accumulated depreciation Equipment Vehicles at cost Accumulated depreciation: Vehicles Investments Current assets: Inventory Trade debtors Prepaid expenses Provisional tax Cash and cash equivalents TOTAL ASSETS 2018 N$ 1 266 000 835 000 240 000 (84 000) 180 000 (30 000) 125 000 2017 N$ 1 365 000 1 100 000 200 000 (60 000) 263 950 73 000 67 675 3 15 125 000 187 550 65 600 73 600 2 980 3220 42 150 1 552 550 120 125 1 529 950 792 880 612 500 1 018 142 612 500 137 500 35 000 233 142 EQUITY AND LIABILITIES Capital and reserves: Ordinary share capital Preference share capital Non-distributable reserves Retained earnings Non-current liabilities: 16% mortgage bond Current liabilities: Trade creditors Interest payable Income tax payable Shareholders for dividends (including withholding tax) TOTAL EQUITY AND LIABILITIES 372 188 372 188 180 380 575 920 575 920 183 750 71 250 50 000 139 620 48 175 10 000 6 445 75 000 1 529 950 62 500 1 552 550 Additional information: 1. The company maintains a gross profit percentage of 30% on sales. 2. Trade debtors for the 2018 financial year include an allowance for credit losses that was created on 30 September 2018 at 4% of outstanding debtors. There was no allowance for credit losses in the 2017 financial year. 3. During the year, 250 000 preference shares were issued at 55c per share. Share issue costs of N$1 150 were paid. 4. The following transactions with respect to non-current assets took place: Land and buildings were sold for N$260 000. No further sales or purchases were made during the current financial year. The above profits/losses on the sale of assets are already included in the profit before tax. No equipment was sold during the year. REQUIRED: 1) Calculate the cash received from customers and the cash paid to suppliers and employees figures. (10 Marks) 2) Prepare the Statement of Cash Flows of Sunrise Limited for the year ended 30 September 2018 to conform with the requirements of IAS 7 using the direct method. (14 Marks) - END OF PAPER - QUESTION 4 (24 Marks: 43 minutes allowed) The following financial statements of Sunrise Ltd for the year ended 30 September 2018 have been presented to you. SUNRISE LTD Extract from the statement of profit or loss and other comprehensive income for the year ended 30 September 2018 2018 2014 N$ N$ Gross profit 525 000 450 000 Dividend income 1 600 1 200 Operating expenses (169 950) (185 088) Profit before finance costs and taxation 356 650 266 112 Finance costs (59 550) (92 147) Profit before tax 297 100 173 965 Income tax expense (83 188) (48 710) Profit for the year 213 912 125 255 SUNRISE LTD Extract from the statement of changes in equity for the year ended 30 September 2018 2018 N$ Retained earnings 180 380 213 912 (1 150) (35 000) (112 500) (12 500) 233 142 2017 N$ Retained earnings 169 125 125 255 Opening balance Profit for the year Share issue costs Transfer to non-distributable reserve Ordinary dividends Preference dividends Closing balance (105 000) (9 000) 180 380 SUNRISE LTD Statement of financial position on 30 September 2014 ASSETS Non-current assets: Land and buildings Equipment at cost Accumulated depreciation Equipment Vehicles at cost Accumulated depreciation: Vehicles Investments Current assets: Inventory Trade debtors Prepaid expenses Provisional tax Cash and cash equivalents TOTAL ASSETS 2018 N$ 1 266 000 835 000 240 000 (84 000) 180 000 (30 000) 125 000 2017 N$ 1 365 000 1 100 000 200 000 (60 000) 263 950 73 000 67 675 3 15 125 000 187 550 65 600 73 600 2 980 3220 42 150 1 552 550 120 125 1 529 950 792 880 612 500 1 018 142 612 500 137 500 35 000 233 142 EQUITY AND LIABILITIES Capital and reserves: Ordinary share capital Preference share capital Non-distributable reserves Retained earnings Non-current liabilities: 16% mortgage bond Current liabilities: Trade creditors Interest payable Income tax payable Shareholders for dividends (including withholding tax) TOTAL EQUITY AND LIABILITIES 372 188 372 188 180 380 575 920 575 920 183 750 71 250 50 000 139 620 48 175 10 000 6 445 75 000 1 529 950 62 500 1 552 550 Additional information: 1. The company maintains a gross profit percentage of 30% on sales. 2. Trade debtors for the 2018 financial year include an allowance for credit losses that was created on 30 September 2018 at 4% of outstanding debtors. There was no allowance for credit losses in the 2017 financial year. 3. During the year, 250 000 preference shares were issued at 55c per share. Share issue costs of N$1 150 were paid. 4. The following transactions with respect to non-current assets took place: Land and buildings were sold for N$260 000. No further sales or purchases were made during the current financial year. The above profits/losses on the sale of assets are already included in the profit before tax. No equipment was sold during the year. REQUIRED: 1) Calculate the cash received from customers and the cash paid to suppliers and employees figures. (10 Marks) 2) Prepare the Statement of Cash Flows of Sunrise Limited for the year ended 30 September 2018 to conform with the requirements of IAS 7 using the direct method. (14 Marks) - END OF PAPER