Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Encik Khairul a professional engineer and his wife Puan Katrina, an auditor in a local audit firm are tax residents in the basis year

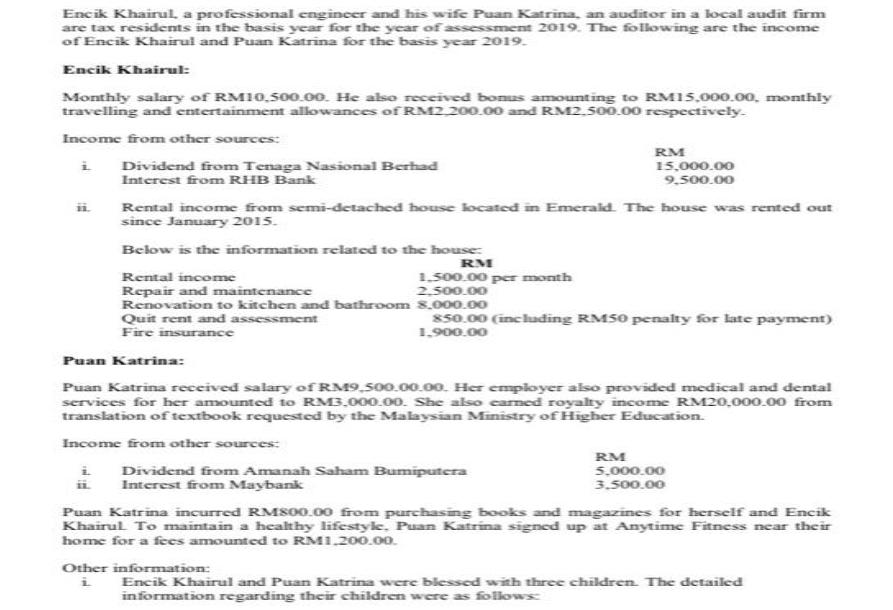

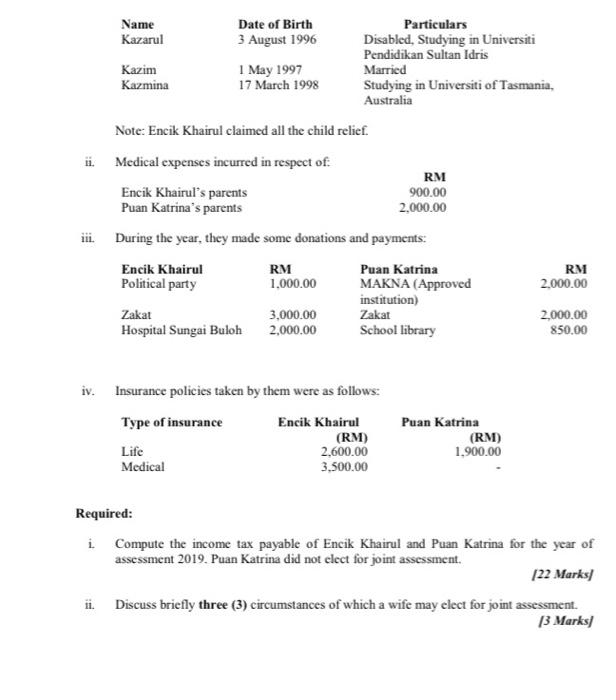

Encik Khairul a professional engineer and his wife Puan Katrina, an auditor in a local audit firm are tax residents in the basis year for the year of assessment 2019. The following are the income of Encik Khairul and Puan Katrina for the basis year 2019. Encik Khairul: Monthly salary of RM10,500.00. He also received bonus amounting to RM15,000.00, monthly travelling and entertainment allowances of RM2.200.00 and RM2.500.00 respectively. Income from other sources: RM i Dividend from Tenaga Nasional Berhad Interest from RHB Bank 15,000.00 9,500.00 Rental income from semi-detached house located in Emerakd. The house was rented out since January 2015. Below is the information related to the house: RM Rental income Repair and maintenance Renovation to kitchen and bathroom Quit rent and assessment 1.500.00 per month 2,500.00 850.00 (including RMS0 penalty for late payment) 1,900.00 Fire insurance Puan Katrina: Puan Katrina received salary of RM9 500.00.00. Her empioyer also provided medical and dental services for her amounted to RM3.000.00. She also carned royalty income RM20,000.00 from translation of textbook requested by the Malaysian Ministry of Higher Education. Income from other sources: RM i Dividend from Amanah Saham Bumiputera Interest from Maybank 5,000.00 3.500.00 ii Puan Katrina incurred RMS00.00 from purchasing books and magazines for herself and Encik Khairul To maintain a healthy lifestyle. Puan Katrina signed up at Anytime Fitness near their home for a fees amounted to RM1.200.00. Other information: i Encik Khairul and Puan Katrina were blessed with three children. The detailed information regarding their children were as follows Name Kazarul Date of Birth Particulars 3 August 1996 Disabled, Studying in Universiti Pendidikan Sultan Idris I May 1997 17 March 1998 Kazim Married Studying in Universiti of Tasmania, Australia Kazmina Note: Encik Khairul claimed all the child relief. ii. Medical expenses incurred in respect of: RM Encik Khairul's parents Puan Katrina's parents 900.00 2,000.00 ii. During the year, they made some donations and payments: Encik Khairul RM 1,000.00 Puan Katrina MAKNA (Approved RM 2,000.00 Political party institution) Zakat 3,000.00 2,000.00 Zakat 2,000.00 Hospital Sungai Buloh School library 850.00 iv. Insurance policies taken by them were as follows: Type of insurance Encik Khairul Puan Katrina (RM) 2,600.00 3,500.00 (RM) 1,900.00 Life Medical Required: i Compute the income tax payable of Encik Khairul and Puan Katrina for the year of assessment 2019. Puan Katrina did not clect for joint assessment. 122 Marks) ii. Discuss briefly three (3) circumstances of which a wife may elect for joint assessment. 13 Marks]

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

COM Computation Income Khaired for the gar ricario of Total Income and Incom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started